Quantum dots (QDs) (Beginning of the End for the Color Matrix Filter?) have been delivering on their promise of delivering better LCD colour and with the development of QD colour filters, may solve some viewing angle and power issues. But can they get more into the mainstream?

Bob O’Brien of Display Supply Chain Consultants recently published an article in his company’s newsletter that suggests a new approach that could help QD by helping to reduce costs. One of the problems for QDs is the cost. DSCC puts the cost of the QD film that is used in the backlight at around $30 per sq. metre, with around half of the cost coming from the difficult barriers needed on the outside of the film to protect the QD materials. The high costs may be a factor in persuading 3M to abandon its QDEF materials.

Bob O’Brien of Display Supply Chain Consultants recently published an article in his company’s newsletter that suggests a new approach that could help QD by helping to reduce costs. One of the problems for QDs is the cost. DSCC puts the cost of the QD film that is used in the backlight at around $30 per sq. metre, with around half of the cost coming from the difficult barriers needed on the outside of the film to protect the QD materials. The high costs may be a factor in persuading 3M to abandon its QDEF materials.

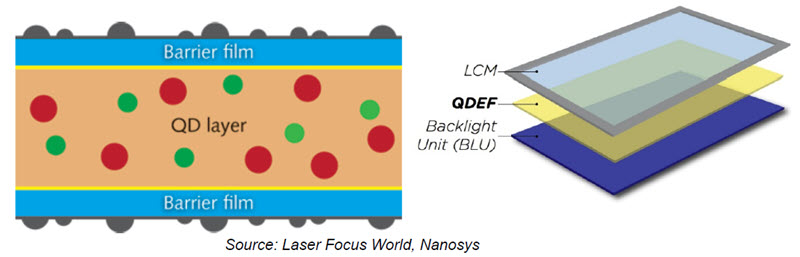

QD Films suffer from high costs in the barrier.

QD Films suffer from high costs in the barrier.

O’Brien is a Corning veteran and so it’s no surprise that the development that DSCC has found is in exploiting glass developments. He suggests makers have realised that, as glass is an excellent encapsulant, you could combine QD with the glass. He’s encouraged in this by the registration of QDOG (Quantum Dot on Glass) as a trademark by Nanosys.

Most mainstream and even many high end TVs are edge-lit to make them as thin as possible to meet the slim look that consumers appreciate. In order to get the light from the edge of the display to the middle, LCDs use Light Guide Plates to move the light to the middle and deflect it through the panel. As we have reported in the past, Corning has been promoting the idea of using glass as a replacement for the materials currently used to make very slim sets.

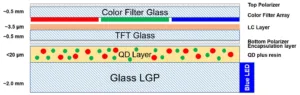

The suggestion is that if you put QDs in a resin layer directly onto a glass LGP, then the glass could form one of the barriers. During manufacture, a simple temporary barrier layer of SiNx could be used for the other side, but then the LGP would be laminated directly onto the back of the LC cell. That would mean a structure like the one below.

Schematic of Quantum Dot on Glass (QDOG) Source:DSCC

One of the problems for the glass LGP, also, is cost and adds around $40 to the cost of a standard panel, partly because of the cost of the patterning for light extraction. It also seems that although Corning has said that a glass LGP means better coupling with the LED light sources, which could help with cost, in order to get that benefit you may have to re-design the placing of the LEDs to put them nearer to the glass, which panel makers may not appreciate.

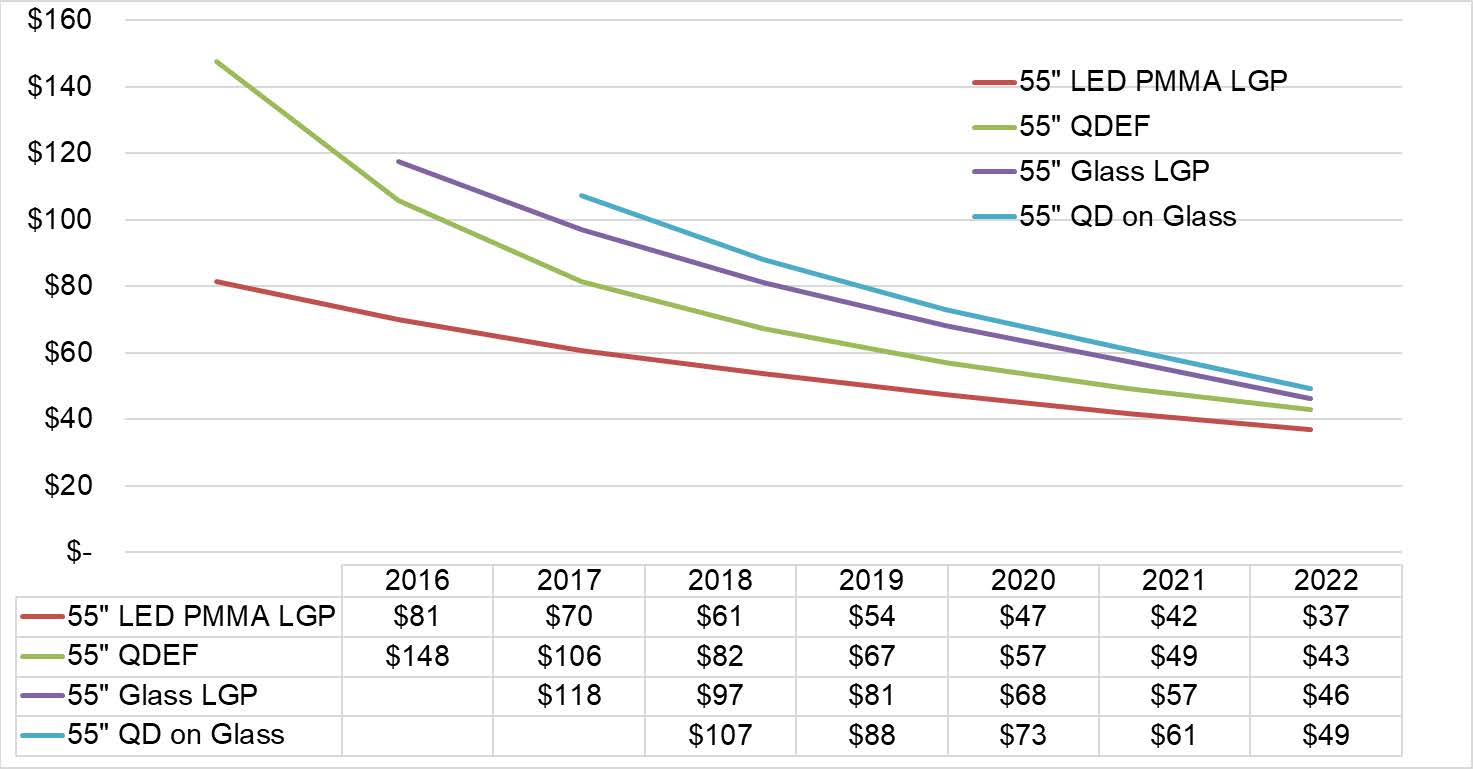

DSCC has made an analysis of the costs of the different approaches.

Estimated Backlight Costs for Glass LGP and QD Products on 55” UHD TV. Source:DSCC Quarterly LCD TV Display Cost Report, DSCC analysis

Estimated Backlight Costs for Glass LGP and QD Products on 55” UHD TV. Source:DSCC Quarterly LCD TV Display Cost Report, DSCC analysis

The analysis suggests that in 2018, makers can get the benefit of both technologies with a premium of $56 which might be very helpful in assisting LCD makers in coming back into contention with OLED, which is doing well in the market.

DSCC suggest that Samsung Display Corp (SDC) is planning to make panels to be sold to TCL and others, but that would be slightly surprising as SDC’s capacity is not optimised for its G8.5 fab. O’ Brien also suggests that it would help Corning and Asahi to absorb some excess capacity in the glass market, to keep prices firm.

DSCC expects us to see some QDOG sets at CES and that would fit with the promise from Nanosys that it would be explaining some new QD architectures at the show.