PC prices will have to climb this year, to offset the effects of currency devaluation, says Gartner. In particular end-user prices in the Eurozone and Japan, where local currencies have fallen up to 20%, are expected to increase as much as 10% in 2015.

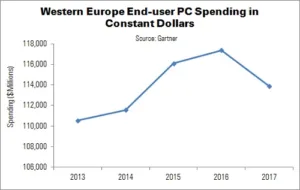

End-user spending in constant dollars (the dollar equivalent of local currencies, assuming fixed/constant exchange rates) in Western Europe will reach $116 billion this year, a 4% YoY rise.

Gartner’s Ranjit Atwal said, “Device vendors will mitigate the impact of their declining ‘dollarised’ profits by taking advantage of single-digit-percentage decreases in PC component costs during 2015, and by selling PCs with fewer features to keep prices down… However, vendors’ margins will fall, even as they shift their shipment focus to the regions least affected by these currency effects”.

PC sales are determined by price in mature markets, so – through 2016 – Gartner predicts that 30% of PC consumers (‘price-driven’ consumers, purchasing sub-$500 PCs) will buy down the price curve. ‘Value-driven’ consumers (buying $500 – $800 PCs), representing about 40% of the market, will delay purchases, while ‘feature-driven’ consumers (buying $800+ PCs, 30% of the market) will extend lifetimes by 10%, to compensate for higher prices. These consumers will simply absorb the remaining price increases.

Large businesses will put priority into other IT budgets with currency-driven shortfalls, such as software and services. Money will be drawn from the PC budget for this spending. Gartner expects businesses to attempt to extend PC lifetime by 10% (six months) over 2014, rather than buying cheaper new models.

PC purchases will be reduced by up to 20% in large organisations. However, small businesses will look to purchase consumer PCs, instead.