Techblick held its Quantum Dots and Mini/Micro-LED Displays virtual event last week and had an impressive list of speakers and topics. I plan to write about several of the talks, but I thought I would start with an analyst’s eye view of miniLED from Eric Virey of Yole Intelligence (I see they gave up on getting people to spell Développement the French way!). He is always an interesting and engaging speaker.

We’ve reported on Yole’s work and information about miniLED, so some of this will be a repeat, but it’s useful to get an overview. Virey looked at the definitions of traditional LEDs, miniLEDs and microLEDs (although there are no accepted definitions). After a quick explanation of the concept of Full Array Local Dimming (FALD) and how this differs with miniLED. The main change from FALD to miniLED is just the number of zones. Adding zones reduces the ‘haloing’ artefacts from zones that are bigger than ideal. Virey sees miniLED really being defined as having 1,000 or more zones although recently he has seen some brands advertising sets as miniLED with ‘just a few hundred’ zones.

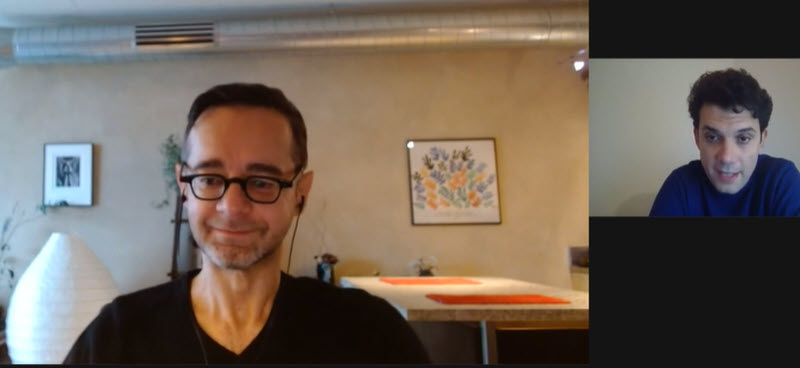

Adding LEDs allows thinner sets because less space is needed to homogenise the light but a big factor in performance is the quality of the driving algorithms and circuits. A really good design, such as the Apple iPad Pro can be close to OLED in performance (A Cut-Away View of MiniLEDs). He presented a great slide that really highlighted the wide range of choices and trade-offs involved in a good miniLED design.

Yole has, as we have reported, the firm has conducted detailed teardowns of a number of high end TVs and that has shown that there can be a big difference in cost according to the design choices made, with a high end TCL set costing 70% more on an area basis than a Samsung QLED (partly because of the thinner design). However, there may be a convergence to reduce cost with around 2,000 zones and 5K-20K LED devices. TCL dropped from 96K LEDs in 2021 to around 10K LEDs in 2022, but keeps the same number of zones. The trade-off is that the TV gets around 5mm thicker.

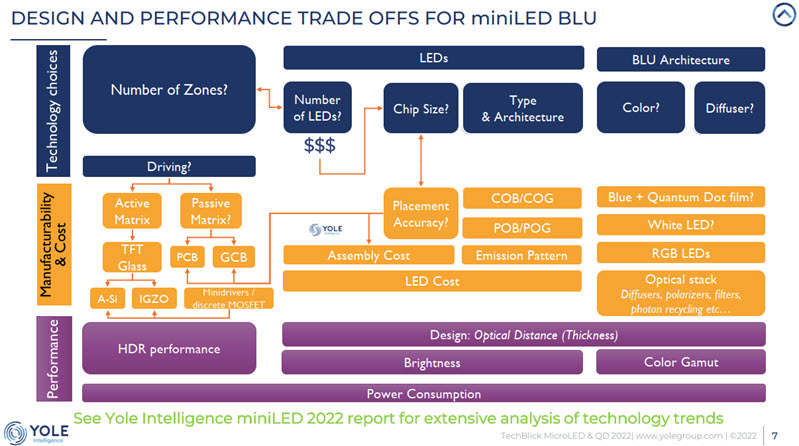

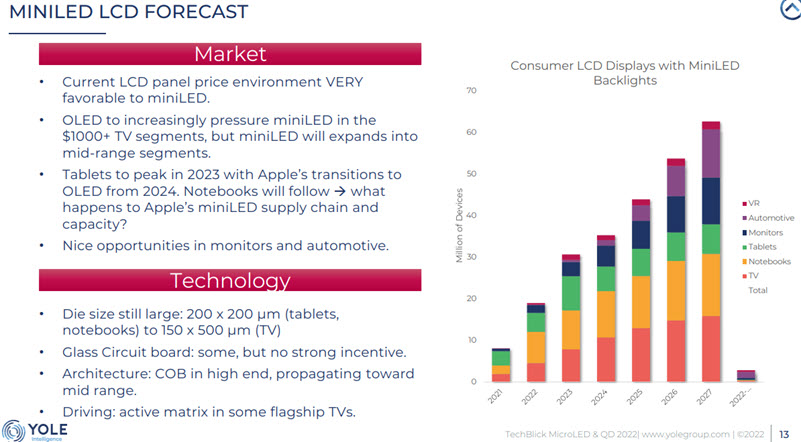

There are still many opportunities for cost reduction. Looking from a market perspective, 75% of all TVs sold sell for less than $600. Only around 7% of the market sells for more than $1,000 and LCD makers need to compete with OLED in that segment which is important for revenues and profit.

But OLEDs are getting cheaper so in that area LCD has focussed on technology features where OLED is weaker such as 8K and sizes above 75″ (and I would add high brightness – editor). MiniLED has to cost reduce to the mid-range to compete with OLED.

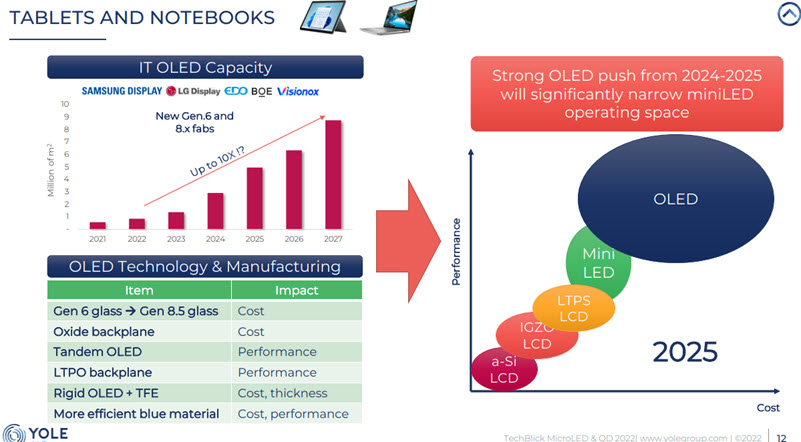

Turning to notebook and tablet applications, IT OLED capacity is expected to increase a lot, by up to 10X if every discussed fab goes ahead (although that seems unlikely at the moment – editor). That will squeeze miniLED significantly and seriously reduce the market opportunity for miniLED which currently is well ahead of OLED.

Yole sees notebook and tablet applications being squeezed by OLED by 2025. Note that today, miniLED is bigger in this chart than OLED

Yole sees notebook and tablet applications being squeezed by OLED by 2025. Note that today, miniLED is bigger in this chart than OLED

Overall, Yole, sees good growth, but not in notebooks and tablets. Apple, for example is expected to shift to OLED for tablets and notebooks in 2024. However Yole is more optimistic about opportunities for miniLED in automotive and monitor applications where the technical challenges for OLEDs are more difficult.

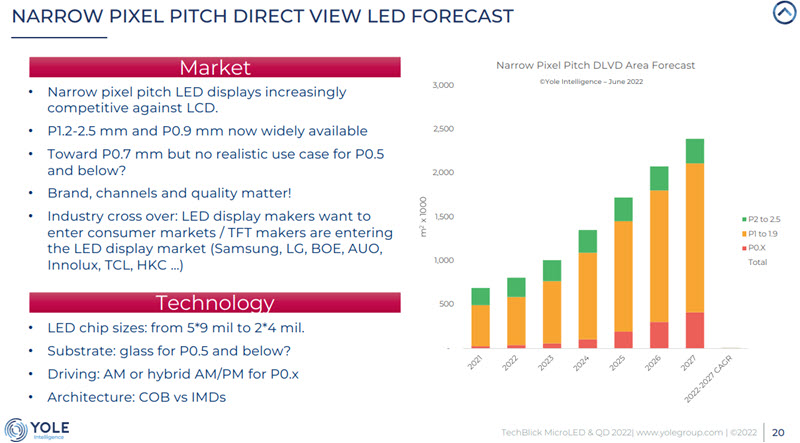

Turning to direct view LED displays, Virey said that the business has been dominated in the past by manufacturing companies in China as there were low barriers to entry to the business. However, the best companies are now focussing on added-value systems and solutions (a trend that was very apparent at this year’s IBC – editor). They are also trying to make higher quality and differentiated displays and they are also building supply chains with partners and resellers for service and support. When you spend a lot, you want long term quality, reliability and a good installation process.

For very big displays, LED is the only solution, but at smaller sizes LCD is quite a good choice. The big advantage of LED is the lack of bezels, but the disadvantage of cost. In the past, pixel pitch was also a challenge, but LED is getting more competitive in terms of pitch. However, price is still a challenge for LED at finer pitches because of the number of LEDs required.

LCD is competitive in TV and smaller sized sets and Yole is sceptical about the likely success of small pitch LED in the TV market because of the cost – you have to switch to microLED. Meeting rooms and virtual production are interesting growth areas, with control rooms and command centres now strong.

Finally, he presented the firm’s forecast for narrow pixel pitch and said that although makers are trying to get below 0.5mm pitch, Yole does not see a use case for pitches below 0.7mm. (BR)