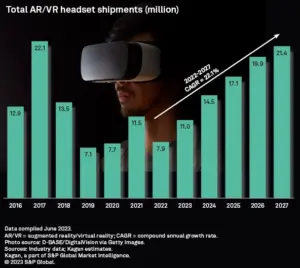

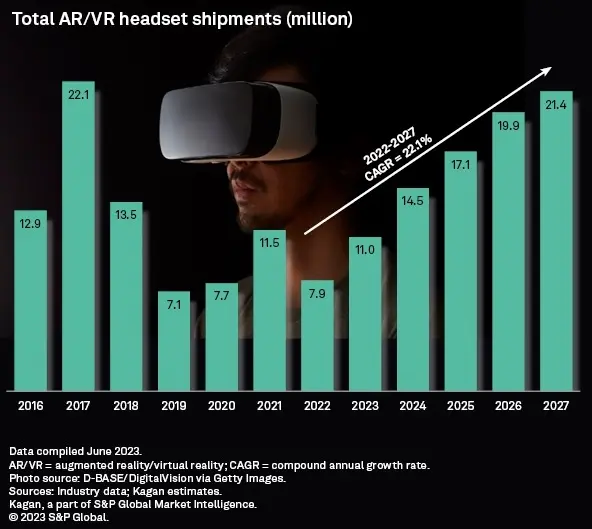

According to a recent report by S&P Global Market Intelligence, the answer is yes. While AR and VR technologies have primarily been confined to niche applications, Apple’s entry into the market with its upcoming Apple Vision Pro headset is expected to spearhead their transition into the mainstream. S&P says that the installed base of AR/VR headsets stood at approximately 39.7 million units at the end of 2022, a decline of 1.2% compared to the previous year. However, the research firm projects a significant increase in headset shipments, with a compound annual growth rate (CAGR) of 22.1% from 7.9 million units in 2022 to 21.4 million units in 2027.

Neil Barbour, an associate research analyst at S&P Global Market Intelligence, attributes the relatively low ceiling of the AR/VR hardware segment to its initial focus on the video game market. While Apple’s high entry pricing, set at $3,500, and the adoption of high-end components and displays, may limit initial sales in 2024, the report suggests other established vendors like Meta stand to benefit. Meta is expected to launch its Quest 3 headset later this year, leveraging its market-leading position and introducing a price reset on its existing hardware.

In the first year of availability, experts project that Apple’s steep pricing may limit sales to fewer than 500,000 units and Jon Peddie Research has estimated that it could be as low as 200,000 units. The Vision Pro may not set the world on fire in 2024 but, as far as S&P is concerned, it’s only a matter of time before Apple puts its stamp on the whole market.