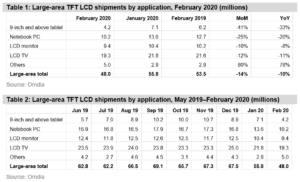

According to the latest Omdia Monthly Large Area Display Market Tracker, combined shipments of large-area and small/medium TFT LCD panels were down by 5% MoM and 1% YoY to 174 million in February 2020. Shipments of large-area panels were down by 14% MoM and 10% YoY to 48 million, while shipments of small/medium panels were flat MoM but increased by 3% YoY to 126 million.

The Spring Festival, which took place from late January to early February 2020, as well as the impact of the coronavirus disease 2019 (COVID-19) were the major factors for the shipment decrease in February 2020.

In preparation for worldwide sports events during the summer, TV brands had already started to stock up on their inventory early in the first quarter of 2020 (Q1 2020). However, with the possibility of those events being delayed because of COVID-19 and the concerns of possible demand deceleration caused by the global pandemic, the shipping performance in the next 2–3 months remains quite uncertain.

With the recovery of normal seasonal demand, panel shipments might increase; and since brands’ fears of a component shortage are still high, there is a strong possibility of shipment recovery and increase. However, as a result of the less transparent processes of some countries in dealing with the COVID-19 pandemic, this could greatly affect the global demand. As such, the shipment forecast for the coming months, especially during late of the second quarter of 2020 (Q2 2020), appears quite pessimistic currently.

Shipments for applications in February 2020 were as follows:

- The 9-inch and above tablet panels were down by 41% MoM and 33% YoY.

- Notebook PC panels were down by 25% MoM and 20% YoY.

- Monitor panels were down by 10% MoM and 8% YoY.

- TV panels were down by 12% MoM and 11% YoY.

On an area basis, large-area panel shipments were down by 6% MoM but managed to keep flat YoY. Despite a significant shipment decrease, the flat YoY area growth was mainly a result of the larger-size trend that is developing quickly now.

Total TFT LCD revenue decreased by 8% MoM and 15% YoY in February 2020. Revenue from

large-area panels was down by 7% MoM and 15% YoY while revenue from small/medium panels fell by 16% MoM and 10% YoY. Thanks to a possible shipping recovery and currently increasing panel prices, shipping revenue performances could improve soon.

Shipments by application

In February 2020, shipments of tablet PC panels (5-inch and above) decreased by 21% MoM but increased by 7% YoY to 14.4 million, while shipments of 9-inch and above tablet PC panels decreased by 41% MoM to 4.2 million.

Shipments of LCD monitor panels decreased by 10% MoM to 9.4 million while shipments of LCD TV panels were down by 12% MoM to 19.3 million in February 2020. With seasonal demand recovery expected in the next 2–3 months, stronger shipping performances are also expected.

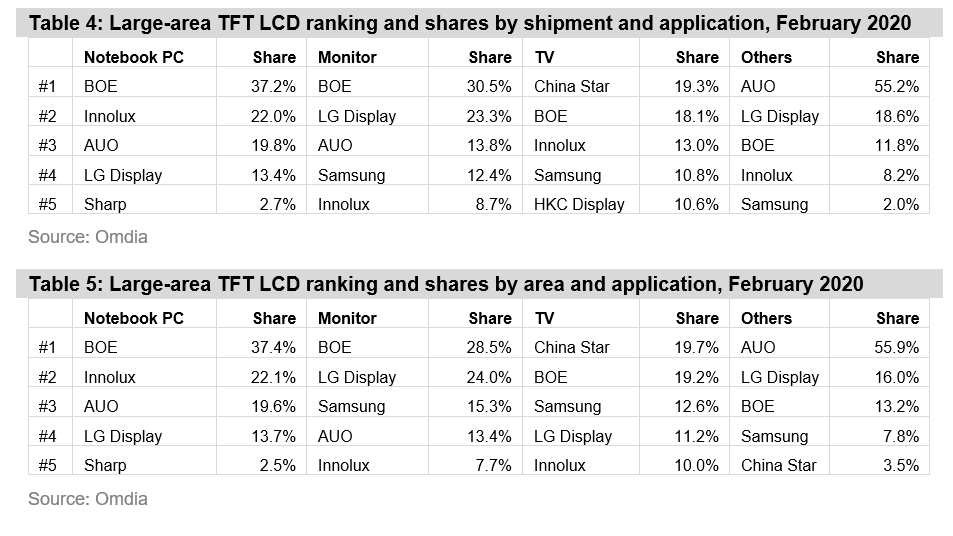

Supplier rankings: China Star the top TV display supplier for the first time

With big capacity investment in mainland China in recent years, Chinese panel makers are gradually establishing themselves as leaders in the market. BOE is now one of the top five shipment suppliers and has remained the leader for large-area displays. Meanwhile, other Chinese panel makers also increased their shipment shares and shipment area shares significantly in the past few quarters. Moreover, with Korean panel makers gradually restructuring their capacities, Chinese panel makers have started becoming the top shipment area suppliers in recent months.

- On a large-area panel shipment basis, BOE was first with 27.7%. AUO was second with 15.7%, LG Display was third with 14.1%, Innolux was fourth with 13.7%, and China Star was fifth with an 8.4% share.

- On an area basis, BOE took the lead in large-area panel shipments with 20.8% of the market. China Star followed with 16.1%. LG Display was third with 12.9%, while in fourth and fifth position were AUO and Samsung with 12.5% and 12%, respectively.

The top five’s shipments for large-area applications were 79.6% of the overall large-area panels shipped in February 2020.

The following table lists the shares of shipments for the top five large-area suppliers. The shares for January 2020 and February 2019 are also included for comparison.

Additionally, the following two tables list the shares of shipment and shipment area for the top five large-area suppliers by application.

UHD (4K) LCD TV panel shipments decreased by 2% MoM in February 2020

Makers shipped 9.7 million UHD (4K) LCD TV panels in February 2020, a decrease of 2% MoM, for a 50% penetration of overall LCD TV panels shipped for the same month. With the gradual release of new Gen 8.6 and Gen 10.5 capacities in upcoming quarters, especially for larger sizes, further increases in the penetration of UHD LCD TV panels in 2020 are expected.

China Star was the top supplier of 4K LCD TV panels in February 2020 with 2 million units shipped for a 20.6% share of the market. BOE, LG Display, and Samsung followed with 18.9%, 13.6%, and 12.9%, respectively. AUO was fifth with a 10.8% share.

Makers shipped 3 million 55-inch 4K panels, making it the leading size for February 2020 with 30.9% of the 4K LCD TV panel market. Shipments of 65-, 43-, 50-, and 49-inch panels followed with 19.7%, 16.7%, 16.5%, and 4.9% of the market, respectively. The 75-inch was sixth in the market at 4.4%.

In addition, makers shipped 196,600 4K LCD panels for monitors and 35,000 4K notebook panels in February 2020.