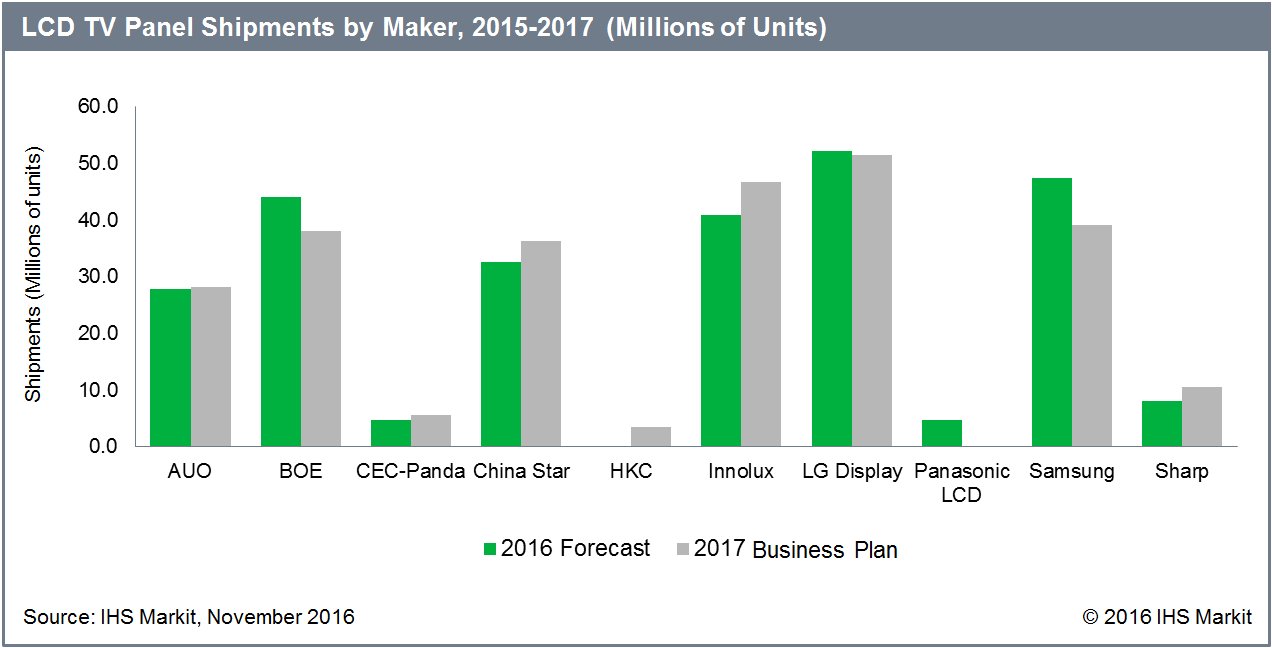

Restructuring of older display fabs, migration to larger-sized LCD TV panels and business strategy adjustments are some of the factors prompting LCD TV panel manufacturers to set a conservative shipment goal of 258.4 million units in 2017, a 1.2% decline from 2016, according to IHS Markit.

Restructuring of older display fabs, migration to larger-sized LCD TV panels and business strategy adjustments are some of the factors prompting LCD TV panel manufacturers to set a conservative shipment goal of 258.4 million units in 2017, a 1.2% decline from 2016, according to IHS Markit.

LCD TV panel unit shipments in 2016 are forecast to decline 5% on year-on-year basis to 261.6 million. Among the top six panel makers, BOE and China Star (CSOT) continue to make the largest contribution to the growth of TV panel shipments in 2016, helped by a shortage of 32-inch panels, said Deborah Yang, director of display supply chain at IHS Markit.

However, this is not enough to offset declines in shipments from South Korean and Taiwanese panel makers, all of which are undergoing the process of moving to larger panel sizes, facing production yields issues, or experiencing drastic declines in demand for 23.6″ panels.

BOE’s shipments have shown positive growth in past years; however, the company is projecting a decline of 14% year-on-year in 2017 due to a production shift to larger panel sizes, in particular to 43″ and 55″ displays, where production capacity will be shared with IT panels.

Deborah Yang of IHS MarkitInstead of ramping up the current supply of TV panels, panel makers are now busy diversifying into larger-sized panels and other premium products, such as UltraHD panels. According to IHS Markit analysis, TV panel makers are planning to ship 63 million units of UltraHD panels in 2016, giving 24% penetration in UltraHD, increasing to 86.4 million units in 2017, bringing penetration to 33%.

Deborah Yang of IHS MarkitInstead of ramping up the current supply of TV panels, panel makers are now busy diversifying into larger-sized panels and other premium products, such as UltraHD panels. According to IHS Markit analysis, TV panel makers are planning to ship 63 million units of UltraHD panels in 2016, giving 24% penetration in UltraHD, increasing to 86.4 million units in 2017, bringing penetration to 33%.

LG Display remains the world’s top maker of TV panels with a target of over 51 million unit shipments. Innolux will take the second largest position with 46.6M units. However, should Innolux decides to produce smaller-size TV panels as well as to use its relationship with Sharp’s fabs in Japan, its unit shipments could be expected to jump to 53 million, even eclipsing LG Display to gain top spot.

HKC, a sizeable LCD TV OEM and ODM maker,which recently entered the LCD TV display market with backing from the Chinese government, represents a new vertical integration business model for the industry.

While TV makers are suffering a profit loss, HKC’s vertical integration business model could prove that a certain level of profit can be maintained through in-house supply in spite of TV panel price fluctuations. However, the biggest challenge for HKC is whether it can overcome the technical challenge that comes with ramping up a brand new fab, Yang said.