A couple of weeks ago, I wrote an editorial about this being a period of anniversaries. Those I had in mind were the tenth birthday of the iPhone and fifty years of colour TV in the UK. However, there was another one, a couple of weeks ago – the fiftieth anniversary of the ATM.

Now, it is said that the ATM was invented by a Scotsman. However, two different Scotsmen have claimed the invention.

One, John Shepard-Barron who worked for banknote printer, Thomas de la Rue, developed a system using special cheques and PINs, while the second, James Goodfellow, registered the first patent and developed a forerunner of the plastic card we use today. The card looked more like a punched card, for those old enough to remember those, with a PIN.

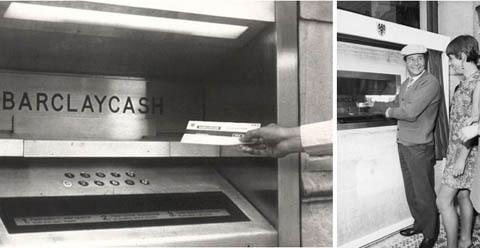

I recently heard an interview with the son of Shepard-Barron who said that his father came up with the idea as he was walking towards the bank door to get some cash on a Saturday at lunchtime, when the bank ‘shut the door in his face’. He immediately went home and started work. (Others have other ideas about the invention, but Wikipedia says that “It is widely accepted that the first cash machine was put into use by Barclays Bank in its Enfield Town branch in North London, United Kingdom, on 27 June 1967”. That was Shepard-Barron’s device.).

UK comedian Reg Varney used the first ATM globally in the UK in June 1967.

UK comedian Reg Varney used the first ATM globally in the UK in June 1967.

The first device that really worked like the ATMs that most of us have used since then was the IBM 2984 Cash Issuing Terminal, developed for Lloyds Bank in the UK.

The ATM has to be incredibly reliable, extremely tough and exceptionally secure and that has made development of the displays very difficult.

Most European ATMs use off screen buttons

Most European ATMs use off screen buttons

Today, most of the installed base in Europe still does not use touch screens, but uses simple buttons around the edges of the display alongside a simple numeric key pad (although touch screens are accepted in other regions).

Many also do not work, still, using the EMV (or ‘chip and pin’) cards that are increasingly being used to try to limit theft via credit and cash cards. (Some have even suggested a potential problem in the US with between 100,000 and 200,000 ‘white label’ ATMs in the US potentially going out of service in October this year. VISA is changing the liability rules which means that the owners of the machines, which don’t use chip and PIN technology, will not be covered for fraudulent use of the terminals after that date.

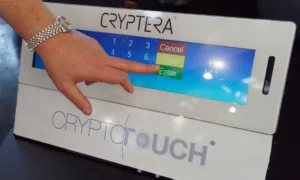

As we reported in our issue on the Electronica show, last year, Zytronic of the UK has developed a full touch system that has approved encryption (PCI) that means that ATM operators are covered for liability. The company is a supplier to NCR and Diebold and those companies are keen to develop more functional systems now that secure touch can be implemented

Zytronics has PCI approval for touch Pin entry. Image:Meko

Adding full screen touch with true graphic displays really opens up the ATM to many more applications, including video-based contact with bank staff at centralised locations. It has been claimed that up to 80% of the transactions currently performed in bank branches could be done using this technology.

NCR recently launched this range of video ATMs

NCR recently launched this range of video ATMs

Of course, in some countries, ATMs are already used for transactions other than cash. In Portugal, they are already used for the sale of concert and cinema tickets, and it’s easy to imagine many other applications, once touch, video and security are all in place.

There are those that believe that the smartphone revolution combined with a move to a ‘cashless society’ will eventually make the ATM obsolete, but it looks as though cash will continue for some time yet (and has a long history).

It seems to me that more and more kiosks of different types are appearing. Just yesterday, I was cycling through a village in North West France that was too small to have a bakery of its own, so had a baguette dispenser! I have seen the same machines outside bakeries to dispense bread out of shop hours. I have also seen ‘French Fry’ and ‘Pizza dispensers’ for those that need carbs at all hours!

It seems to me that more and more kiosks of different types are appearing. Just yesterday, I was cycling through a village in North West France that was too small to have a bakery of its own, so had a baguette dispenser! I have seen the same machines outside bakeries to dispense bread out of shop hours. I have also seen ‘French Fry’ and ‘Pizza dispensers’ for those that need carbs at all hours!

It seems to me that ATMs might just become a more specialised form of vending machine. Alternatively, vending machines might just dispense cash along with other goods. That would bring things full circle as Shepard-Barron said that he imagined the cash machine dispensing cash in the same way that chocolate machines worked in the 1960s.

And for those that just love bizarre stuff, check out this link I found when researching this article! — Bob Raikes