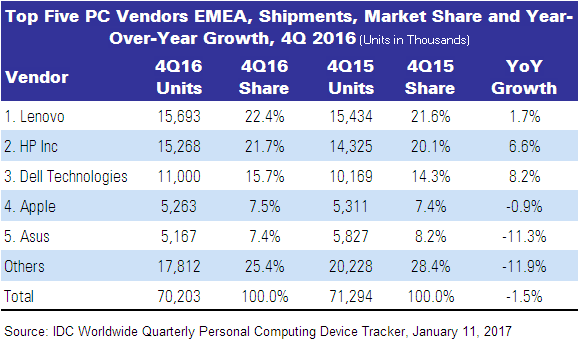

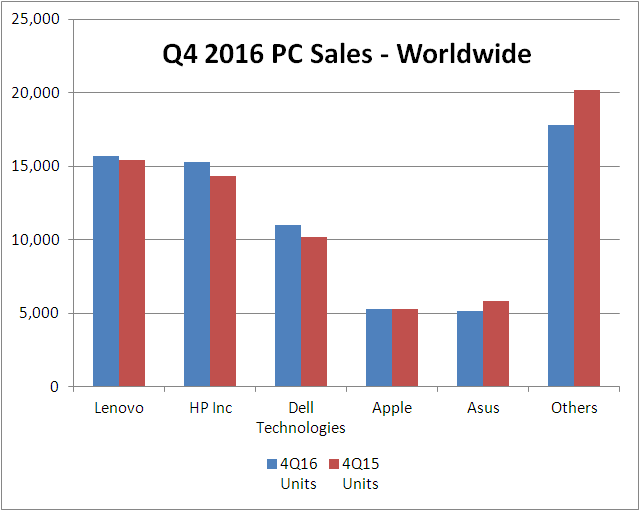

IDC said that worldwide shipments of traditional PCs (Desktop, Notebook, and Workstation) totalled 70.2 million units in the Q4 2016, a year-on-year decline of 1.5%, the fifth year of decline since 2012.

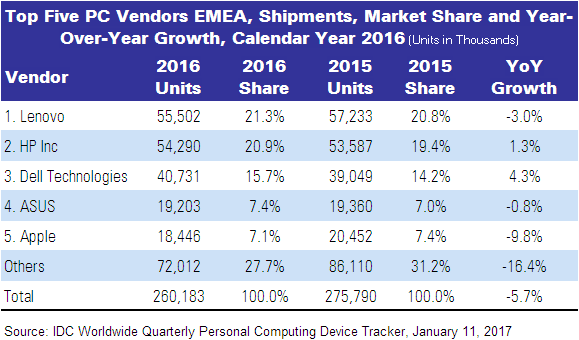

Annual shipments of PCs slipped to 260 million units, down 5.7% from 2015. The first quarter of 2016 was still constrained by high inventory, free Windows 10 upgrades, and difficult comparisons to commercial replacements in 2014 that were fuelled by the end of support for Windows XP. However, mid-2016 and particularly the recent fourth quarter have moved beyond these inhibitors and seen commercial demand recovering. Contraction of the consumer PC market has also slowed as growth and competition from tablets and phones has eased up. Recent quarters have faced some tight supply of components such as SSDs, displays, and memory. The supply constraints did not significantly slow overall shipments, and in fact may have boosted growth slightly and accelerated market consolidation as the largest players moved to lock up supply.

Mature regions continued to perform best. Japan and Canada extended positive growth from 3Q16, while volume in the Europe, Middle East, and Africa (EMEA) region was stable. Shipments in the US declined slightly, although the country performed slightly better than the global average. Asia/Pacific (excluding Japan)(APeJ) continued to improve with only a mild decline in shipments while Latin America continued to experience significant contraction.

“The fourth quarter results reinforce our expectations for market stabilization, and even some recovery,” said Loren Loverde, VP, Personal Computing Trackers & Forecasting. “The contraction in traditional PC shipments experienced over the past five years finally appears to be giving way as users move to update systems. We have a good opportunity for traditional PC growth in commercial markets, while the consumer segment should also improve as it feels less pressure from slowing phone and tablet markets.”

“The fourth quarter results reinforce our expectations for market stabilization, and even some recovery,” said Loren Loverde, VP, Personal Computing Trackers & Forecasting. “The contraction in traditional PC shipments experienced over the past five years finally appears to be giving way as users move to update systems. We have a good opportunity for traditional PC growth in commercial markets, while the consumer segment should also improve as it feels less pressure from slowing phone and tablet markets.”

Regional Highlights

The US market witnessed a slight decline in shipments this quarter. Following inventory growth in the third quarter, the fourth quarter saw growth toning down. At the same time, the retail PC market in the U.S. came out strong, backed by aggressive promotions by top PC vendors in December. Overall, traditional PC shipments for 4Q 2016 stood at 17.0 million units.

The EMEA market performed better than expected, fueled by strong holiday season sales of traditional PCs. While desktops performed in line with IDC’s expectations, notebooks grew above forecast across the region. However, component shortages are expected to have driven some of the vendors’ shipment towards inventory build-up.

The Asia/Pacific (excluding Japan) PC market continued to stabilize with only a slight year-on-year contraction. The demonetization crisis in India had a significant impact on the market, stifling demand and inhibiting shipments in the consumer and SMB segments, but recovery towards the end of the quarter allowed for more sell-in. In China, robust demand for consumer notebooks supported by a shift to thin and light devices continued. The commercial market in most APeJ countries remained soft. Projects in India have been delayed, while China saw weaker than expected commercial demand. A negative macroeconomic environment also inhibited shipments, particularly in Malaysia, Indonesia, Singapore and the Philippines. On the other hand, larger orders from the public sector pushed the commercial market above expectations in Korea.

The Japan traditional PC market came in ahead of forecast, but still slowed from the third quarter, as expected. Consumer shipments remained under pressure while the commercial segment was resilient, driving overall growth in 4Q16.

Vendor Highlights

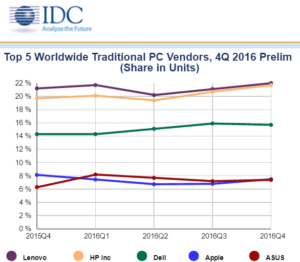

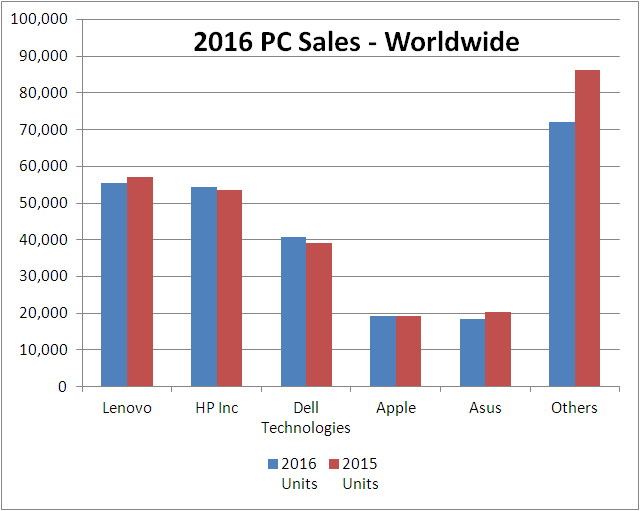

Lenovo continued to hold the top spot, though the competition with HP remains fierce. The top vendor still faced a tough climate in APeJ but made significant strides in the holiday quarter in Europe and the Americas with a stronger performance in notebooks and capped the quarter growing globally at 1.7%, ending six consecutive quarters of year-on-year declines.

HP Inc. held the second position, growing 6.6% compared to 4Q15 for its third consecutive quarter of positive growth and shipping more than 15 million units for the first time since 4Q14. HP Inc. further consolidated its share in the United States market, growing its market share to 31%. The company also saw sizable gains in EMEA and APeJ.

Dell Technologies also had a productive quarter with shipments of just over 11 million (the first time it has done so since 4Q11) and growth of 8.2%. The number 3 vendor managed positive year-on-year growth in every region with strong notebook volume as well as a positive desktop quarter.

Apple was boosted by the launch of new MacBook Pro models during the fourth quarter. The company moved back into fourth place and stabilized global shipments.

ASUS growth slipped in the fourth quarter, particularly in the U.S., but remained in the top 5 globally, ranking number four for all of 2016.

Analyst Comment

The big trend is that the big brands are increasing or flat, whereas the alternative brands continue to shrink, so life is not getting easier for smaller brands and ‘local hero’ brands.

Gartner also put out its numbers and had Asus ahead of Apple. The company also highlighted that while heavy users and enthusiasts continue to buy PCs strongly, occasional users continue to rely on other devices such as smartphones and tablets and continue to extend purchasing cycles. The company also said that sales ‘events’ such as ‘back to school’ and Black Friday are having less effect on PC sales as demand is driven by need rather than desire, although Gartner highlighted good Black Friday sales in EMEA. PCs are no longer a desired gift for many consumers. Consumers are also buying VPAs such as Amazon Echo and VR headsets, so PC makers have reduced their marketing efforts for PCs. (BR)