Charles Annis of IHS in a classic, Displaysearch-like high bandwidth presentations (which I love!), said that the company is getting more and more queries about OLEDs and this is because there is some revenue growth in the category, whereas other display markets are very limited. Annis is a specialist in display manufacture and his talk was titled “AMOLED Tidal Wave: Technology Revolution or Investment Bubble?”.

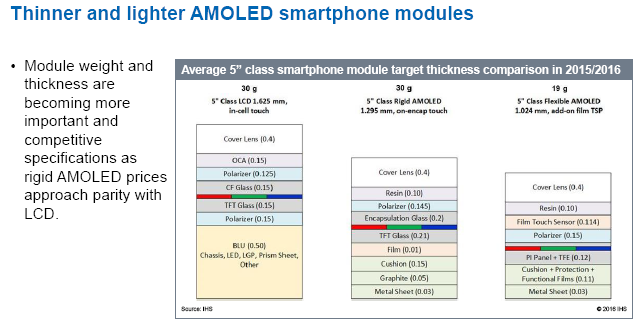

Thinner and lighter panels and lower prices have helped Samsung Display to sell to other smartphone makers than the company’s own phone business.

The LCDs have been getting thinner, but rigid and flexible OLEDs remain ahead, although LCD might eventually get down to 1mm thickness.

Modules get thinner lighter – click for higher resolution

Modules get thinner lighter – click for higher resolution

All current flexible AMOLEDs are made by EPLaR processing – glass is used as a carrier for the plastic that the OLEDs are made on. There are a lot of issues in getting to high yields as the processes are quite tricky and have a lot of steps.

Flexible OLEDs are made using a fine metal mask (FMM) process and that has been continuously improved to get to 400-500 ppi in RGB or 576 ppi using pentile pixel layouts. New developments suggest a roadmap to 700ppi using FMM.

Looking at foldable flexible displays it’s hard to make a 9H hardness cover lens which is what is needed for real products. Maybe, there might be a product from Samsung in 2017. The displays can also develop defects from creasing when repeatedly folded.

In TV, AMOLED will remain a niche. LG remains with white OLED and Samsung looked long and hard at taking this approach, but eventually decided against it. Costs really need to get much closer to LCD (perhaps as close as 30% might enable growth).

Ink jet deposition is a contender for making OLED, but the inks are not as robust as evaporated materials. There are still a lot of issues to be solved, but the volume of smartphones will drive material and manufacturing processes and that will help.

Traditionally, panel makers tried to reduce the number of photomask steps. There was an attempt to get to three, but around five is typical. On the other hand, for oxide, eight mask steps is currently typical. Annis said that the LTPO process, patented by Apple and mentioned by Hsieh earlier in the conference, is probably too complicated and risky for Apple to adopt.

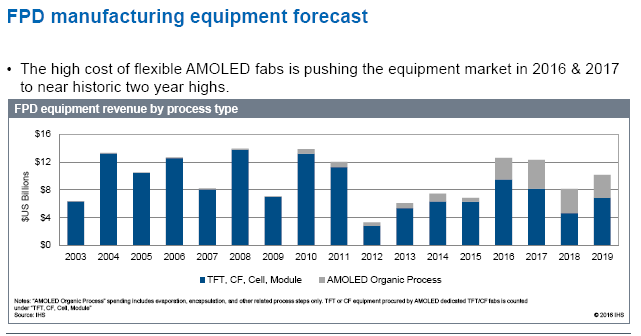

The plant to make flexible OLEDs is around 30% more expensive than making LCDs, so there is quite a good market for equipment – almost back at 2010 and 2011 levels, which were a time of record investment.

Looking at supply demand balance, there is a lot of capacity being added. Samsung is adding enough capacity that it can meet all the new demand and that will make it very hard for anybody else to gain share until 2019. There may be a bubble of oversupply. So the answer to the question posed in the title is “Both!”