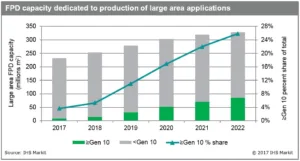

IHS said that the majority of all new incremental capacity for producing FPD televisions and other large area applications will be added at G10.5 in the future. With BOE, China Star, LG Display and Foxconn expected to build seven new Generation 10.5 factories by 2020, Gen 10 and larger fab flat panel display (FPD) capacity is expected to grow at a compound annual growth rate of 59 percent between 2017 and 2022.

Charles Annis, senior director at IHS Markit, said:

“The majority of all new incremental capacity for producing FPD televisions and other large area applications will be added at Gen 10.5 in the future. The new Gen 10.5 fabs will install 735,000 substrates per month of capacity by the end of 2022. This is enough capacity to produce more than 60 million 65-inch televisions a year.”

Gen 8 and 8.6 fabs that currently account for the bulk of large-area dedicated supply were designed to produce 55″ and 58″ panels respectively, but suffer from inefficiency at bigger sizes. Now with premium televisions rapidly moving to larger sizes as prices fall, FPD makers are racing to build Gen 10.5 factories that are highly optimized for 65″ and 75″ panels.

Gen 10.5 factories, which use 2940 x 3370 mm glass substrates, require high capital outlays to construct. Based on panel makers’ public announcements, total project costs of a Gen 10.5 LCD fab with a monthly capacity of 60,000 substrates will range between $3.4 billion and $6 billion, varying by maker and process to be adopted. To help finance such expensive factories panel makers in most cases are turning to regional governments for support.

IHS Markit estimates that FPD equipment spending will reach a record high of more than $20 billion in 2018, of which new Gen 10.5 factories are a major contributing factor.

As the many new Gen 10.5 factories begin to ramp-up, IHS Markit expects 65″ and larger panel prices will fall continuously, about 5% annually. Subsequently, demand for this high-end segment of the FPD market is forecast to expand 2.5 times to approximately 40 million units in 2022.

Annis added:

“65 inch and larger panels are predicted to be one of the fastest growing segments of the FPD market over the next five years. Even so, with so many new Gen 10.5 factories being built, capacity is forecast to surge ahead of demand. After 2020, smaller than Gen 10 capacity is expected to start to decline as legacy factories are shuttered. The 735,000 substrates per month of Gen 10.5 capacity in the pipeline will not only dramatically increase FPD capacity, but will also shift industry leadership towards to the four companies that are building them.”

Analyst Comment

As we report separately, DSCC is much more bullish on the spending in equipment markets in 2018. See DSCC is Bullish On Equipment Spending (BR)