DSCC recently ran a virtual forum on the AR & VR industry and developments. The recordings were available for 30 days from 20th September – so you could still register and listen if you are quick! If you miss it, the firm has a more general session on 19th October.

Guillaume Chansin opened the session by thanking the sponsors and introducing himself. He gave the first talk which was an overview of the market highlighting “Opportunities for Emerging Display Technologies”. His first slides covered the general display market, the Crystal Cycle and the battle between LCD and OLED.

He then moved on to the AR/VR topic and he emphasised a big change, that companies that had started from the software side (Meta, ByteDance/TikTok and Snap Inc), have moved to really work on the hardware side of the business as well. Meta has been investing for a long time and has been joined by the others in recent years. ByteDance bought Pico and Snap has bought Daqri assets, WaveOptics, Compound Photonics and NextMind (2022).

Sony delayed the launch of the PS VR2 headset from this year and that should give the market a boost. Chansin said that by the time the headset arrives, there should be an installed base of 25 million consoles that the headset can be used on. Samsung Display, which is the supplier of the displays for the headset, is pushing the limit for the OLED panels to be used at >800ppi. The delay reduces the DSCC forecast that it presented earlier this year.

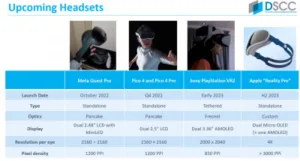

Looking at other plans, Chansin listed the Meta Quest Pro, the Pico 4 and Pico 4 Pro and the Apple “Reality Pro” (probably), which DSCC expects to arrive in the second half of 2023. It is expected to be a high end and expensive unit.

Looking at displays with see through performance, Magic Leap has its new product aimed at enterprise, while Microsoft has been reported to have cancelled the Hololens 3 and DSCC thinks that they might work with Samsung on the hardware. Many of the Microsoft staff have moved to other firms with AR initiatives.

Google has got more serious about AR again and has acquired Raxium (microLED technology). There has been a lot of investment in waveguides with Digilens raising over $50 million, Dispelix raising $33 million and Snap acquiring WaveOptics. In addittion, Vuzix, Xiaomi, Oppo and TCL have developed headsets based on microLED with diffractive waveguides. Nreal (which has just made its headsets available in the US) is concentrating on virtual monitor-like applications which, Chansin said, are easier as less processing power is needed than for true AR.

Turning to video passthrough AR, it is an important development that has some real advantages especially in ‘hard’ occlusion where light is blocked behind an object you are looking at. It is also hard to show black on optical pass-through, but video passthrough can have some latency and that can mean that it may not be usable in safety-related applications.

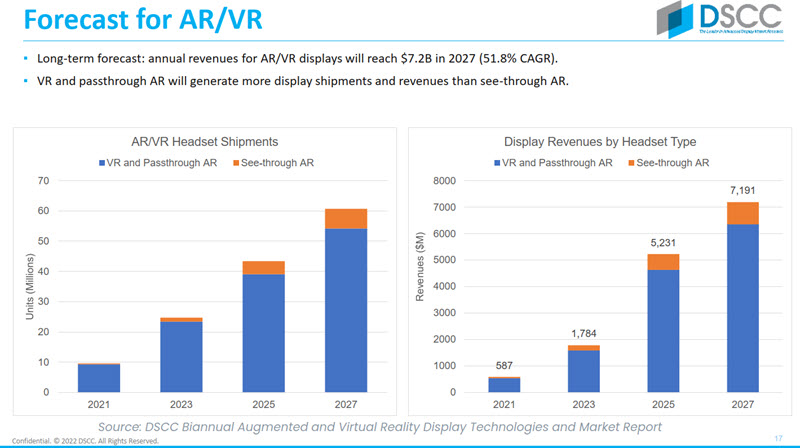

Chansin then showed the firm’s latest long term forecast with growth through to 2027 when volume should get to 60 million. The forecast was done in April and is updated twice a year. The firm expects VR and passthrough AR to be the biggest opportunity.

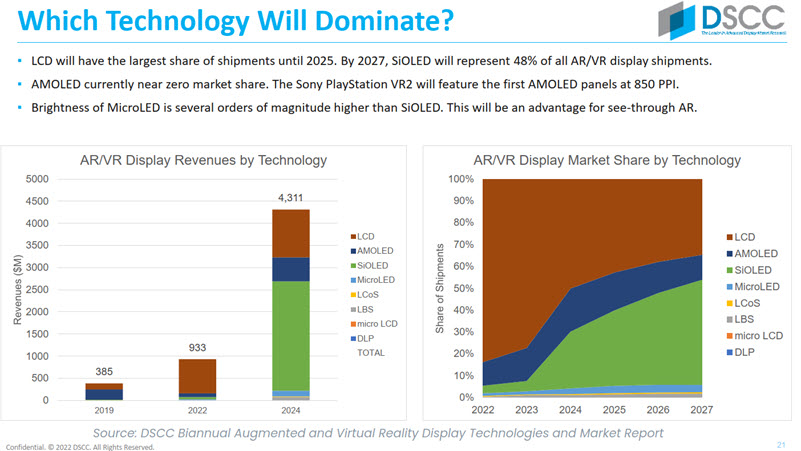

The battleground between display technologies has not really changed in the last year. More work is going into MicroLED to get high brightness for AR.

Chansin then looked at the ways of boosting brightness for OLED on silicon (SiOLED) displays. He explained that one of the challenges is that, to get good motion visually, you have to use a duty cycle of around 10% for the display and that means you have to produce a lot more brightness when the display is actually emitting.

DSCC knows that Apple will use SiOLED displays and Qualcomm has a reference design using this kind of display with birdbath optics, so there is less light loss than with OLED. Nreal has this kind of technology (and we saw the TCL version at IFA – editor see IFA 2022 – Display Components).

There will be a big move to SiOLED over the next few years with half the displays using the technology by the end of the forecast.

Chansin finished by looking at the development of monolithic microLEDs. A lot of OEMs and technology companies are working in this segment and he said that Jade Bird Display (JBD) has stood out for the development of a monochrome microLED that will be in new Vuzix and Oppo devices. Moving to colour is the aim and there are several approaches but there seems to be a shift to using colour conversion or use alternatives to using different LED technologies. Who and what will win is not clear. (BR)