Despite slower demand from end market and panel price erosion, the large thin-film transistor (TFT) display market expanded in 2017 in all three aspects — unit shipments, area shipments and revenue.

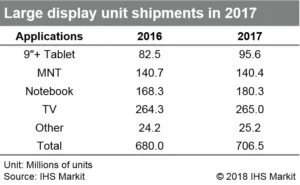

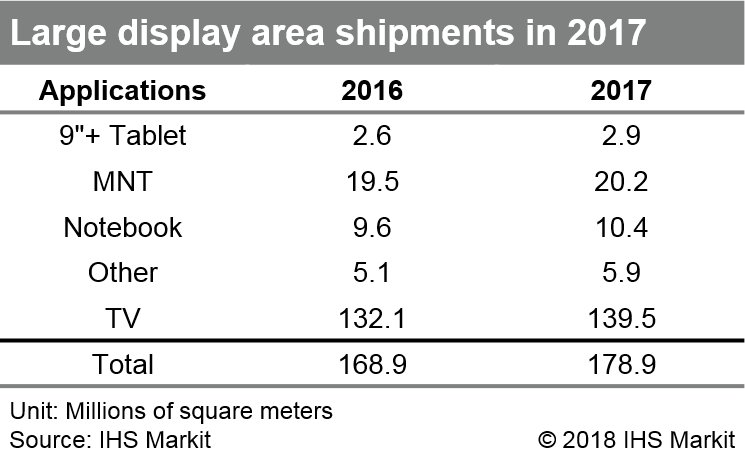

According to a new report from business information provider IHS Markit (Nasdaq: INFO), unit shipments of larger than 9-inch TFT displays increased by 4 percent in 2017 compared to a year ago, while area shipments rose 6 percent and revenues up 13 percent during the same period.

“Revenue growth was higher than that of area shipments, which was again bigger than that of unit shipments. This indicates that the display market is moving to larger screens in all applications, and the penetration of high specification products with a higher price tag, such as high resolution, wide viewing angle and slim design panels, has increased,” said Robin Wu, principal analyst at IHS Markit. Large TFT display revenues reached $63.7 billion in 2017, according to the latest Large Area Display Market Tracker by IHS Markit.

By area shipments, TV displays, which grew 6 percent year over year, accounted for 78 percent of total large TFT display market, leading the overall market growth. Despite ongoing decline in TV panel prices, which started in the middle of 2017, revenue continued to grow by a double digit as panel makers have focused on high-end products, such as 4K TVs and 55-inch-and-larger TVs. Shipments of 4K TV panels amounted to 92 million units in 2017, up 46 percent year over year, making up 35 percent of the entire TV display market. OLED TV panels also continued its growth, marking unit shipments of 1.8 million with a 102 percent growth from 2016.

BOE led the large TFT display market with a 21 percent share in 2017 in terms of unit shipments, followed by LG Display with 20 percent and Innolux with 16 percent. It was the first time that a Chinese panel maker took the top position in an annual base result. However, in the TV panel market by unit shipments, LG Display retained its lead with a 19 percent share, followed by BOE with 17 percent. In terms of area shipments, South Korean panel makers remained strong, with LG Display accounting for 23 percent and Samsung Display for 17 percent.

The Large Area Display Market Tracker by IHS Markit provides information about the entire range of large display panels shipped worldwide and regionally, including monthly and quarterly revenues and shipments by display area, application, size and aspect ratio for each supplier.

About IHS Markit

IHS Markit (Nasdaq: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world’s leading financial institutions. Headquartered in London, IHS Markit is committed to sustainable, profitable growth. www.ihsmarkit.com