Workstations again proved that they are not subject to the same market trends as PCs, falling only 0.8% YoY in Q4’15, and roughly the same for 2015 overall, compared to double-digit declines in PC shipments. Jon Peddie Research (JPR) reports that around 1.04 million workstations were shipped in Q4’15.

While PCs and workstations are largely built using the same core technologies, workstations focus on different areas: reliability and application-optimised performance for visual applications. While consumer PCs will run acceptably for several years, users working in CAD, digital media and other workstation applications need and value the performance of new machines.

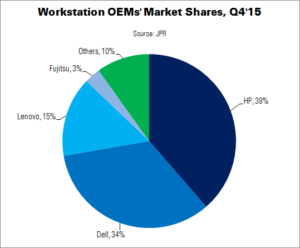

Market shares for the big three workstation OEMs (HP, Dell and Lenovo) do not tend to change much QoQ. Over the last few years, Lenovo has climbed steadily and Dell has stabilised, following a long period of losing share to HP. Following its privatisation, Dell’s has stopped the decline of its workstation business and has pulled some share back: from a low of 30.7% to 35.9% in Q3’15. HP halted the recovery in Q4, however, rising 1.5 percentage points while Dell dropped by more than two. Lenovo rose 1.2 points, to its highest-ever share (15.1%). Fujitsu had a 2.9% share, and smaller players accounted for the remaining 9.5%.