Ian Hendy of Hendy Consulting then spoke. Hendy has a consulting business with David Barnes of Bizwits and spends his time consulting for companies that want to be in the display business somewhere. The firm consults on display materials, manufacturing and on investment strategies.

Ian Hendy of Hendy Consulting then spoke. Hendy has a consulting business with David Barnes of Bizwits and spends his time consulting for companies that want to be in the display business somewhere. The firm consults on display materials, manufacturing and on investment strategies.

Last year was a good year in the display industry but 2015 will be a different issue. His basis for saying this is the “huge” increase in supply by the Chinese. Samsung had a great year in OLED in 2013, but a poor year in 2014 as Galaxy phones didn’t sell so well, so its OLED profits dropped dramatically.

Hendy then talked about the problems of the long term cashflow of the display industry, a topic that we have covered in detail when it has been explained by Barnes. The key take away is that if you look at a region such as Taiwan, the investors are effectively $15 billion down so far.

Barnes wrote a great Display Daily article on “business pivots” a short while ago and Hendy went through the pivots that he discussed. (Pivot Time)

Large panel OLED pivoted last year and Samsung more or less gave up large OLEDs and the Chinese have started to talk much less confidently about large OLED manufacturing plans.

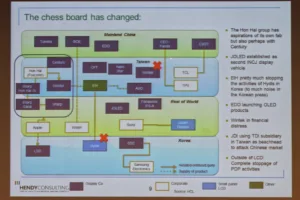

CEC Panda starts to be important as a Chinese LCD maker, alongside CSOT and BOE who have been shipping for some time. Taiwanese touch panel maker, Wintek, got into serious trouble last year and Hon Hai/Foxconn is still marshalling and working its resources – it has relationships with several panel makers.

In 2014, the TV business did relatively well which allowed panel makers to move the allocations around between markets, ensuring tight supply and even allowing small price increases in the panel business.

There is a big build-up of capacity this year. There has been a slowdown in price reductions to 8% per year since 2008/9, so the question is “is that slower rate of price decline permanent?”.

The Taiwanese have given up on the idea of large OLED. They are looking at applications in industrial displays, automotive and anywhere they can find added value.

Quantum Dots will be important and Hendy said that “coatable” materials that could be deposited without needing sputtering are becoming more commercially realistic. Organic TFT may become interesting as materials develop.

There are a number of generic strategies that could be used in this situation, but, Hendy said, it’s hard to get companies to change their behaviour even when that behaviour has not been dramatically successful. There are lots of new materials and innovations around – he cited graphene as a particular favourite. Sub-pixel rendering will be important – and high resolutions are coming.

Poly-silicon has become commoditised and offers little chance to differentiate The development of metal oxide backplanes has been much harder than expected and that has slowed down some process development.

Analyst Comments

I had an interesting chat to Hendy during the “Author interviews”. We discussed David Barnes’ theory, often demonstrated according to Hendy, that price moves in the panel industry do not depend on supply demand balance, but simply on supply side changes. When extra supply becomes available, the price falls, regardless of the level of demand.

On the other hand, DisplaySearch was saying that broadly supply and demand would be balanced in 2015. As it happened, Paul Gray of IHS DisplaySearch was close by, as he was planning to speak on the second day of the event. He said that the demand side has changed a bit because of the issues of currency and macro economics which are impacting demand in markets from Russia to India. He wasn’t, therefore, sure that the idea that 2015 would be a difficult year was wrong. (BR)