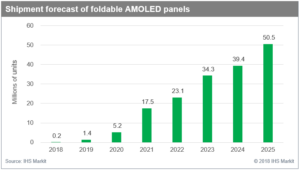

Spurred on by growing demand for innovative user experience in smartphones, shipments of foldable active-matrix organic light-emitting diode (AMOLED) panels are expected to reach 50 million units by 2025 for the first time since their launch in 2018, according to IHS Markit (Nasdaq: INFO), a world leader in critical information, analytics and solutions.

The foldable AMOLED panels are expected to account for 6 percent of total AMOLED panel shipments (825 million), or 11 percent of total flexible AMOLED panel shipments (476 million) by 2025.

“As the conventional smartphone market has become saturated, smartphone brands have tried to come up with an innovative form factor for a smartphone,” said Jerry Kang, senior principal analyst of display research at IHS Markit. “A foldable AMOLED panel is considered to be the most attractive and distinguishable form factor at this moment.”

In October 2018, China’s Royole Corporation unveiled the world’s first foldable-screen smartphone with a 7.8-inch AMOLED panel. A few other brands are also expected to launch foldable-screen smartphones in 2019.

“Smartphone brands are cautious about launching foldable smartphones because the phones should be durable enough for repeated folding and thin and light enough even when supporting a larger display and battery,” Kang said. “Unit shipments of foldable AMOLED panels may not grow as fast for the first few years, but area per unit will be expected to be larger than that of conventional displays. Panel makers are forecast to see an increase in fab utilization.”

Due to lower demand for conventional flexible AMOLED panels, suppliers are hoping that smartphone brands release foldable devices as early as possible. With more optimism, some are even considering investing in another fab solely for foldable AMOLED panels.

“Panel suppliers should consider how much demand will increase for the foldable application before investing in additional fabs, because the supply of flexible AMOLED panels is forecast to exceed demand even as we move into 2019,” Kang said.

According to the AMOLED & Flexible Display Intelligence Service by IHS Markit, the supply capacity of flexible AMOLED panels will account for more than half of total AMOLED capacity in the fourth quarter of 2019.

The AMOLED & Flexible Display Intelligence Service covers the latest market trends and includes forecasts of AMOLED display industries (including shadow mask and polyimide substrate), technology and capacity analysis, and panel suppliers’ business strategies by region.

About IHS Markit

IHS Markit (Nasdaq: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world’s leading financial institutions. www.ihsmarkit.com