The markets for the largest categories of consumer electronics, such as TVs, smartphones and computers have been pretty weak over recent years, and everyone is looking for the ‘next big thing’ to drive the market. One of the prime categories is virtual reality (VR) and it gained huge attention when Oculus VR, a company that only started in 2012, was bought by Mark Zuckerberg’s Facebook for $2 billion in the spring of 2014.

One strategy in watching the market is to ‘follow the money’, so many saw the big payout for a two year old company with no finished products as identifying VR as the next big CE segment.

VR seemed to be interesting, despite the failure of the Google Glass project, which had Google had hoped would drive the development of the augmented reality market and which was eventually withdrawn from sale early in 2015.

A number of companies and groups have swung behind the idea of VR, including HTC with its Vive headset, Sony with the PlayStation VR as well as Oculus with its Rift product. Smartphone vendors such as Samsung, LG and Alcatel got behind the provision of headsets to allow smartphones to be used as VR displays. Google has developed the Cardboard concept, which enabled incredibly low cost use of smartphones. It has developed the Daydream platform which is now garnering support. Microsoft has developed the Hololens and then there’s Intel’s Project Alloy. And, of course, Magic Leap has raised huge sums without showing the world anything other than videos.

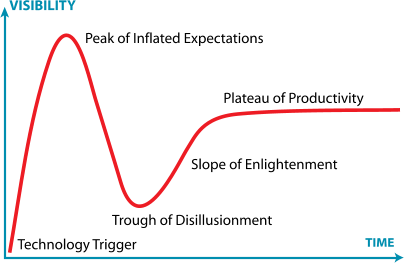

Did anybody say “Hype curve”? Gartner’s hype curve

Gartner’s hype curve

Supply Chain and Content Lines Up

Meanwhile, the supply chain has been developing better displays, GPUs and new technologies such as foveated rendering which uses gaze to optimise the use of GPUs in VR.

At CES and other trade shows, long lines of end users queued for extended periods to try VR and one UK retailer even has an ‘in-store rental’ scheme to charge potential buyers for trying out VR headsets. MediaMarkt and others have set up special areas to try VR. So, retail is lined up.

Content vendors, including publishers, movie makers, advertising companies, education specialists and games developers have been developing content for VR headsets. Camera makers have been working on a range of 360º cameras to allow user created content from entry level to professional levels of quality.

So, we seemed to have covered most of the bases. Lots of investment; ‘check’. Technology companies all keen; ‘check’. Content available; ‘check’. User content creatable; ‘check’. End User demand; ‘check’. Education, for serious applications; ‘check’. Channels; ‘check’.

Just to give a sense of the level of interest, we have published over 400 stories since the beginning of the year that have been tagged ‘Virtual Reality’.

Demand Unfulfilled

Earlier this year, the Rift was not shipping and the HTC Vive wasn’t quite ready, but by the summer it seemed that the supply chain was ready to meet the demand. The first suggestion that VR might not be the saviour of the CE market came in August, when we reported in our newsletters (http://tinyurl.com/j2hg5nl – subscription required) that registrations of VR headsets on the Steam gaming platform had barely increased despite the Rift and the HTC Vive finally becoming (relatively) freely available.

A few weeks ago, Sony started to ship its PlayStation VR product, widely seen as an important market test as the headset is designed to work with its PlayStation 4, whereas other dedicated headsets need really high end PCs, which is a barrier to adoption. There are lots of PlayStation 4’s out there, so one of the potential barriers to adoption could be disregarded. The headset was also from a known brand and sells for less than the €500 that Context reported on as a barrier to VR headset purchases (update-on-vr-in-europe – subscription required), following a research project in Europe.

Getting Up to Steam

Checking the Steam site again this morning, the latest data was for October 2016, when Steam’s hardware survey was showing the HTC Vive as the most used headset, but showed this headset at just 0.2% of all users, increasing by only 0.01% in October. We know that these users are the early adopters, so it’s clear that they are not ‘rushing in’ to VR.

The worry about this data was that, for a couple of years (since the Oculus deal), there had been a lot of hype about VR, and apparently strong demand, but there had been no real products that could meet that demand so it remained untested. Finally, some products (the Rift & Vive) were available to meet the pent-up demand. However, it seemed, not many actually wanted to buy the headsets.

Black Friday

I’m grateful to Statista for drawing my attention, with the chart below, to data from Superdata, which has revised its forecast for VR headsets down substantially, after it had seen data for the Black Friday weekend and it seems to confirm the earlier view from Steam. The reality seems to be that there is very limited demand for VR from buyers (but for more analysis of the data, see this article on gamesindustry.biz)

The question is “Are we just hitting the trough of disillusionment” for VR, or will VR be like 3D TV and simply not get to the mainstream? – Bob Raikes