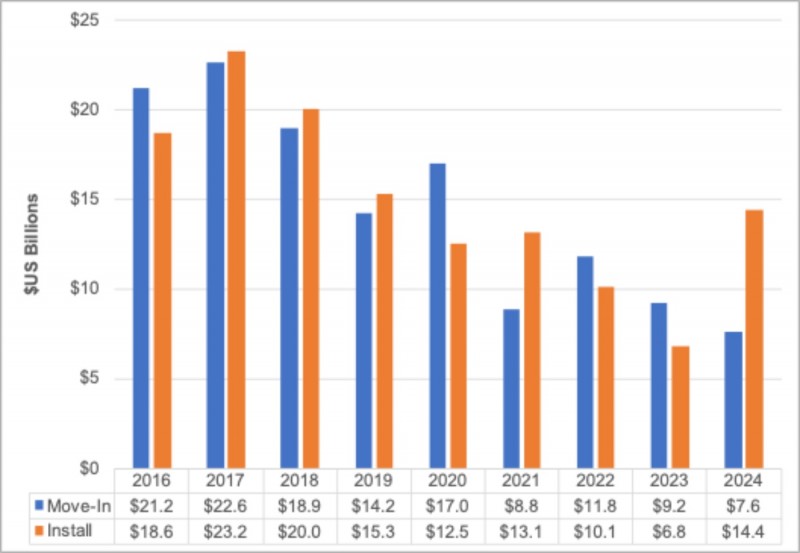

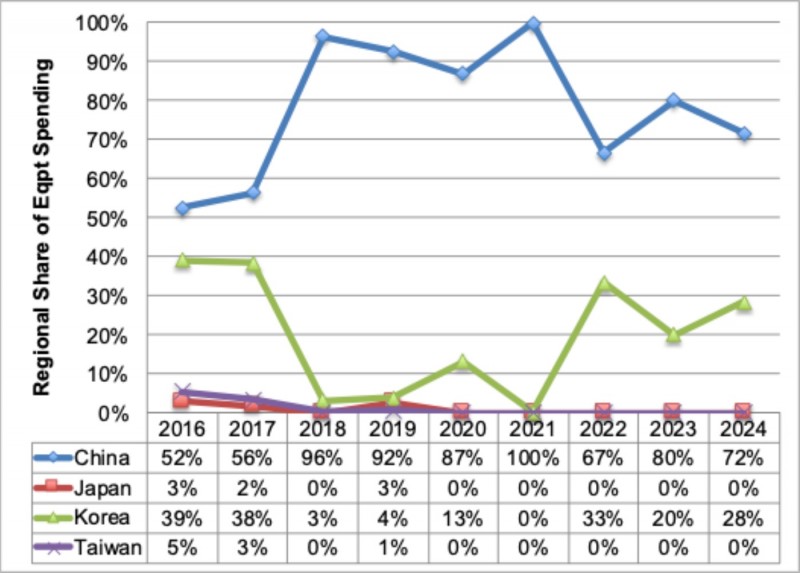

DSCC issued the Q3’20 version of its Quarterly Display Capex and Equipment Market Share Report last week which upgraded 2019-2024 spending by 4% on a move-in basis and 5% on an install basis on a number of new fabs added in China. There were 3 new fab lines added over the 2021-2023 period all in China for OLEDs. China is expected to account for 84% of 2019-2024 LCD and OLED spending.

China’s share of LCD spending will be 100% and its share of OLED spending will be 76%. Other highlights include:

- Revealed timing changes at 48 different future fab lines for purchase orders, move-in, install or MP ramp. All of this data is compared with the prior quarter. Fab timing is always fluid, more so now as a result of COVID-19 which has constrained mobile phone and TV demand while expanding notebook, monitor and tablet demand.

- COVID-19 also limited Japanese equipment engineers from travelling to China from February to June which has impacted a lot of fab schedules, but they have solidified in 2H’20. DSCC shows 68% of 2020 equipment spending on a move-in basis in 2H’20 with 71% on an install basis. For some companies, it will be even higher. Canon recently revealed that only 6 of their 35 litho tool shipments were recognized in 1H’20 with 29 or 83% in 2H’20. Nikon indicated it installed 0 tools in Q2’20 and is expected to ship 18 tools over the next 3 quarters. Litho tools do take longer to install than other tools.

- While some of the fab schedule changes were only a month or two, the biggest change was at LCD manufacturer HKC’s H4 fab which was previously expected to install 90K G8.5 substrates in 2020. However, due to market conditions and financial challenges, they shifted to just ~45K substrates worth of equipment installed in 2020, with the remainder delayed to 2021 or later.

- Along with Korean manufacturers Samsung and LGD shutting down significant LCD capacity, COVID-19 related MP delays at BOE, China Star and HKC should significantly tighten LCD supply and demand and lead to high single digit price increases in Q2’21 and Q3’21 and prices higher Y/Y by Q4’21 for the first time in a very long time. Margins should also improve significantly.

- BOE is expected to lead in spending from 2019-2024 with a 23.4% share followed by closely by China Star at 21.9% as these two companies will continue to gain in importance in the display industry. SDC is expected to be #3 at 11.8% with HKC at 11.0%, Visionox at 8.7%, Tianma at 7.1% and LGD at 7.0%.In OLEDs, BOE is expected to lead with a 24% share followed by China Star at 20%, SDC at 17%, Visionox at 13% and LGD and Tianma with 10% each. In LCDs, we show HKC leading with a 35% share followed by China Star at 27%, BOE at 21% and Sharp at 16%.

- We added two new segments this quarter raising the total of equipment segments covered to 79. The new segments are:

- COF/COP/COG bonding

- FOF/FOG bonding

- These segments amounted to $200M per year from 2016-2020.

- We also established quarterly and annual market share for these two segments.

DSCC’s Latest Equipment Spending Forecast

DSCC’s Latest Equipment Spending Forecast

Other highlights include:

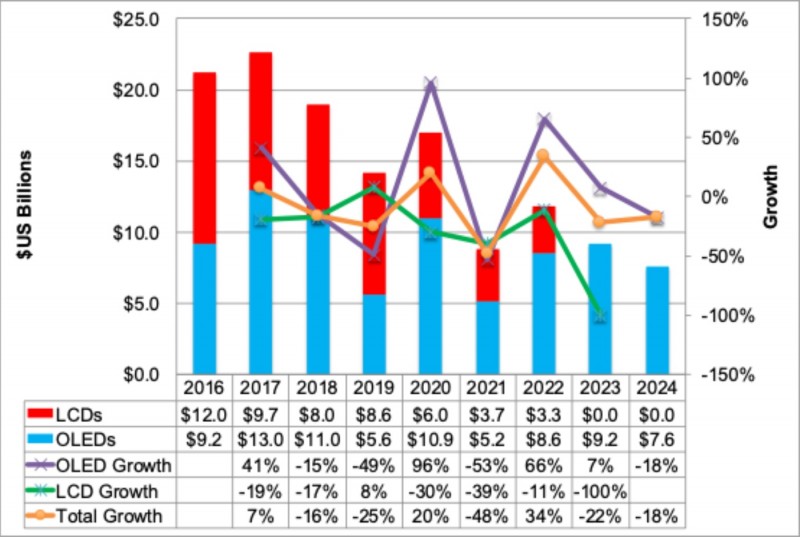

- The difference between move-in and install are widening in 2020 due in part to the quarantining of Japanese equipment engineers as well as HKC’s delay. We reduced 2020 install spending by 17% vs. last quarter and increased 2021 installs by 14%. OLED spending is expected to rise by 96% in 2020 with LCD spending down 30%. Mobile OLED spending will rise by over 240% as many more OLED fabs are equipped in 2020 despite the current oversupply in mobile OLEDs.

- In 2021 on a move-in basis, we see a 48% decline in spending to $8.8B, although there is still time to pull-in spending from 2022 to 2021, especially if utilization/demand improve more than expected. OLED spending is expected to fall 53% after the big 2020 surge with LCDs down 39%. No OLED TV spending is expected in 2020.

- We see 2020 spending up 34% vs. a 27% decline last quarter on new fabs, delays from 2021 and fabs pulled in from 2023. OLEDs are expected to be up 66% with OLED TVs accounting for a 60% share of OLED spending. LCD spending is expected to be down 11%. 2022 is currently shown as the last year of LCD spending on a move-in basis.

- In 2023, we see a 22% decline with LCDs down 100% and OLED spending up 7%. Mobile OLEDs are expected to lead OLED TVs with a 53% to 47% advantage. From 2019-2024, OLEDs should lead LCDs with a 67% to 33% advantage.

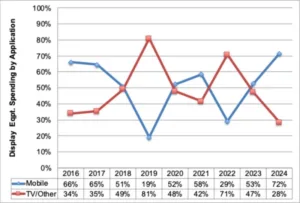

- In terms of equipment spending by application, while the mobile share of spending fell to just 19% in 2019, it is expected to account for a majority of spending in 2020, 2021, 2023 and 2024. Mobile is expected to account for 51% of 2020-2024 spending. TV spending is expected to decline in 2020 and 2021 before rebounding in 2022 and declining in 2023 and 2024 as OLED TV pending remains lumpy.

- a-Si is expected to hold a slight lead over other backplane technologies with a 31% share with LTPS at 29%, oxide at 24% and LTPO at 14%.

- Flexible is expected to account for 43% of 2019-2024 display equipment spending and 63% of total OLED spending.

- WOLEDs are expected to lead in OLED TV spending from 2019-2024 with a 43% share followed by QD-OLEDs at 35% and RGB IJP OLEDs at 23%.

- By glass size, G6 is expected to lead with a 45% share followed by G8.5/8.6 at 30% and G10.5 at 24%.

DSCC’s Display Equipment Spending Forecast by Technology (Move-In Basis)

DSCC’s Equipment Spending Forecast by Application (Move-In Basis)

Of the top 25 suppliers in 2020, there are expected to be 12 from Korea, 10 from Japan and 3 from the US. Market share is provided for each of the 79 segments and is available by year, quarter, country, frontplane, backplane, etc.

For more information on Quarterly Display Capex and Equipment Market Share Report which analyzes 79 different market segments and has the industry’s most complete equipment spending data, please contact [email protected].