As we’re at the start of a New Year and, whisper it quietly, if not at the end of the Covid pandemic, at least at the beginning of the end, I thought I would look at the overall dynamics of the LCD market to see where we might go this year.

I have relied on a number of sources, but particularly DSCC and Sigmaintell (registration required), who have both published their views recently, but also on some of the content of the NPD presentations at CES (NPD Forecasts the US Tech Scene).

The LCD market is the one to watch as, despite all the excitement about QD OLED, OLEDs and microLED, it’s still the dominant technology in all volume applications except smartphones. So that’s what I’m focusing on, today.

2021 for LCD – A Game of Two Halves

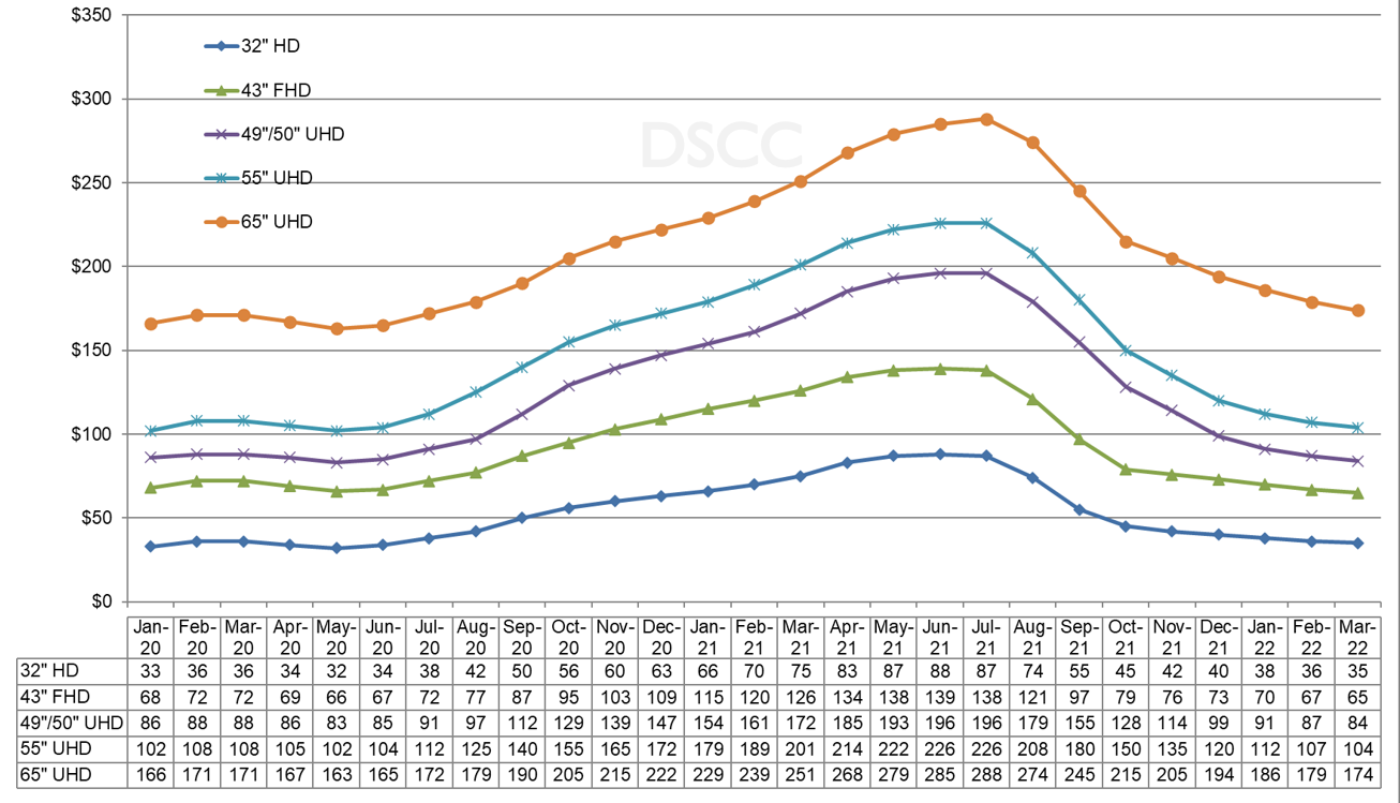

LCD had a very very good first half of 2021 as the Crystal Cycle pushed pricing higher very strongly because of strong demand for TV, notebook and monitor panels related to the pandemic and because there was relatively weak growth in the supply side of LCD. Samsung and LG Display both deferred decisions to close LCD capacity to make the most of the pricing. However, eventually, the higher panel prices fed through into higher TV set prices and the market demand softened. That was compounded by some supply chain limitations – there’s no point in having panels if you don’t have drivers or other chips to build sets, or you can’t get the sets to the market because of shipping constraints. TV takes more than half the area of LCD glass made, so is the critical application for pricing.

So, despite the hopes expressed at the DSCC/SID Display Week Business Conference, that stability might finally come to the market after years of up and down swings, the Crystal Cycle returned with a down slope in pricing. (Here We Go Again on the Crystal Cycle)

The Second Half of 2021

The second half of 2021 saw TV panel prices dropping sharply and losing much of the gains seen in 2020 and the first half of 2021. Prices fell faster than they have ever done in the history of the industry, with 32″ panels falling by 41%. The rate of drop has slowed in the last month or two and is expected to decline only slowly in 2022. Prices will get down to somewhere near cash cost and at that point panel makers will reduce capacity utilisation to stabilise the market. There is little point, with established fabs, in making panels and paying for the privilege! (although there is if you are still ramping a new fab). The Koreans are expected to revert to their plans to close or reduce their TV LCD manufacturing with Samsung Display reported to be on track to be completely out of LCD production by the middle of 2022.

TV set prices have also returned to pre-pandemic levels and as we saw from NPD the other day, in key markets such as the US (NPD Forecasts the US Tech Scene) TV demand in 2022 is likely to be back at pre-pandemic levels, too. As Sigmaintell reported, TV demand growth in China is weak as it is in India because of poor macroeconomic conditions – and because set prices rose on the back of panel increases – a critical factor in the price sensitive developing markets, even though demographics should lead to more demand.

A Boost from the World Cup?

Interestingly, Sigmaintell said that panel makers are hoping to get a boost to sales in the second half of the year, because of the World Cup.

It has long been said in the TV market that ‘even years’ when there were Olympic Games or a World Cup event saw a surge in demand. When I was tracking the European TV market, I didn’t see much effect, although there was influence to the seasonality of the market. Taking out the effect of the sporting events the panel market demand would be heavily weighted to peak in Q3, to supply the panels for the TV set market sales which would peak in Q4. In the years with sporting events, some of that demand would be moved forward to the end of Q1 or Q2 for set sales in Q2 or Q3.

(I had a theory that any demand boost was because retailers and set makers hoped for a spike in demand around sporting events, but when it didn’t materialise to any great extent, they would dump their inventory at low prices. Lower prices always helps drive demand in TV!)

What panel makers don’t seem to have noticed is that the World Cup will not take place in the summer this time, but in December. That’s because it will be in Qatar (unless cancelled by political opposition to the human rights regime there or Covid) and, although it will be hot in December, the summer would have suffered from, literally, killing heat. That shift in timing will mean that the demand for extra sets for the soccer will be hard to unpick from the demand for the holiday season from Black Friday through to the January sales.

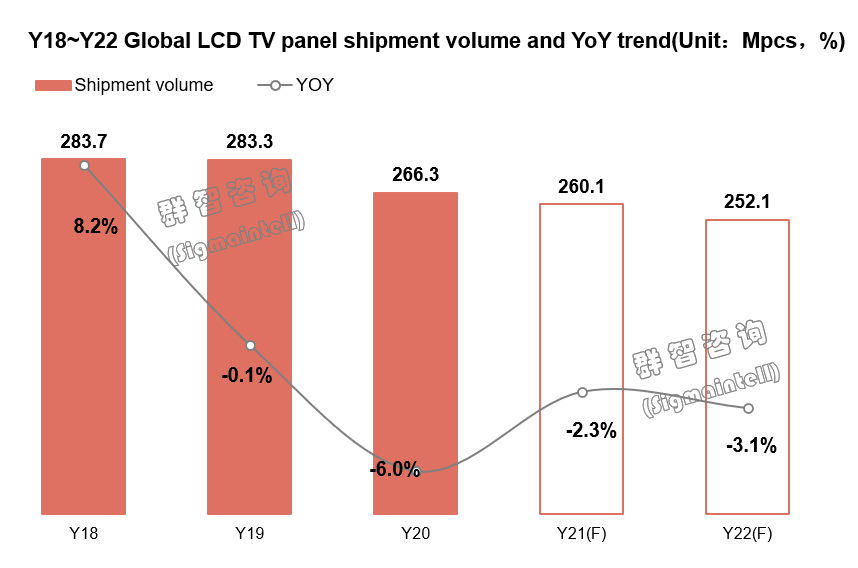

Area Grows Despite Volume Reductions

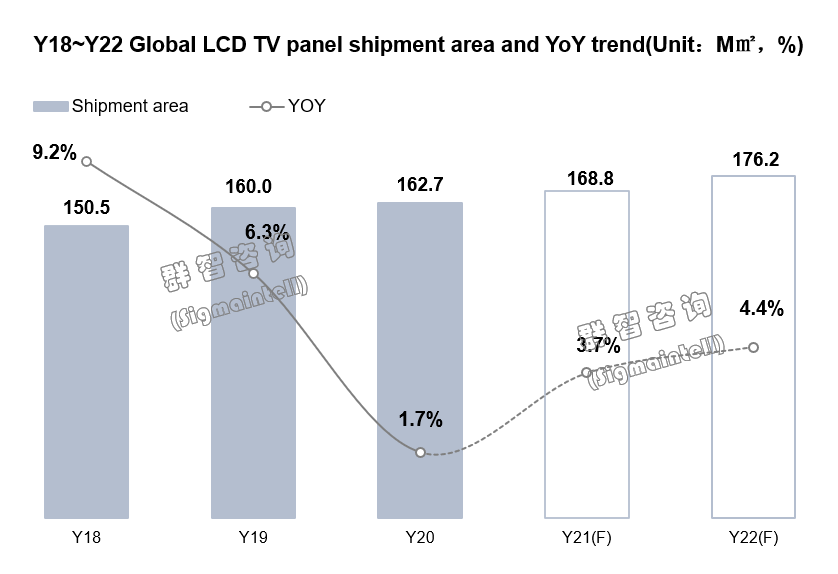

Although volumes are expected to be down in 2022, the continued shift to larger TVs means that area shipments are still expected to grow despite the loss of unit volume.

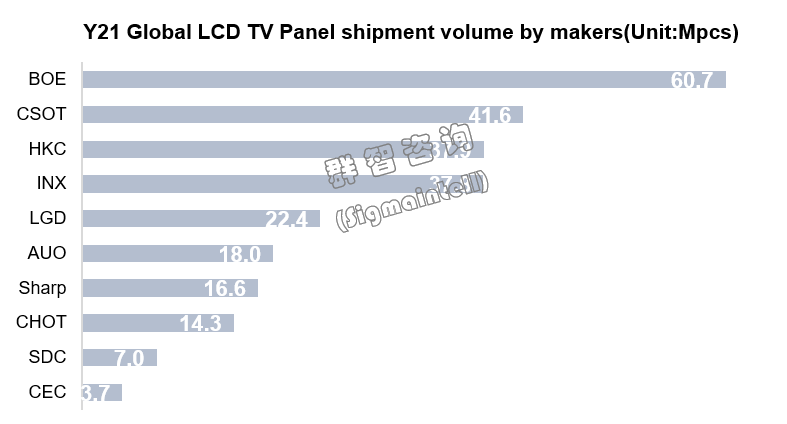

The top dog, these days, in panel production for TV is BOE of China, followed by CSOT, then HKC and Innolux.

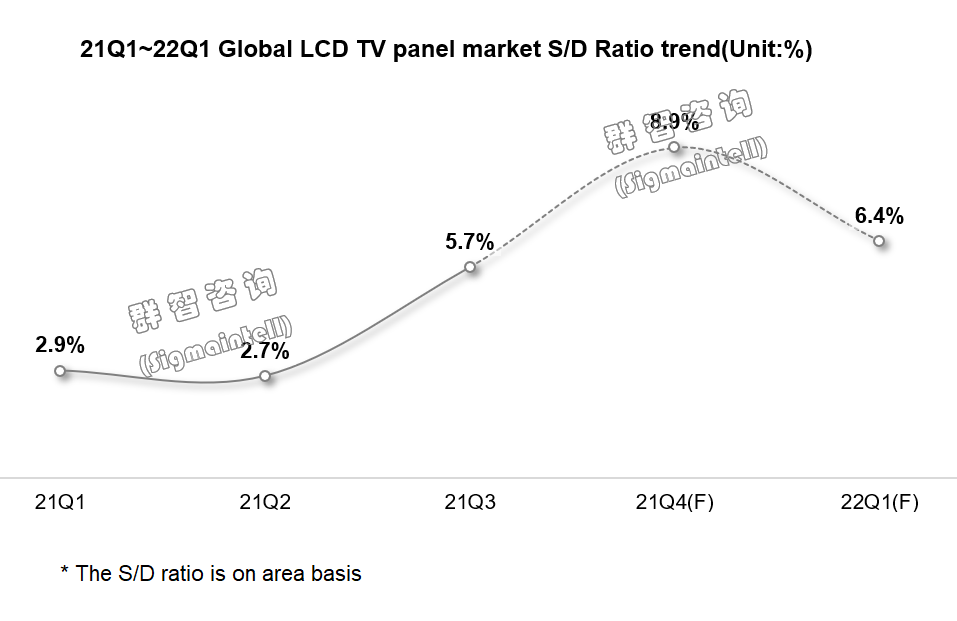

Pricing of panels depends on the supply/demand balance and tight conditions are when there is less than 5% more capacity than supply. Balance is around 5% oversupply and above that there is oversupply that leads to falling prices. This chart from Sigmaintell on the balance highlights that the inverse of the pricing chart is the balance chart.

Sigmaintell’s view of TV panel supply/demand. 5% oversupply is considered to be ‘balance’

Sigmaintell’s view of TV panel supply/demand. 5% oversupply is considered to be ‘balance’

These conditions mean that the panel makers will focus hard to try to sell panels that make a bit more money than standard TV panels, so expect to see promotions on technologies such as miniLED backlights, quantum dot-enabled panels and panels with new features, such as the dual frequency panel that Vizio announced at CES that can support 120Hz operation at UltraHD resolution, but can run at 240Hz with a drop back to 1080P for gaming.

Of course, IT applications of monitors, notebooks and tablets also take significant volumes of large LCD panels, but after the big boost of the last couple of years in the pandemic, they are likely to go back from their peak, although they should stay above the levels of 2019. However, the level of demand will not be enough to materially affect the core panel prices, although panel and set makers will also be looking to boost their share of premium products in ultrawide, curved, miniLED and gaming categories. (BR)