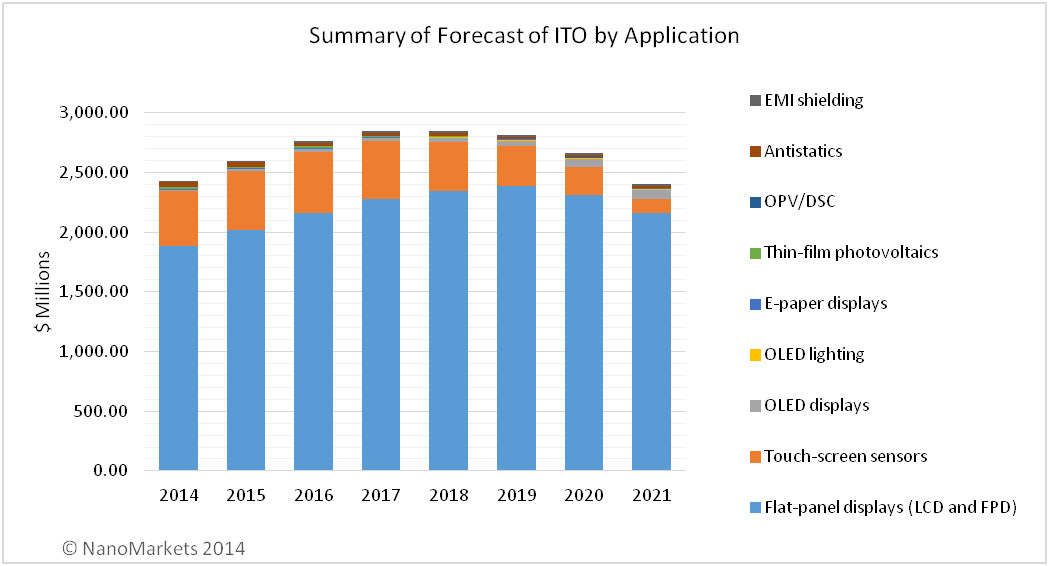

Materials, Manufacturing and Components – Indium Tin Oxide, or ITO, is a key material for making displays. It is a transparent conductive material that applies voltage to the clear aperture in the LCD and provides the transparent electrodes for touch screens as well. Alternative solutions by a number of companies are in development, and these are now seeing success in the market. In fact, their success is already starting to impact the cost and adoption of ITO in a range of applications beyond just displays. According to a new report from Nanomarkets (Transparent Conductor Markets: 2014-2021), revenue from ITO sales will increase for a few more years before leveling off and then declining (see figure below).

Bill Jackson of the US-based Indium Corporation told us in a phone interview that the price of the Indium metal impacts how alternatives are viewed. “One and half to two years ago, Indium sold for about $900-$1,000 per Kg, but for the last year or so, it has been stable in the low $700 range”, explained Jackson. “When the price is high, you tend to see more activity and press coverage of alternatives, but when the price is lower and stable, like now, these activities diminish”.

The manufacture of ITO (as opposed to the mining of Indium) is still a strong Japanese industry with Nitto Denko being the dominant player. About a year ago, Nitto Denko lowered the prices of ITO by around 20% in a strategic move to fend off alternatives.

This has apparently worked – to a degree. For example, one conductive polymer developer, Heraeus, said their on-going customer projects have indeed slowed recently.

But measuring the advantage of an alternative vs. ITO is complex. Panel makers can buy ITO material, sputtering targets, or ITO sputtered on plastic or glass substrates. Alternatives can be delivered as films or solution processed. So while the alternative raw materials may not be much less expensive than ITO, the processing may be less expensive. But the choice of when and when not to consider an alternative is also very dependent on the application and needed performance.

The alternatives to ITO encompass a range of technologies including carbon nanotube films, nanowire-based transparent conductors, metal meshes and conducting polymers. In general, non-ITO developers will point to three main advantages vs. ITO:

- Lower cost

- Greater flexibility and bendability

- Equivalent or better performance (low sheet resistance and haze)

As mentioned, lower cost really needs to be evaluated at the display level on an apples-to-apples basis that includes processing and yield issues as well. Here, Jackson says any benefit must be proven in high volume production – an area where ITO has a decades-long track record.

I think most readers of this column would also assume that the alternatives offer greater flexibility and bendability compared to ITO. We have heard for years how ITO is brittle and not ideal for flexible displays, yet ITO can be sputtered on plastic substrates and we have seen it used in curved LCD and OLED smartphones. It seems reasonable to assume that ITO will be OK for displays that have a fixed curvature, but for truly flexible and foldable displays, maybe alternatives will find a real opportunity.

I think most readers of this column would also assume that the alternatives offer greater flexibility and bendability compared to ITO. We have heard for years how ITO is brittle and not ideal for flexible displays, yet ITO can be sputtered on plastic substrates and we have seen it used in curved LCD and OLED smartphones. It seems reasonable to assume that ITO will be OK for displays that have a fixed curvature, but for truly flexible and foldable displays, maybe alternatives will find a real opportunity.

Firms selling alternatives to ITO remain heavily focused on opportunities in the touch-screen business but are also looking for new opportunities, says Nanomarkets. One new trend in the touch space is the move to use alternative approaches to adding touch to larger panels. Success in this area may not only put them at a competitive advantage, but also increases the addressable market for transparent conductors as a whole.

For example, large touch screens have tended to be based on technologies such as infrared. At Display Week, CimeNanotech showed a 42” touch screen prototype with a company called Amdolla that offered a very fast 150Hz touchscreen refresh rate. This fast rate is possible in smaller screens but not usually in larger screens, but the low sheet resistance now makes this possible. At the recent Touch Taiwan 2014, Heraeus showed a 55-inch touch screen developed by Taiwan-based Inputek that uses the Heraeus Clevios PEDOT conductive polymer for the projected capacitive touch panel with 10 sensor points.

Inputek is a specialist IC design house and PCT touch solutions company. It incorporated the Clevios film into the device using screen printing and etch patterning processes. This should allow lower cost large screen solutions, thinks the company, for applications like signage, point of sales, industrial and digital white boards.

Typically Clevios coatings can reach 100 -250 Ohm/sq. at a transparency of 90% (excluding substrate film). The 55 inch touch screen uses a Clevios coating that provides 150Ohm/Sq. That’s quite high as the resistance equals the sheet resistance times the length of the conductive coating divided by the thickness of the conductive coating. In a 55” screen, the length will be long, so the film will have to be quite thick to offer low resistance, which does not seem likely as this will then impact transparency and haze.

According the Nanomarkets analyst Lawrence Gasman, there has not been a lot of focus by the alternative companies to look at replacing ITO in the LCD glass panel fabs, where it is used to deliver voltage to the LCD material under the clear aperture. However, he notes that these display companies are seeing how alternatives are used in touch panels and how this might be a good time to consider their use in the fab as they develop in-cell and on-cell touch screen methods that bring this touch screen part back into the LCD panel fab facility.

“The use of alternatives might make sense for a new fab investment or for production of target display types like passive matrix LCDs”, says Gasman, “but it seems unlikely that existing fabs will be retrofitted simply to replace ITO”.

So where else should alternative companies look? OLED displays are clearly an area all say they are looking at but very few actual demos have been shown to date that we or Nanomarkets are aware of.

But Gasman also sees OLED lighting as an interesting area where alternatives might have a more level playing field to compete in. Gasman noted that Konica Minolta has started production at an OLED lighting factory and is producing 1M panels per month for general lighting applications. “They are still using ITO, but this suggests the market is maturing and a potential opportunity”. concluded Gasman. “The solar and automotive markets are also interesting”.

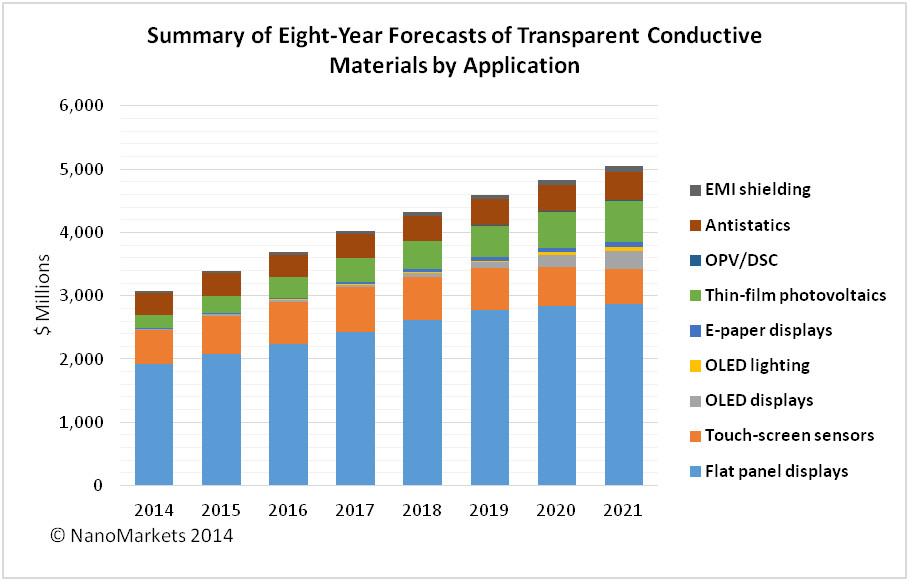

The chart below from Nanomarkets shows the total market for transparent conductive materials (ITO and alternatives). Since ITO will peak and decline, the growth of the market will be in alternative materials.

There do indeed seem to be markets that ITO alternatives can target which should result in good growth for some of these companies. –Chris Chinnock