IDTechEx Research has put out the latest version of its forecast for ITO alternatives and has forecast that the market will reach $250 million by 2026. Dr Khasha Ghaffarzadeh, Research Director, IDTechEx summarised the developments in the market which the firm has been watching for five years.

IDTechEx Research has put out the latest version of its forecast for ITO alternatives and has forecast that the market will reach $250 million by 2026. Dr Khasha Ghaffarzadeh, Research Director, IDTechEx summarised the developments in the market which the firm has been watching for five years.

Metal Mesh Gaining Traction

The ITO alternative landscape is emerging from its period of consolidation triggered by slashed ITO film prices. Metal mesh solutions, in particular, are gaining traction. In the short to medium term, they will be finding success in medium-sized consumer electronics (e.g. tablets) and large area capacitive touch surfaces, a market space traditionally dominated by either optical and micro wire touch technologies. In addition, metal mesh is being increasingly proposed and evaluated for use in the automotive industry as a transparent window de-mister.

There are many ways of manufacturing metal mesh but direct printing had typically been locked out of the market to date. This was mostly due to performance: the line width could be easily reduced to <20µm without compromising production yield. This meant that the lines remained highly visible, ruling out their use in consumer electronics devices.

Can Printing Find a Way to Become Competitive Again?

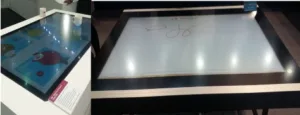

This is beginning to change. One reason is that line visibility may be tolerated in large area (>50″) capacitive touch surfaces or tables. This is why companies like Gunze have employed direct printing to create metal mesh with 24µm line width. The product is shown below. It has already been installed in several public places in Japan.

The next reason is that gravure offset printing can now reduce the linewidth reliably to 5µm using inks with sub-micron particles. This makes printing a viable technology for creating high-performance metal mesh solutions. It will now be able to compete with etching or embossing based approaches.

In parallel to this, numerous promising developments are taking places. For example, hybrid printing is making good progress. Here, the wide conductive lines and photoresists can be printed before being subjected to an over-etching step aimed at narrowing the linewidth to 5µm or less. The over-etching process requires accurate control so as not to compromise the yield but eliminates the need for precise photolithography or printing techniques.

Left: a 50-inch capacitive touch table showcased by 3M. Here, a copper-based metal mesh is used from a Japanese supplier. This non-printed process was preferred to silver nanowires due to higher reliability. Right: A large area capacitive touch screens showcased by Gunze. Here, direct printing is employed to create the metal mesh. Source: The author took these photos at C-Touch in Taiwan in Aug 2016.

Novel ink-based approaches are also emerging. In one example, the substrate is coated with fluoropolymer. UV light is used to change the hydrophobicity in specific regions before a specialized nanoparticle ink is blanked coated. The ink only adheres to the patterned areas, giving rise to sub-micron linewidths. This and similar technologies are still in prototyping or early pilot stages.

Other nanoparticle-based approaches have also been in development for some time. In particular, hybrid embossing/printing was commercialized by a major Asian touch panel manufacturer as a TCF technology. It had become the market leader in ITO alternatives by putting in place one of the most aggressive scale-up plans. Despite the early success, however, continued customer satisfaction with the product is now in question.

The picture has not however been all bright and rosy. For example, an Israeli firm set up to commercial TCFs based on inkjet printing of specially formulated inks has ceased trading whilst another firm focused on the so-called self-assembling nanoparticle inks has also gone eerily quiet.

Analyst Comment

Thanks to IDTechEx for permission to reprint this article. We believe that Ghaffarzadeh is referring to Cima Nanotech which apparently went bankrupt (Cima Nanotech is Insolvent), but still has a website and is still, apparently, trying to continue in some form. (BR)