Abysmal Q4-18 subscriber losses reached some 650K by Warner Media (ummm AT&T – DirecTV satellite provider combined with AOL Time Warner remember?). While that number was offset by new (mostly U-Verse home video) subscribers, this was still a 403K net subscriber loss – a gut punch for DirecTV that boasts the highest ARU (average revenue per user) at $126/ month.

To translate this into dollar terms, the effect to the company is north of $51M / month decline in pay TV subscriber revenue for the newly-formed entertainment behemoth. The total payTV subscriber base at year’s end (2018) for the new Warner Media is now at 24.5M paid customers.

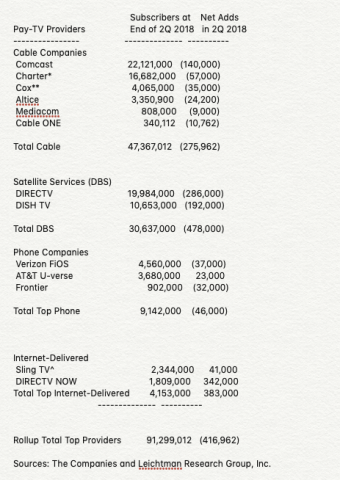

Warner Media losses are not isolated. In Q2 2018, Swiss based Leichtman Research Group (LRG) reported 415K subscriber loss for the US payTV industry of the top payTV providers that represent 95% of the market. That was a year over year reduction in losses over the 660K subscribers reported in 2017 according to the group, documenting that payTV subs are hemorrhaging as video streaming takes full hold in the internet dominated space.

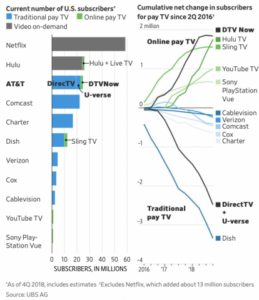

One picture is worth… well just ask yourself what side of the equation would you want to be invested in (see chart below)?

With almost 60M subscribers and growing, Netflix dominates the video streaming space and shifted the content game by producing its own content

Q2-2018 PayTV subscriber losses

Q2-2018 PayTV subscriber losses

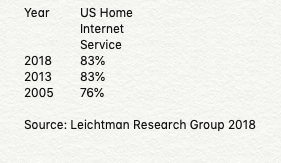

On the content streaming side, powered by internet to the home, in December 2018, Leichtman reported a steady 83% of US households that get internet service at home. Interestingly, LRG said historic growth here has been flat over the past five years where the trend growth includes 83% and 76% internet service penetration for 2013 and 2008 respectively. Here’s a brief table to make it clear:

Of this group “not online,” almost half (49%) do not use a laptop or desktop computer, tend to be older (with one-quarter in the plus 55 age group) and at the lower wealth bracket (38% with annual household income below $30K per year) the research group reported. For more detail, see the study, Broadband Internet in the U.S. 2018.

So, along with the dawn of the internet era, comes the close of another… PayTV that started as a simple idea to provide rural areas with a TV signal simply not available to those excluded by geography. That technology blossomed into a multi-billion dollar industry that changed all the rules of (good old 3-channel FCC regulated) “over the air” (OTA) TV. Some “500 channels with nothing to watch” later, showing everything from “Red Neck Island” to “Bridezilla” (not making this up, see Brenden Gallegher’s 25 Worst TV shows) we have not come to the end of obscure programming, simply the writing on the wall (in the US anyway) for an outdated, over-priced payTV distribution model.

But was payTV doomed to fail as new delivery/distribution systems came online? Or is the industry the victim of its own intransigence?

Much like the music industry, or even VHS that came years before, content providers had to move kicking and screaming into new industries with billions in additional revenue dollars waiting at the end of all their resistance. Simply put, was payTV’s own resistance to change, insistence on outdated price models and unsustainable policies that spurred the stellar growth of upstarts like Netflix that now dominate the space (and was originally delivering DVD’s by US Mail for crying out loud!)?

It just goes to show even an 18th century distribution model-hand delivered US Mail, can (and will) eventually topple a giant whose time has come… Time to think again. – Stephen Sechrist

Pay TV and SVOD in Europe on the up, TV Viewing and Blu-ray Slump

Comcast Becomes Major Shareholder in Sky as Fox Decides to Sell

Spain’s Pay TV Subscriptions Grew Over 10% Year-on-Year in 2018 Q1

Amazon Prime Video App To Be Available On Comcast’s X1 Later This Year

An Inflection Point in Pay TV Production to Delivery

Comcast and Netflix Expand Partnership Following Successful Xfinity X1 Integration

NAGRA and Samsung launch TVkey Cloud Internet-based Smart TV security for premium pay-TV

Major U.S. Pay TV Providers Lost ~415,000 Subscribers in 2Q 2018