Tamura-san is from DSCC and is a very experienced display industry analyst and he talked about the smartphone market.

Tamura-san is from DSCC and is a very experienced display industry analyst and he talked about the smartphone market.

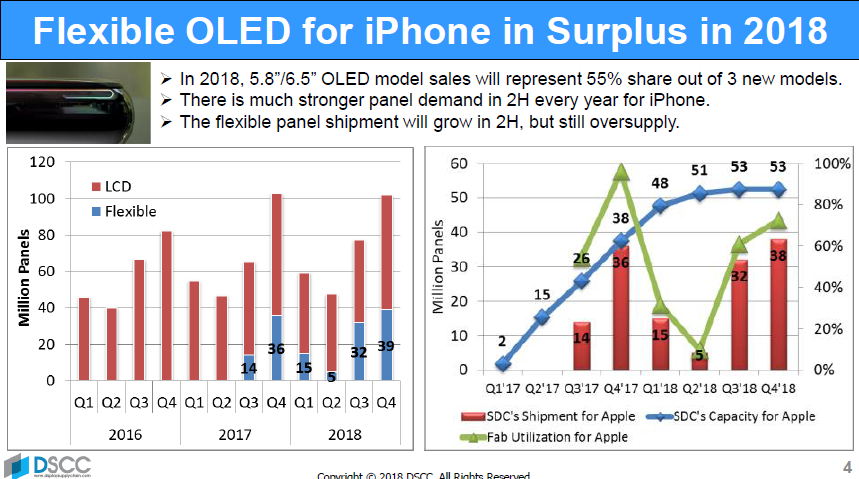

The Apple iPhone X was a lot more expensive than he expected and as a result, the phone saw lower volumes than some hoped, so there is excess supply capacity for flexible OLEDs. On the other hand, next year Tamura expects two OLED models and one LCD to be released by Apple. This year, LG may be able to sell a small volume of OLEDs to Apple, but will be able to start supply in some volume in 2019. Because of the less than expected volume, Samsung has cancelled one fab plan and LG may do the same. There is a question as to whether a third supplier is needed or not.

In Q1, Apple’s result was OK – it had revenue growth, although the Galaxy overall demand may go down by 5% compared to 2017. There is a question of whether Samsung may move flexible OLEDs down further into its range of smartphones. For Chinese makers, LTPS LCD is very attractive against both a-si LCD and also against OLED. Tianma is the biggest supplier and can supply LCD products that can give a look similar to the iPhone X. If rigid OLED gets close to the LCD price, then it could increase a lot, but flexible OLED is still a bit expensive. However, LTPS is in oversupply, like OLED, but Japanese suppliers and Taiwanese have amortised their fab costs, while the Chinese have low finance costs, so the overall cost is quite low.

Now, Samsung has dropped the price of its rigid OLEDs and that has proved attractive to Chinese makers who will adopt it, so Samsung has got to 80% utilisation for rigid OLEDs. Visionox is also doing well with rigid OLED and has high utilisation, as has Tianma for LTPS.

In Q3 and Q4, Apple should increase its demand for flexible OLEDs as it has a very strong seasonality and that will reduce the oversupply for flexible OLEDs.

At the moment, rigid OLED is slightly cheaper on direct cost than LTPS LCD, but from next year, Samsung’s fab will be depreciated, so the total cost will get within a couple of dollars of LTPS, which may allow Samsung to be more aggressive. In Q1 2018, Samsung’s margin was around 6%, but 10% for flexible, but with a loss on rigid OLEDs. Next year, rigid OLED demand should get close to supply, but in flexible there could be 40% overcapacity this year and may still be 30% in 2019, although things may get better in 2020 as there is not a lot of capacity increase coming, even though Chinese suppliers will be trying to boost their production.

Analyst Comment

Tamura said that there is a question of whether a third supplier of flexible OLED is needed or not. That’s not a question from companies such as BOE! (BR)