IHS Markit said that Chinese makers hit one million units of shipment of AMOLEDs for the first time in Q3, but that is less than 2% of the AMOLED smartphone market. Overall volume was 101 million, with Samsung supplying 99.7 million.

IHS Markit said that Chinese makers hit one million units of shipment of AMOLEDs for the first time in Q3, but that is less than 2% of the AMOLED smartphone market. Overall volume was 101 million, with Samsung supplying 99.7 million.

The small number of Chinese panels was split three ways, between EverDisplay Optronics, Tianma and Govisionox (Visionox) but at 1.4 million was more than double the 590 thousand in Q2.

“Strong demand from Chinese smartphone brands, especially OPPO and Vivo, helped boost overall AMOLED panel demand significantly”, said Terry Yu, principal analyst of small and medium displays for IHS Markit. “Many Chinesesmartphone makers,such as Meizu, Gionee, Lenovo, Huawei and even Xiaomi, are planning to adopt AMOLED panels in their devices. This gives Chinese display suppliers a great opportunity to gain more orders, improve their mass production yield rate and enhance their product reliability”.

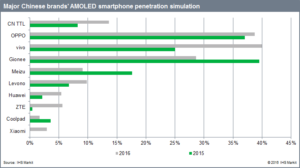

According to IHS Markit, AMOLED display penetration among Chinese smartphone brands is expected to increase from 8 percent in 2015 to 13.6 percent in 2016. However, due to the tight supply of AMOLED panels from Samsung Display, many domestic smartphone brands are turning to local Chinese panel makers. For example, after Xiaomi and Huawei failed to secure their orders of AMOLED panels from Samsung, they struck partnerships with EDO, the leading AMOLED panel suppliers in China, with the promise of mass production and product reliability. EDO, which started operating its Shanghai-based Gen 4.5 AMOLED fab in 2014, shipped one million units of AMOLED panels in the third quarterof 2016, up from 0.2 million units in the first quarter. Similarly, Tianma and Govisionox have also developed business relationships with ZTE as its secondary supplier of AMOLED smartphone displays.

“Chinese panel makers are still too small to threaten Samsung’s dominant position, but they still play an important role as a second or third source for major smartphone brands in China”, said. “Furthermore, as Samsung Display shifts its focus to the flexible OLED, Chinese panel makers are expected to expand their shares in the rigid OLED panel market”.

This penetration data shows that while most brands have increased the balance towards OLED, not all have.