As supply becomes more constrained and panel prices rise, TV brands are seeking to aggressively increase panel purchases as we enter Q3.

IHS expects the panel shortage to continue to affect the industry in Q3: a critical time, as TV makers seek to stock up for the end-of-year sales. The industry has become concerned about these shortages, in particular for 40″ units, as more panel makers consider closing unprofitable fabs.

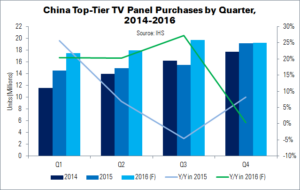

IHS reports that Samsung Electronics and LG Electronics are planning to raise their joint panel purchases by 12% YoY, to 46.6 million units, in the second half of 2016. The six leading Chinese brands, meanwhile, plan to increase their joint purchases by 27% in Q3, to 19.7 million units. Hisense, TCL, Konka, Changhong and Haier are especially big purchasers, taking 19 million units (although this is down 2% QoQ); Skyworth, in contrast, already carries a relatively large panel stock.

Deborah Yang of IHS said, “Not all the panel suppliers are able to fill the rising demand from their TV customers, considering constraints on supply and capacity utilisation… Basically, panel supply will be allocated based on price negotiations, TV makers’ business outlook and the state of the supply-chain supply relationship. Display manufacturers have limited supply and a strategy to hold supply-chain bargains, to optimise panel prices, to improve revenue flow.”

IHS’s TV data shows that ‘strategic panel supplier negotiations’ will be critical for late 2016 and 2017, especially for 40″, 43″, 45″ and 49″ panels; as well as product positioning and cost competitiveness of 49″, 50″, 55″, 60″, 65″ and 70″+ displays. Chinese makers are expanding their supply of 32″-49″ and 55″ panels, but some quality and reliability concerns remain. The supply of larger sizes (55″ and 65″ in particular) is also short of demand, as outputs are constrained by tight capacity and lower yield rates.

Overall, Chinese TV makers are not under pressure to source panels “with any urgency,” said Yang. However, they keep buying in the hope of mitigating future panel supply constraints, and to achieve their domestic and international shipment targets. Makers like TCL, Hisense and Skyworth are set particularly aggressive targets to grow market share this year, and still need to buy more panels in the second half of 2016.

China’s top six TV brands will have to refill panels aggressively, says IHS, though inventory adjustments might be necessary in Q4.