The next speaker was Stephen Baker of NPD, an analyst that is very focused on the consumer experience. He said he wanted to bring some clarity from the ‘front end of the supply chain’. He said that he thinks that a couple of points were missing in earlier talks.

The next speaker was Stephen Baker of NPD, an analyst that is very focused on the consumer experience. He said he wanted to bring some clarity from the ‘front end of the supply chain’. He said that he thinks that a couple of points were missing in earlier talks.

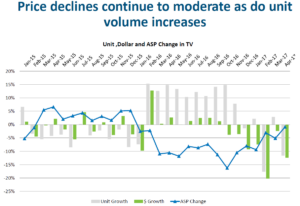

He said that there have been some shortages of larger TVs this year. Volume has been challenged this year, but prices are relatively stable, after falling dramatically last year. Small size (32″ and 40″) price reductions are continuing, similar to 2016, and the same is happening in larger sizes. 4K TVs are declining in price and there are a lot of different price points. Just because there are high priced TVs at $3,000 it doesn’t mean that they sell! Even at $1,500, the market segment is only 10% of the market. People in the US don’t spend a fortune on TVs, he said. The mix of different products at different prices is important for maintaining the ASP.

NPD showed that ASP price declines have reduced. Click for higher resolution.

The Future for Wall TV

55″ is the top selling TV and Baker believes that the ‘wall TV’ will ‘never happen’.

He showed a chart with ASP declines of up to 5% per month. In the US, February and April were poor and the market seems to be slowing. NPD sees a flat volume forecast and a slightly negative revenue forecast. Next year there may be some growth in volume, but still a drop in revenues. 40″ class TVs with UltraHD will be $299 to $399 and that will be a big part of the market.

Baker said that younger people do want bigger screens than they are currently using. That will mean some demand for 55″ to 65″ TVs for ‘when their friends come around’, although those that want the sets may not be in the income segments that can buy them.

He then showed some recently weekly growth charts and it showed that there had been little growth in big sizes, but that is mainly because of a lack of supply. Looking at ASPs, they are around the same level as last year, after a lot of challenges around six weeks ago.

There is an accelerating difference between 2K and 4K sets and that is because FullHD sets are coming towards the end of life.

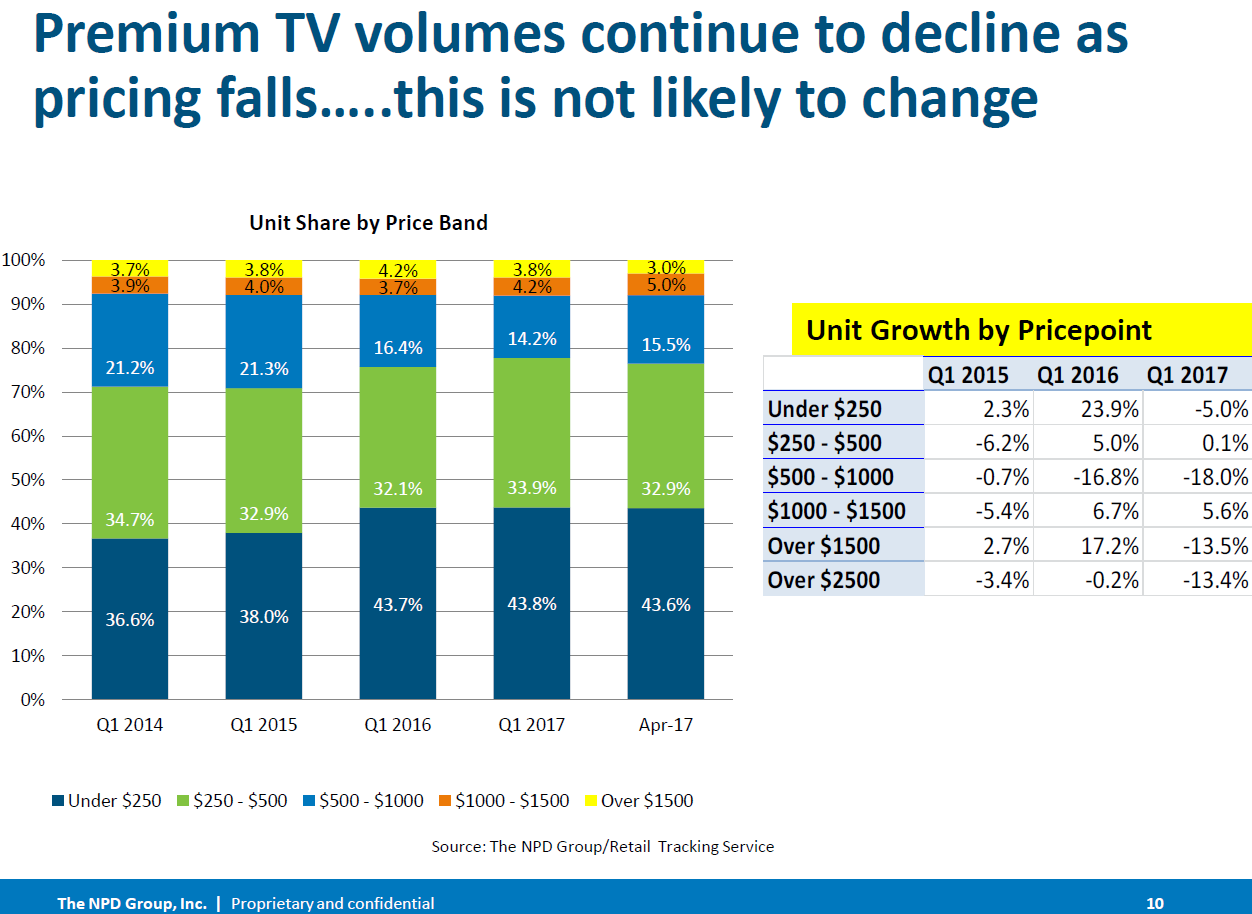

Pricing segmentation doesn’t change fast – click for higher resolution

Pricing segmentation doesn’t change fast – click for higher resolution

Looking at sales by price segment – around 8% of the market is around $1,000, but under $250 is 45% of the market. Sets at $1000 to $1500 are up, but that is because sets at $2000 or more are coming down in price. There is a move down to lower price points, with five quarters of decline in the above $1000 sets. Baker said that there are few customers for big sets at 65″ or more. If you want to double the sales of 65″ you have to sell them at $699. Half of 55″ volume is now below $500, a big percentage of the market. If you go above $1000, you wipe out a huge percentage of the potential market.

Looking at revenues, a big share of the market comes from bigger screens. More than 60% of large screen TVs (50″ and above) are now UltraHD – that’s what people want as long as they are not too expensive. 40″ has already seen 15% of the market move to UHD, even if most of the time the viewer can’t really see the difference. Around a third of the volume of UltraHD sets is in 60″ and above. Unit growth of UltraHD at less than $500 is up 500% on last year!

Almost 40% of 32″ TVs are smart now, with 80% of 55″ and 100% of 65″. Adding ‘smarts’ to allow the play of Netflix on the big screen is a way to keep demand for smaller sets

Analyst Comment

At SID, the discussion over the prospects of a wall TV came up several times. Baker thinks it won’t happen. I think it will, ever since I saw the NTL/Cisco Project Fresco at IBC several years ago. The company had done a lot of work to see the practicality of very large TVs and the demo was very compelling. I also think that there is huge resistance to ‘the big black hole on the wall’. Big TVs, currently, when powered down are not at all attractive. Samsung, BOE and others are working on sets that can show artworks when not watching video. Loewe and Panasonic have developed design concepts based on transparent display and NHK has shown design concepts of a 130″ roll-up OLED with 8K. At the right price, there’s no question that I would want one of those!

In discussions with other veterans of Baker’s points about the need for prices to drop to drive the 65″ volume from up-coming G10 fabs, we concluded and agreed that there is no question that prices will come down to whatever level is needed to absorb the capacity. Prepare from some very good deals in 65″ TVs in a couple of years! (BR)