A recent update to DSCC’s Quarterly Advanced TV Shipment and Forecast Report reveals a decline in advanced TV shipments and revenues in the first half of 2023. However, the forecast suggests a potential recovery in the second half of the year and expects growth to resume in 2024.

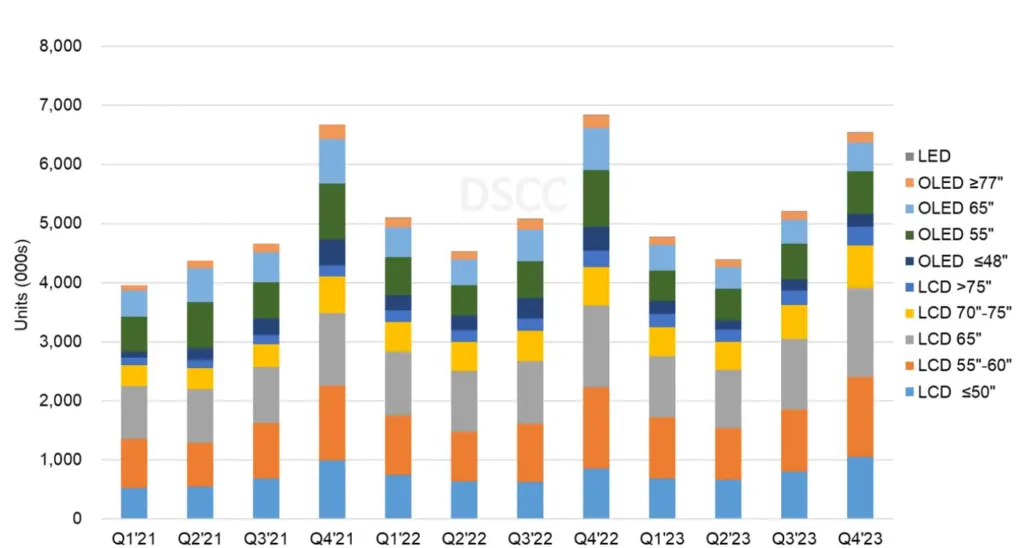

According to the report, advanced TV shipments experienced a 4% year-on-year (YoY_ decline in the first half of 2023. However, the forecast indicates that total advanced TV shipments are expected to be flat year-on-year in the second half of 2023. Specifically, OLED TV units are anticipated to decline by 23% YoY, while advanced LCD TV units are projected to increase by 11% YoY.

In terms of revenues, advanced TV experienced a 14% YoY decline in the first half of 2023. The forecast suggests a 7% year-on-year decline in total advanced TV revenues in the second half of 2023. Notably, OLED TV revenues are expected to decline by 28% YoY, while advanced LCD TV revenues are anticipated to increase by 8%. Among OLED TVs, revenues for all screen sizes are forecasted to decline. However, revenues for 65″ and larger advanced LCD TVs are expected to increase, while 55″ and smaller advanced LCD TVs are forecasted to decline.

Looking at the long-term forecast, the report predicts a 2% year-on-year decline in total advanced TV shipments for 2023. However, from 2023 to 2027, the shipments are expected to grow at a compound annual growth rate (CAGR) of 10% and reach 30.5 million units. OLED TV units are projected to grow at a CAGR of 14% during the same period, reaching 9.4 million units, while advanced LCD TV units are expected to grow at an 8% CAGR, reaching 21.1 million units. By 2025-2027, including QD-OLED, OLED TV is expected to stabilize its market share at 31% of the advanced TV segment. The emerging technology of MicroLED is anticipated to have minimal volumes.

In terms of revenues, advanced TV revenues surged in 2021 due to pandemic-induced demand and higher prices. However, in 2022, revenues declined by 3% as price decreases offset volume increases. The forecast suggests a further decline of 12% in advanced TV revenues for 2023, primarily driven by price declines and soft demand. However, the report predicts a recovery in revenue growth starting in 2024, with a projected 6% CAGR from 2023 to 2027, resulting in revenues of $29.3 billion. OLED TV revenues, including QD-OLED, are expected to grow by 7% to $10.9 billion in 2027, while advanced LCD TV revenues are forecasted to grow by 2% to $16.7 billion. The share of advanced LCD TV revenues is projected to decline to 57% in 2027. The report also highlights MicroLED as a super-premium TV technology that is expected to capture 6% of advanced TV revenues, amounting to $1.7 billion, despite accounting for only 0.1% of units.

Among the LCD technologies, MiniLED has emerged as the champion, with TCL introducing MiniLED TVs in 2019, followed by other major brands such as Samsung, LG, and Sony. The forecast predicts an ongoing competition between MiniLED, White OLED, and QD-OLED for the premium TV market. Due to the advantages offered by Gen 10.5 LCD fabs, MiniLED is expected to have a cost and price advantage over OLED in larger screen sizes. Additionally, MiniLED is expected to play a significant role in the adoption of 8K TVs, with the majority of 8K TVs employing MiniLED technology since 2022.

In terms of future market share, the forecast indicates that MiniLED LCD TV shipments will surpass OLED TV shipments (including QD-OLED) in 2027. LCD TVs, including both MiniLED and standard backlit models, are projected to maintain a unit share of over 50% in the advanced TV segment.