Ryosuke Kuwada is from TPK in Taiwan and is a veteran of several large companies. He pointed out that talks from TPK are unusual (this was the first one that we could remember!).

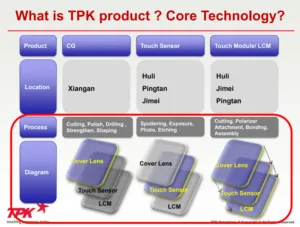

The company has more than 20,000 employees and has sales of $3.5 billion and is one of the largest touch technology companies. When it had its IPO, the market cap was even larger than it is today. TPK was an early iPhone supplier, but now it has many touch applications. So, what is the core technology? The company buys glass and processes it by cutting, polishing and hardening as well as adding the touch elements then adding polarisers, and encapsulation.

Two or three years ago there were ten or more companies in touch in Taiwan and many more in China, but some left the business which was very bloody! Three or four years ago, TPK was in a crisis, but now “it is back” after clearing a lot of debt. The company also focused on premium customers rather than volume and the staff level dropped by half. There is a move by some customers to move away from in-cell touch being integrated as buyers don’t like it, Kuwada said, as they prefer more flexibility to control the display and touch separately. The company is also developing non-touch applications.

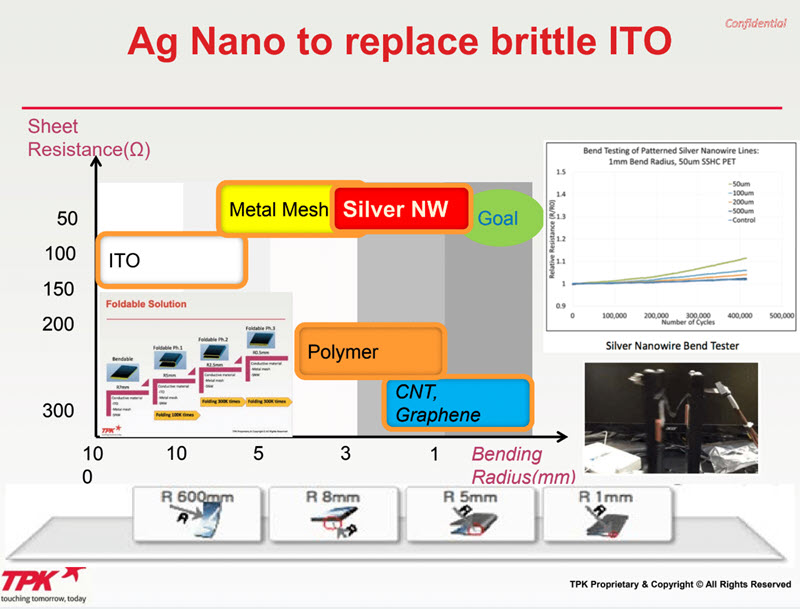

TPK is also working on printed electronics and developing silver nanowire technology. It has a new specialist manager in printed electronics and is also working with a big Japanese company to move from glass to film substrates for this technology.

Silver nanowire is now good enough for foldable and flexible displays, Kuwada said. TPK sees that Chinese companies are pushing flexible displays very hard and are developing well. TPK started working with Cambrios in 2012 and later worked with Innova (which is a competitor to Cambrios Innova Adds Touch to Films (IC14)) and TPK is working with both. (The Cambrios ip was bought by TPK and taken in house – see Does C3Nano Have the Technology that Will Kill ITO?). Innova and Cambrios had similar technologies (Kuwada said he worked for Innova and spent $500K on lawyers, fighting the Cambrios patents, but the differences between the two are ‘grey’)

TPK bought the IP from Cambrios and is working with Innova

TPK bought the IP from Cambrios and is working with Innova

Turning to its product range, TPO can offer a lot of options including a wide range of different substrates such as PI and PET as well as glass. It has a flexible PET solution using 2.5mm radius bending for 300,000 tests. It also has an option with 1.5mm bend radius using a different architecture.

The company has a new ClearOhm film that may be very useful for flexible displays. Kuwada said that more than ten clients are evaluating the technology.

Analyst Comment

It’s not surprising to hear TPK say that customers prefer separate touch technology, but I wonder if that is more than the top one or two, that have big volumes and resources. For others, the simplicity of in-cell touch must be compelling, especially in cost critical applications such as smartphones. (BR)