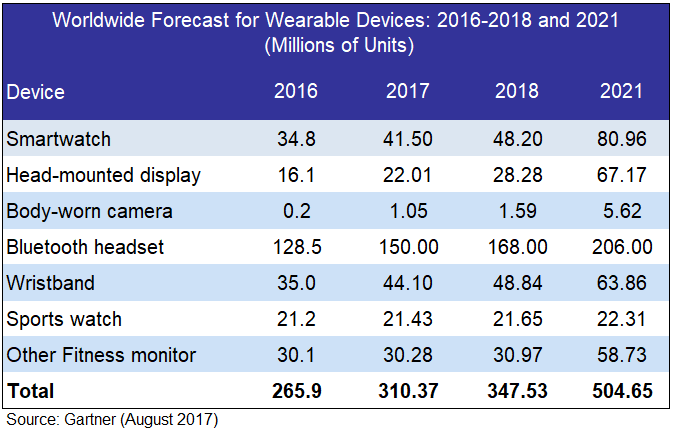

Gartner has forecast that 310.4 million wearable devices will be sold worldwide this year, which is an increase of 16.7% compared to last year. The revenue generated this year for wearables, is forecast to be $30.5 billion, with smartwatches accounting for $9.3 billion and 41.5 million sales.

Smartwatches are forecast to have the highest unit sales of all wearable device from 2019 to 2021, except for Bluetooth headsets. Sales of smartwatches are estimated to be 16% of total wearable devices in 2021, with 80.96 million units sold.

According to Angela McIntyre, research director at Gartner, smartwatches will achieve the greatest revenue potential among all wearables through 2021, reaching $17.4 billion. She believes that revenue from smartwatches is bolstered by relatively stable average selling prices of Apple Watch. She also believes that the average selling price of smartwatches will drop from $223.25 in 2017 to $214.99 in 2021, but strong brands such as Apple and Fossil will keep pricing consistent with price bands of traditional watches.

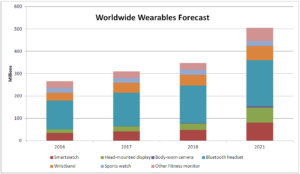

Gartner’s Global Wearables forecast. Image:Meko

Apple is forecast to have the greatest market share of any smartwatch provider. However, Apple’s market share will decrease from approximately a third in 2016 to a quarter in 2021 as more providers enter the market. The new Apple Watch, expected in September, may enable direct cellular connectivity for interacting with Siri, texting and transferring sensor data when the phone or WiFi is not present. Gartner expects Asus, Huawei, LG, Samsung and Sony to sell only 15% of smartwatches in 2021.

Gartner expects children’s smartwatches and traditional watch brands to perform well, and this will emerge as a significant segment for smartwatches. Gartner expects children’s smartwatches to represent 30% of total smartwatch unit shipments in 2021. These devices are targeted at children in the age range two to 13 years old.

Smartwatches from fashion and traditional watch brands, will account for 25% of smartwatches by 2021. Start-ups and white-label brands, such as Archos, Cogito, Compal, Martian, Omate and Quanta, are expected to account for 5% of smartwatch unit sales in 2021.

This year, it is expected that 150 million Bluetooth headsets will be sold, which is an increase of 16.7% from last year. In 2021, sales will increase to 206 million units, and will be the most sold wearable device through 2021. McIntyre believes that the growth in Bluetooth headsets is driven by the elimination of the headphone jack by some smartphone providers, and Gartner believes that by 2021 that almost all premium mobile phones will no longer have the 3.5 mm jack.

Head-mounted displays will account for 7% of wearables this year, and will not reach mainstream adoption with consumers or industrial customers through 2021. Gartner believes that the market is still in its infancy. Near-term opportunities for VR head-mounted displays are with video game players. Others will also use them for tasks such as equipment repair, inspections and maintenance, but also in warehouses and manufacturing, training, design, customer interactions and more. Theme parks, theatres, museums and sports venues will purchase head-mounted displays in order to enhance the customers’ experience.

Smartwatches to reach 41.5 million sales this year

Smartwatches to reach 41.5 million sales this year