What They Say

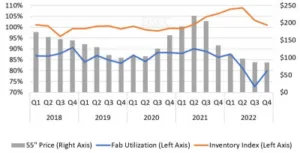

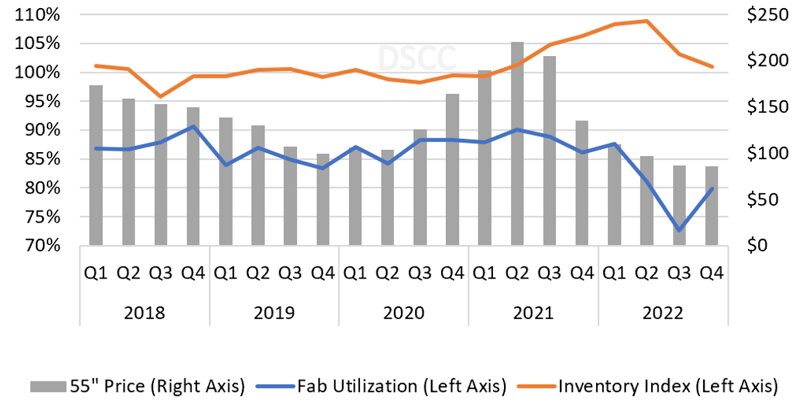

The topic of inventory is one that DSCC has looked at a number of times this year. It has published a new blog post on the topic of TV inventories and said that the growth of inventories has seen the level of fab utilisation drop to historically low levels, below 75% in June 2022. The firm has an index based on the inventory in the whole supply chain and that index grew from 106 at the end of last year (3.2 weeks) but had grown to 110 (5.4 weeks) but recent cuts in panel purchasing have eased it back to 109 (4.6 weeks).

TV panel prices continue to fall and while 50” and 55” panel prices fell below cash cost in Q1, all sizes from 32” to 65” and above, began to plummet in Q2. As of June, the prices for all sizes under 65” fell below cash cost. Even those in China that have support for their capex have to react to that level of pricing.

Although crystal cycles have historically been around a year from one side to the other, DSCC sees few reasons for the cycle to roll around this time although with steady efforts to reduce inventories, the industry can hope to see prices bottom out and began to correct by the end of the year.

What We Think

Over the years, I have often felt at the bottom of the cycle that ‘it’s hard to see how it turns around’, but it always has in the past (as the poet said “the night is darkest before the dawn”). No doubt it will this time, but may take a bit longer than before. However, as DSCC says, bringing inventory back under control has to be a key part of the process, so that is good to see. (BR)