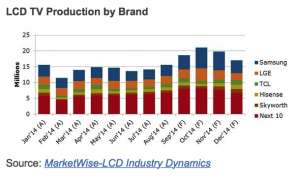

LCD TV Production by Brand, Source: NPD DisplaySearch

LCD TV Market – With the recent boost in annual LCD TV production plans to 48M and 34M units respectively, both Samsung and LG are leading the way to an LCD TV production boom this holiday season. Panel sales are to top 21M units in October, or 15% year on year growth and the highest for the entire year, which is characteristic of the typical buying season, so says NPD DisplaySearch analyst David Hsieh.

What is not so typical is the extent to which big brands are moving to boost production this October. LCD TV production is up to 40% month on month for Samsung and LG alone, and the two Korean firms accounted for a massive 48% of all LCD TV global revenues in the second quarter of this year. The market research firm said that all of the top 15 brands will boost production in October; that is excluding the Chinese who are hampered by fewer production days due to its National holidays. Beyond Samsung and LG in first and second place, the remaining top five LCD TV brands to date include TCL, Hisense and Skyworth. Others in the top 10 category include the Japanese household brands that once dominated the TV living room including Sony, Panasonic, Sharp and Toshiba. Vizio is also in the second tier group of large area display LCD TV panels as well as AOC/TP Vision, Changhong, Funai, Haier and Konka, according to the NPD DisplaySearch “MarketWise-LCD Industry Dynamics report”.

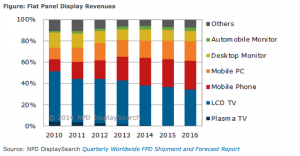

Flat Panel display revenue Source: NPD DisplaySearch

Flat Panel display revenue Source: NPD DisplaySearch

Until this year, LCD TV production has dominated flat panel display revenues for the past eight years running. DisplaySearch reported in April that 2014 is the tipping point year for mobile display panel shipments to finally pass the LCD TV as top display application by revenue. When mobile phone and mobile PC (laptops, tablets et al.) revenues are combined, they make up 42% of the global flat panel display market, passing LCD TVs (with 37% market revenue share) for the first time, according to the group. NPD said it expects the market to reach $131B, and the number could go higher as both LG and Samsung are revising their LCD TV production numbers upward.

NPD said that other top application areas for LCD panels include auto monitors, and panels used for public display. In this latter area, we reported last month the eighth consecutive quarter of commercial panel increase in the US. Both here and in other developed nations sell-through of 26″ and-larger commercial displays is strong, growing 33% in the first half of 2014, coming off a 20% and 10% respective increase in 2012.

In conclusion, Hsieh said to look for strong market pull in preparation for the holiday season, which will propel LCD TV panel production to new heights. He also expects many leading brands to drop retail prices by as much as 10% or more to stimulate sell through. Meanwhile, it’s the new mobile world that is now driving the LCD panel makers revenue that finally hit the tipping point, bumping LCD TV from its long dominant position in the market. – Steve Sechrist