Global unit shipments of flat-panel displays (FPD) are expected to plunge by 11.1 percent in 2020 as the coronavirus crisis cripples demand for televisions and smartphones, according to Omdia.

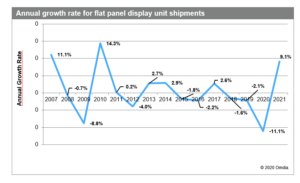

FPD shipments are set to total 3.2 billion units in 2020, down from 3.6 billion in 2019. The market has been undergoing low-single-digit increases and decreases since the financial crisis in the second half of 2008 caused shipments to drop by 8.8 percent in 2009. However, the double-digit drop this year represents an unprecedented rate of decline, as reported by Omdia’s Display Long-term Demand Forecast Tracker.

“The coronavirus is spreading throughout the world at a faster pace than expected,” said Ricky Park, director of display research at Omdia. “The pandemic is starting to directly impact application market demand as stores close and lockdowns become widespread, weakening consumer accessibility. In particular, TVs and smartphones—products that rely heavily on retail consumer demand—will find it difficult to avoid the direct impact of coronavirus and will be hit more severely than other areas by the contagion. This will result in a sharp decline global flat-panel display demand in 2020.”

Omdia predicts the market will recover in 2021 as the impact of the coronavirus recedes, with shipments rising by 9.1 percent during the year.

TV and smartphone sales skid

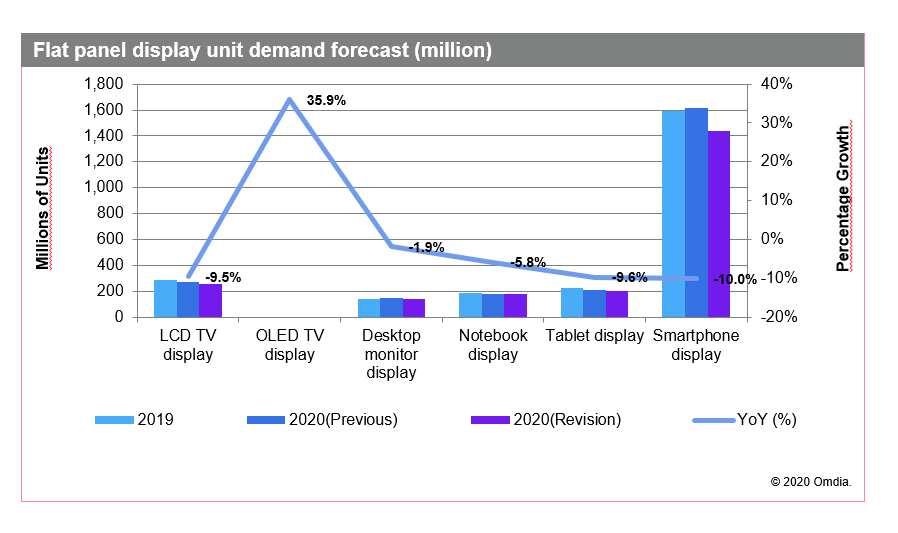

Omdia has slashed its forecast for display demand for LCD-TVs and smartphones in 2020. LCD-TVs display shipments are expected to fall by about 9.5 percent, while smartphone will drop by 10 percent.

Initially, major global sports events were expected to be the main drivers of growth this year. However, most of these events have now been cancelled or postponed.

Monitors and notebooks remain steady

Despite these challenges, desktop monitors and notebook displays should fare relatively well, experiencing only 1.9 percent and 5.8 percent declines respectively in 2020. Consumers account for less than 40 percent of the demand for these displays, with the remainder in the commercial sector. As many countries impose limitations on economic activities, this will increase the amount of working from home, leading to relatively stronger demand from corporations. In addition, with schools closing down and online courses becoming more prevalent, homes and schools are asking for more notebooks and tablets.

Area shipments set for decline

Omdia has also reduced its 2020 projections for global flat-panel display area shipments and revenue by 4.5 percent and 4.0 percent respectively compared to the previous outlook.

However, in terms of area, demand should grow by 1.8 percent in 2020 thanks to the larger contribution of demand for large displays. Large display suppliers are attaining improved yield rates and lower costs, making their products more attractive. Suppliers also are offering more foldable displays and bezel-less displays.

Korean suppliers migrate to more advanced displays

Korean brands have been aggressively withdrawing from their LCD production lines and shifting to advanced displays. This should result in a significant drop of small/mid-size TV panel production in Gen 7 and Gen 8 fabs and should eventually spur a boost in sales growth for TV panels sized 60-inches and larger.

As for AMOLED demand, although Omdia’s original outlook was downwardly revised, demand growth in terms of units is still expected to be relatively high, at 9.5 percent in 2020. OLED TV panels are set to grow approximately by 35.9 percent and the demand for AMOLED for smartphones is projected to grow by approximately 9.0 percent.

Demand for advanced display technology should continue to be strong, despite the overall market recession.