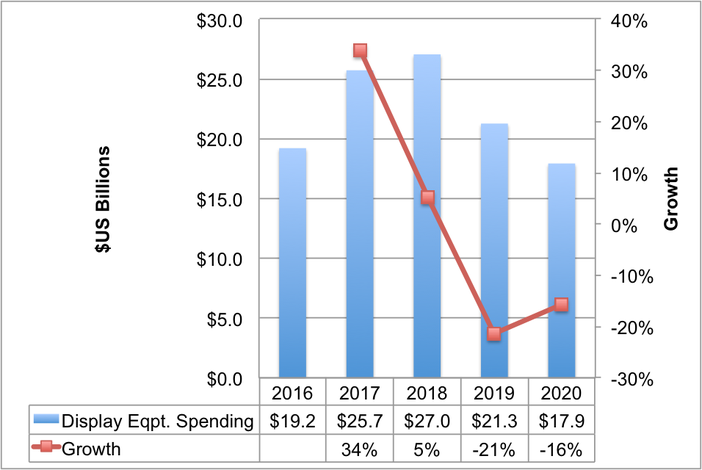

Display Supply Chain Consultants (DSCC) has a new release of its Capex forecast and believes that the market is bigger than other analysts have reported. The firm said that it believes that others have underestimated the investment needed in module assembly, especially in flexible OLED fabs, which are much more complex than typical TV LCD fabs. The company estimates that the display equipment market will rise 34% in 2017 to $25.7 billion and a further 5% in 2018 to $27 billion.

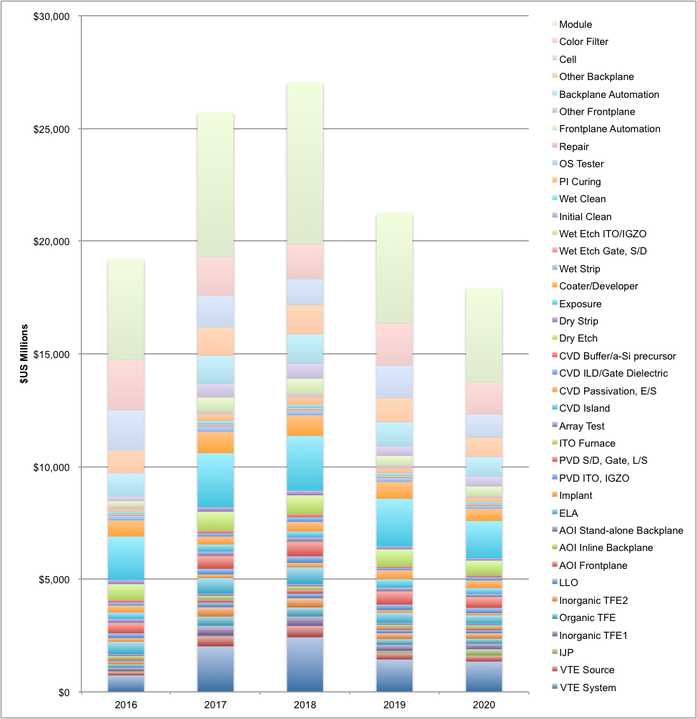

Spending by equipment segment is shown in the chart below, which shows that Vacuum Thermal Evaporation (VTE) Systems and Exposure are the two largest segments. If VTE Systems and VTE Sources are combined, Exposure leads in 2016, 2019, 2020 and 2021 while VTE leads in 2017, 2018 and 2022 on higher OLED spending in those years. Canon is one of the leaders in both of these segments.

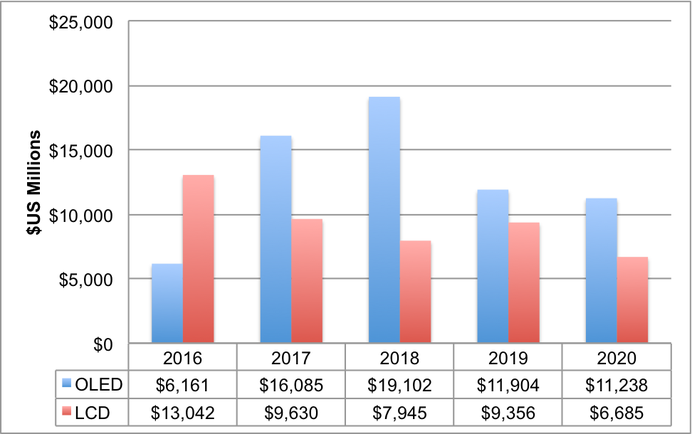

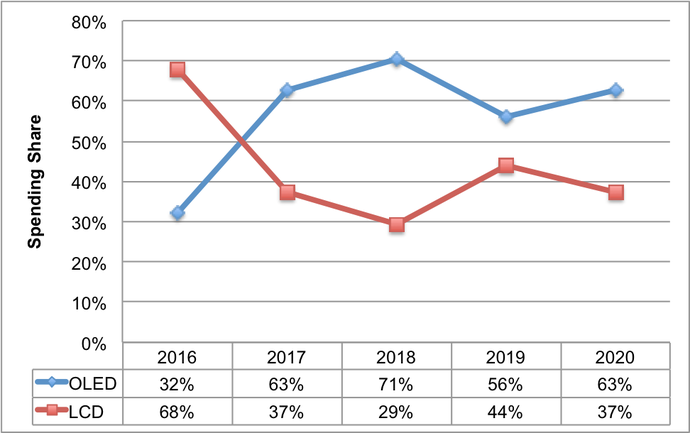

This report also allows users to segment fabs by frontplane or backplane type. As shown in the figures below, OLED fabs are expected to lead equipment spending from 2017. From 2016 – 2020, OLED equipment spending is expected to account for a 58% of equipment spending, overtaking LCD spending with a 63% to 37% margin in 2017. This highlights the capital intensity of OLED fabs with flexible OLED fab spending more than 2.5X greater than a-Si LCD fab spending at the same glass size.

DSCC’s forecast shows that OLED equipment will dominate spending

DSCC’s forecast shows that OLED equipment will dominate spending

Analyst Comment

Ross Young of DSCC has a long-established reputation of strength in this field. He founded DisplaySearch after making a survey of equipment makers in the semiconductor market for SEMI and realising that there was a rapidly growing market in display equipment. Once he knew the equipment used, he could make a very accurate calculation of the capacity of the market and from there calculate the supply side. Demand is a little tricker to forecast, but the method is extremely good at getting the supply side right.

Back in the days when DisplaySearch, led by Young, was competing with Stanford Resources, we used to say “Show the investors the DisplaySearch data, but plan your finances based on Stanford” as Stanford tended to be be more conservative. However, what looked like outlandishly optimistic forecasts for the LCD business often turned out to be correct! (BR)