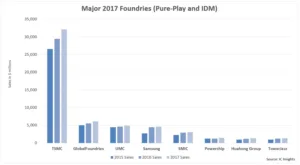

In 2017, the top eight major foundry leaders held 88% of the $62.3 billion worldwide foundry market, according to IC Insights. The 2017 share was the same level as in 2016 and one point higher than the share the top eight foundries represented in 2015.

With the barriers to entry (e.g., fab costs, access to leading edge technology, etc.) into the foundry business being so high and rising, IC Insights expects this “major” market share figure to remain at or near this elevated level in the future.

TSMC was the leader by far, with $32.2 billion in sales last year. In fact, the company’s 2017 sales were over five times that of second-ranked GlobalFoundries and more than ten times the sales of the fifth-ranked foundry SMIC.

Huahong Group, which includes Huahong Grace and Shanghai Huali, displayed the highest growth rate of the major foundries last year with an 18% jump. Overall, 2017 was a good year for many of the major foundries with four of the eight registering double-digit sales increases.

Of the eight major foundries, six of them are headquartered in the Asia-Pacific region. As shown, Samsung was the only IDM (integrated device manufacturer) foundry in the ranking. IBM, a former major IDM foundry, was acquired by GlobalFoundries in mid-2015, while IDM foundries Fujitsu and Intel fell short of the $1 billion sales threshold last year.

Although growing only 4% last year, Samsung easily remained the largest IDM foundry in 2017, with over five times the sales of Fujitsu, the second-largest IDM foundry.