More households in the Netherlands are taking their fixed and mobile services from the same provider, according to Telecompaper’s latest multiplay report. Combined deals with fixed telephony, TV and/or internet with mobile telephony made up 42.5% of total multiplay revenues in the fourth quarter of 2017, against a bit over 27% the year before. VodafoneZiggo and T -Mobile Netherlands are both responsible for this growth. The first started in April 2017 with a promotional offer for customers taking both fixed and mobile calls, while T-Mobile NL has been operating in this way since October 2017.

Total multiplay revenues lifted 1.5% in the fourth quarter of 2017 to €1.15 billion ($1.42 billion). Revenue growth in multiplay was lower than in the third quarter when it advanced on the back of price increases at Ziggo and various KPN brands for dual and triple-play packages. The total number of multiplay households grew by 0.5% during the quarter, 2.3% more than at the end of 2016, to 6.68 million.

The share of fixed-mobile among all multiplay households grew to almost 33%, almost 13% more than at the end of 2016. Most multiplay households still have a traditional triple-play bundle—broadband, fixed telephony and TV—but that share has declined to 47% from 51% year-on-year.

KPN is the largest quad-play provider with 58.8% of connections, thanks in part to the early launch of the KPN Complete offer. VodafoneZiggo increased its market share by 1.3% to 38.7%. Looking at quad-play revenues, growth at VodafoneZiggo was greater—to 36% from almost 34%—although KPN is still the largest with 62%.

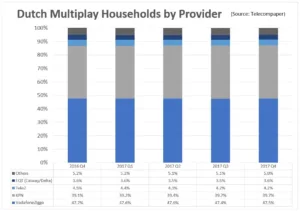

The market positions of multiplay providers are more balanced than those in the quad-play market. VodafoneZiggo is the largest multiplay provider when it comes to connections with a 47.5% market share, followed by KPN with 39.7%. VodafoneZiggo is also the largest provider in terms of sales, with a 47.9% market share and €549 million ($680 million) in revenue, followed by KPN with a 42.6% share and €488 million in revenue ($604 million).

Despite the growth of quad-play sales, triple-play is still the largest segment within multiplay, with a share of almost 52%. Quad-play did grow by 1.8% in the quarter, to 33.5%.

In 2018, Telecompaper expects that fixed-mobile will increase even more in terms of both revenue and connections, again mainly due to growth at T-Mobile NL and VodafoneZiggo. In addition, people are expected to further move from traditional triple-plays with broadband, fixed telephony and television to deals including mobile telephony as well.