The MiniLED Quantum Dot (QD) TV market has experienced accelerated growth in 2022, with higher performance, a broader range of product availability, and lower prices. MiniLED QD TV demand surged even when TV display shipments declined and premium TV market growth slowed down. MiniLED QD TV is the best-performing LCD TV in the market but it still lags OLED TV in terms of shipments and revenue. It has the potential to offer even stronger growth in future years by offering larger, higher performance, thinner and more power efficient TV at a lower cost. Cost is still a big challenge. With significant cost improvement, it could trigger a faster replacement cycle for TV, enabling MiniLED QD TV to outperform OLED TV shipments in the future.

MiniLED QD TV Experiencing Accelerated Growth

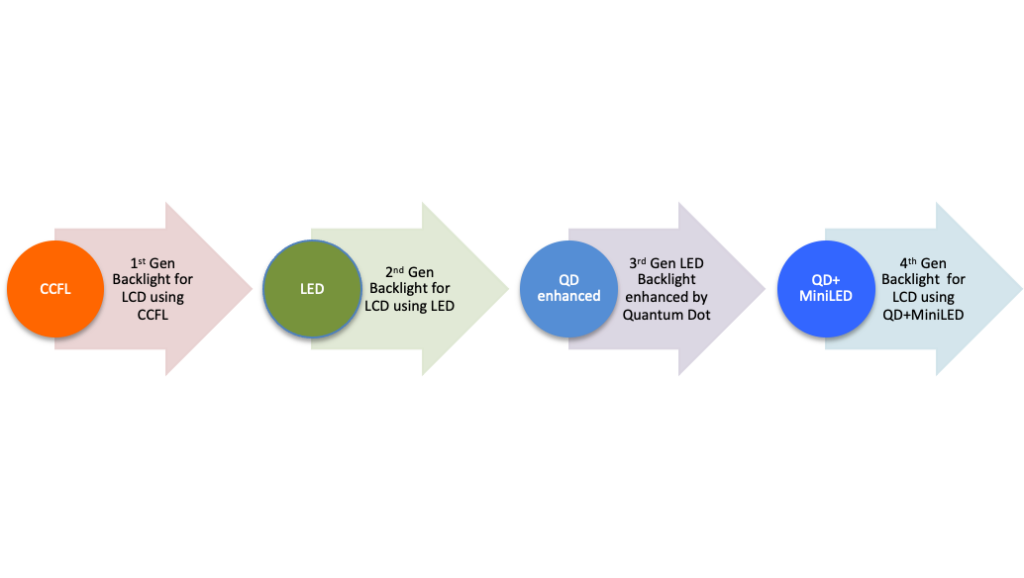

MiniLED backlight technology has enabled LCD TV to achieve high brightness, very high contrast, better HDR (High Dynamic Range), thinner form factor and higher power efficiency to compete directly with OLED TVs. Adding QD enhancement film (QDEF) enabled LCD TV to have a wider color gamut (WCG), better color purity, very high brightness, and more immersive HDR experience while maintaining power efficiency. The cost of QDEF film has reduced considerably in recent years enabling a combination of MiniLED and QD backlight LCD TV for the premium market. QD technology is also evolving with new processors, new materials, and new product offerings. Nanosys has introduced xQDEF diffuser plate that brings together the color and brightness performance of QDEF with precise light diffusion necessary for perfect contrast levels in MiniLED and full-array-local-dimming (FALD) LCDs. The xQDEF diffuser plate can simplify the display assembly process, enabling lower costs. All MiniLED TVs in the market now have QD technology.

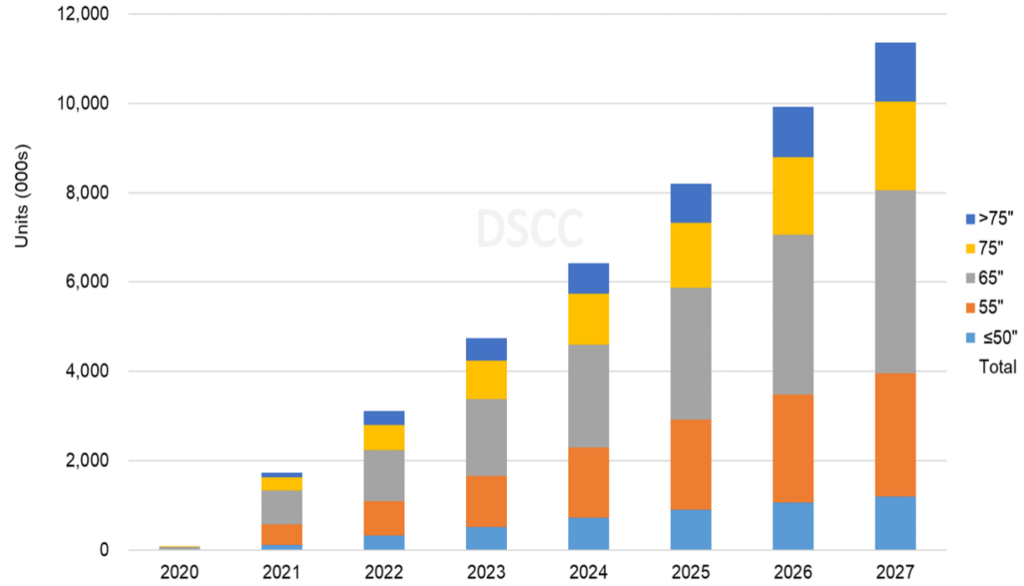

According to DSCC press release on March 9, 2023,

- “From less than 100K units in 2020, MiniLED TV shipments grew to more than 1.7 million units in 2021, and revenue grew from $73 million in 2020 to $3.5 billion in 2021.

- For the full year 2022, MiniLED TV shipments grew by 82% Y/Y to 3.15 million units and revenues increased by 42% to $4.9 billion”.

- Growth accelerated for MiniLED TV shipments in Q4’22 with 40% growth Y/Y to 990k units but revenues increased only 7% as ASPs fell by 24% Y/Y.

- Samsung continues to dominate the MiniLED TV category with 69%/71% unit/revenue share even as the number of competitors in the space continues to increase”.

TCL was the first brand to introduce MiniLED LCD TV in 2019. Top consumer brands Samsung and LG Electronics joined TCL in introducing MiniLED LCD TVs combined with QD at CES 2021. TCL won the CES innovation award for its QD zero MiniLED 8K TV in 2022 featuring an ultrathin profile of less than 3.4 mm. Sharp made a global debut of their AQUOS XLED TV with MiniLED and QD at CES 2023. Sony, Hisense, Changhong, and many others are already selling MiniLED QD TVs. Drastic panel price reductions for LCD TV due to oversupply has helped to reduce cost in 2022. Retail prices are coming down with price reductions in recent weeks including Samsung products. TCL’s 65-inch and 55-inch 4K MiniLED QD TVs are being offered at $699.99 and $599.99, respectively at Best Buy. Display performance is also improving. According to industry news, TCL is introducing a new MiniLED QD TV series TCL X11G with 5184 zones, 5000:1 contrast ratio, and 5000 nits peak brightness pushing the performance to a higher level. MiniLED QD TVs have increased shares and shipments with higher display performance, higher resolutions (4K and 8K), larger screen sizes up to 98 inches (higher production from 10.5 Gen fabs), and more product options in 2022. They are expected to increase shares and shipments in 2023 and beyond.

White OLED & QD-OLED TV: Providing Fierce Competition in the Premium Market

MiniLED QD TV, White OLED TV, and QD-OLED TV are all competing fiercely for market shares in the premium TV market. According to DSCC press release on March 9, 2023,

- “Despite strong growth in Q4’22, MiniLED remained much smaller than OLED in both units and revenues. Total MiniLED TV shipments in Q4’22 was 990K compared to 2.35 million OLED TV shipments, while total MiniLED TV revenues in Q4’22 were $1.35 billion compared to $3.57 billion for OLED TV.

- For the second time in 2022 and the second time ever, OLED TV shipments decreased Y/Y in Q4’22, falling 1% to 2.3 million units.

- For the full year 2022, OLED TV shipments increased just 1% Y/Y to 6.9 million units.

- Within the OLED TV category, QD-OLED grew from nothing in 2021 to represent 12% of OLED TV units and 15% of OLED TV revenue in Q4’22.

- With the increased competition from QD-OLED, White OLED TV shipments declined by 13% Y/Y in Q4’22, and revenues declined by 21% Y/Y.

- With a limited QD-OLED product portfolio, Samsung gained 10% of the OLED TV market in Q4”.

LG Display is the sole supplier of White OLED TV panels. White OLED TVs are sold under several brands including LG Electronics, Sony, and others. W-OLED TV has experienced a strong growth path and gained dominance in the premium market. The technology is still evolving and capacity is expanding. LG Display has introduced META Technology with ‘Micro Lens Array’ that can achieve 60% brighter images and 30% wider viewing angles than conventional OLED with improved energy efficiency. Using Meta technology, a TV can have 2100 nits peak brightness. LGD deuterium technology last year also enhanced brightness by up to 30% compared to previous gen products. LGD plans to apply Meta technology to its 55-, 65-, 77-inch 4K and 77-, 88-inch 8K OLED TV panels with the strategy of focusing on the ultra-premium TV market.

Samsung Display, the sole supplier of QD OLED introduced QD-Display 55- and 65-inch TV display, along with a 34-inch curved gaming monitor at CES 2022. The display integrated printed Quantum Dots with blue self-emitting pixels. QD OLED Display can provide superior color performance. The company has added 77-inch TV and 49-inch ultra-wide monitor at CES 2023. The 2023 products used advanced AI and new OLED materials improving RGB color brightness to reach >2000 nits. According to Samsung, QD OLED 2023 has reduced the power consumption of 2022 models by up to 25%. Further investment to increase QD OLED capacity is expected in 2023. Samsung Electronics and Sony are currently selling QD OLED TVs and more brands are expected to join in 2023.

OLED TV (W-OLED + QD OLED) technology is continuing to evolve and improve. The planned introduction of all phosphorescent RGB emitters by Universal Display in 2024 can further improve performance, reduce costs, and increase lifetime. OLED TV needs more new investment in capacity for stronger growth in shipments whereas MiniLED QD TV can use already available LCD capacity, especially from 10.5 Gen fabs.

MiniLED QD TV Can Outperform OLED TV Shipments

According to Omdia’s press release on March 21, 2023, “size migration for TVs will help to increase area shipments in 2023. 65-inch and above TV display shipments decreased 5% YoY in 2022 owing to global recession and display makers’ low fab utilization for Gen 10.5 fabs due to historical low display prices. However, it is forecast 65-inch and above TV display shipments will increase by 17% YoY in 2023”. Omdia expects 2023 to be a recovery year with a focus on TV replacement demand for 50-inch and above sizes, driven by lower retail prices. If MiniLED QD TV can reduce costs to offer products also in mid-range and eventually in mainstream market with product offering at various price/performance ranges, it can drive stronger growth.

MiniLED QD TV: Road to Success:

- MiniLED QD TV can have substantial cost advantages by using 10.5 Gen LCD capacity from China for larger size displays (65-inch and above). Samsung Display and LG Display are shifting towards OLED reducing LCD capacity but BOE, Chine Star, and HKC from China have increased their market shares.

- Drastic panel price reduction for LCD in 2022 will contribute to cost reductions.

- Higher collaboration: among suppliers within the MiniLED supply chain including substrate, LED epitaxial wafer, packaging, driver ICs, display suppliers and even consumer electronic companies can help to reduce costs.

- Lower LED costs, higher dimming zones per driver ICs, higher transfer throughputs and transfer yield rates combined with integrated supply can reduce costs.

- TV industry went through major replacement cycle and growth in demand when LCD backlight shifted from CCFL to LED. MiniLED backlight shift can drive higher replacement demand for TV.

Lower costs and products in mid-range and mainstream can enable MiniLED QD TV to outperform OLED TV shipments in the future.

Sweta Dash is the founding president of Dash-Insights, a market research and consulting company specializing in the display industry. For more information, contact [email protected] or visit www.dash-insights.com