Total mobile shipments fell 5.2% YoY in Western Europe throughout 2014 – the second consecutive year that the market has shrunk. Total shipments reached 174.1 million units.

Feature phones continued to plummet, with shipments decreasing 39% to 28.4 million units, and a value of $1.4 billion. IDC now classifies feature phones as a niche segment, with just a 16% market share and representing 2.2% of market value.

Smartphone shipments passed 145.8 million units: a 6.4% YoY rise, to an 84% share. Market value of this segment was $62.4 billion, up 1.7%. The market was impacted by higher penetration rates, but the end result was still a record high in terms of units shipped and value.

70% of people in Western Europe now own a smartphone, said IDC’s Francisco Jeronimo. The largest contributors to this were the success of Apple’s iPhone 6 and 6 Plus; phablet popularity; and the rise of sub-$150 devices. 28 new brands entered the European smartphone market in 2014, focusing on low-end and affordable phones. They helped to ease consumers’ move from feature phones to smart devices. These new entrants to the market, plus those that appeared in 2013, already have a collective 6.4% share.

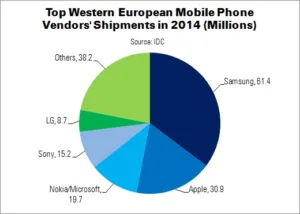

| Top Western European Mobile Phone Vendors’ Shipments and Market Share (2014 Smartphones and Feature Phones) (Millions) | |||||

|---|---|---|---|---|---|

| Vendor | 2014 Units | 2013 Units | 2014 Market Share (%) | 2013 Market Share (%) | YoY Change (%) |

| Samsung | 61.4 | 77.7 | 35.3% | 42.3% | -21.0% |

| Apple | 30.9 | 26.9 | 17.7% | 14.6% | 14.9% |

| Nokia/Microsoft | 19.7 | 25.9 | 11.3% | 14.1% | -23.9% |

| Sony | 15.2 | 14.8 | 8.7% | 8.1% | 2.7% |

| LG | 8.7 | 8.1 | 5% | 4.4% | 7.4% |

| Others | 38.2 | 30.3 | 22% | 16.5% | 26.1% |

| Total | 174.1 | 183.7 | 100% | 100% | -5.2% |

| Source: IDC | |||||

Phablets accounted for almost 10% of smartphones shipped in Western Europe in 2014. ASPs were much higher than normal smartphones ($428), but shipments still exceeded 14.3 million units – equal to 174% YoY growth. Samsung, Apple and LG had an 80% share of this segment.

The Western Europe smartphone market is now divided between Android (71.2% share), iOS (21.2%) and Windows Phone (6.8%). Other platforms, like Blackberry (0.7%) and Firefox (0.07%), risk disappearing from Europe altogether.

Market leader Android will continue to be challenged by iOS at the high end and Windows Phone at the low end. IDC expects iOS’ market share to rise this year, with continuing momentum around the iPhone 6, while Windows Phone will rise in the enterprise sector. The OS is available across multiple screen sizes and price points, while retaining a consistent experience. It is also fully integrated with Microsoft’s enterprise solutions.

| Top Western European Mobile Phone Vendors’ Shipments and Market Share (2014 Smartphones) (Millions) | |||||

|---|---|---|---|---|---|

| Vendor | 2014 Units | 2013 Units | 2014 Market Share (%) | 2013 Market Share (%) | YoY Change (%) |

| Samsung | 51 | 58.3 | 35% | 42.6% | -15.5% |

| Apple | 30.9 | 26.9 | 21.2% | 19.6% | 14.9% |

| Sony | 15.2 | 14.8 | 10.4% | 10.8% | 2.7% |

| Nokia/Microsoft | 10 | 7.6 | 6.9% | 5.5% | 31.6% |

| LG | 8.6 | 7.7 | 5.9% | 5.6% | 11.7% |

| Others | 30.1 | 21.7 | 20.6% | 15.9% | 38.7% |

| Total | 145.8 | 137 | 100% | 100% | 6.4% |

| Source: IDC | |||||