This is the second part of a 2-part blog on the trends in QDs at SID Display Week 2019. If you missed it, you can find the first blog about trends #1 and #2 here.

#3 Interest in QD technology continues to expand but not without threat

From small startups to well-established brands, more and more companies continue to get involved in QD technology. It was difficult to tally the number of companies either using or making QDs (believe me I tried). I’ll highlight a few of the notable ones here.

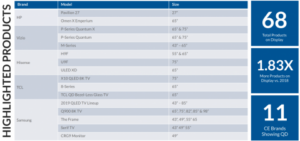

Nanosys remained a strong presence at the show, and I thought one slide of theirs captured the continued interest in QDs nicely. While these stats are for CES, it demonstrates the strong growth of this technology as it branches into more display sizes, types, and brands.

Source: Nanosys presentation, SID business conference 2019 – click for higher resolution

Source: Nanosys presentation, SID business conference 2019 – click for higher resolution

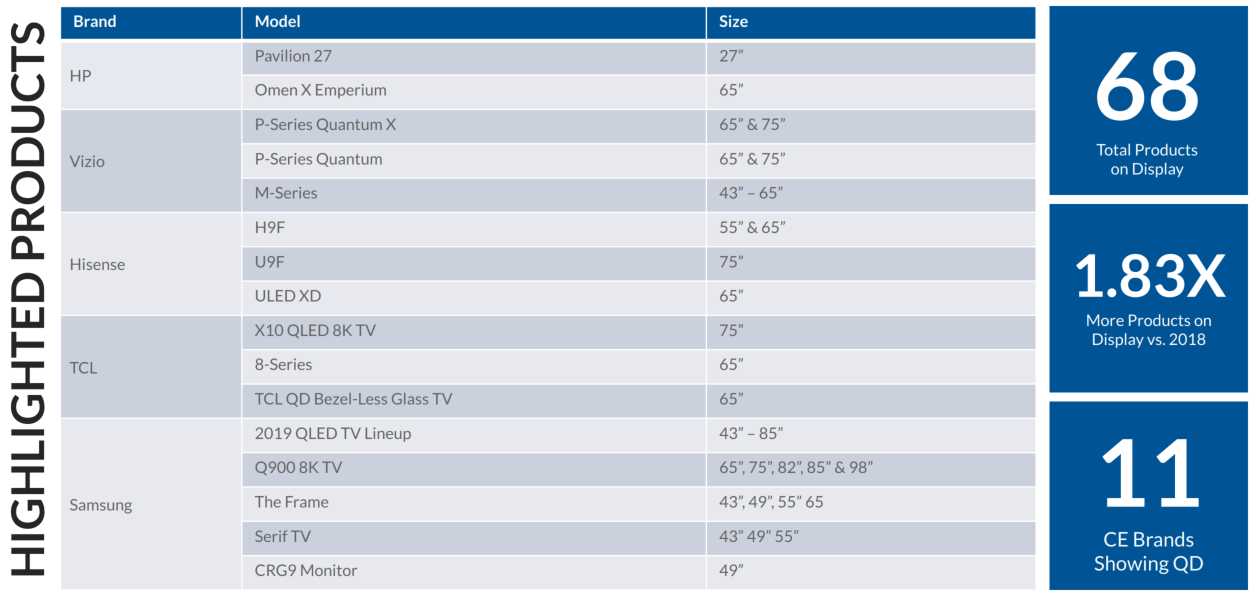

Kateeva, a company that has made its mark in OLED thin film encapsulation, had a surprising focus on QD technology during a presentation from their director of marketing at the business conference. Of course, they were encouraging others to use Kateeva inkjet printing platform over other fabrication methods for both OLED and QD depositions. They even did a calculation of predicted cost savings for IJP vs photolithography deposited QD layers (for a QD color filter). The analysis depends on the price of QDs, but it’s in the 10s-100s of millions range per fab. This is, of course, due to the high loss of material when using traditional photolithography where most of the material is wasted. It’s worth noting that Kateeva has placed QD color filters as the next technology target on their roadmap, so expect more QD activity from Kateeva in the coming years.

Source: Kateeva presentation, SID business conference 2019

Source: Kateeva presentation, SID business conference 2019

Nanophotonica recently announced a reinvestment from Samsung Ventures, surely a good sign of things to come for the small company. Nanophotonica focuses all its efforts on QD-EL, and during the Investors’ Conference at SID described their strategy. As a materials company, they are heavily partner-oriented, relying on a combination of in-house QD technology as well as external expertise and capabilities to bring their technology to market. Their solution processed devices (printable) show impressive efficiency, and lifetimes of red and green (Cd containing) are respectable. As with everyone else though, blue needs a lot of work, and Cd-free is a long way from commercial viability.

Pixel Display has always been loosely grouped in with QDs and phosphors, but they have remained quiet about their technology other than claiming its superiority. This year was no different as we learned of their “nanobright” technology that appears to have all the best properties of QDs and phosphors combined into one material with none of the drawbacks. It remains to be seen if this will gain traction but put in on the list as competition in the color conversion space. (The company said at the show that it had found that ‘nobody wants to pay for better colour, so is targeting its marketing towards other benefits of its technology (BR))

GE gave one of the few phosphor talks at the entire show, but their voices were heard loud and clear with the claim that they have an excellent phosphor (narrow red KSF/PFS) with significant market penetration. I’m probably unique in that I own two QD displays (monitor and TV) and only one KSF display (laptop). But many of you carry a phone that contains KSF, it’s that prevalent (but not heavily marketed by display manufactures).

Over 30 billion LEDs have been sold with KSF according to GE. And while there still is a lot of talk about the relatively long fluorescence decay lifetime, they pointed out the fact that this has not prevented their customers (or rather licensees) from implementing blue LEDs with KSF phosphor in their displays. GE claimed equal or superior performance to red QDs in most categories (EQE, thermal quenching, stability), but admitted that QDs still take the cake for green color. They hinted at a narrow green phosphor in the works, though.

Size remains a distinct advantage for QDs in many up and coming applications including micro LEDs and color filters, where the size of the color-converter must be in the nanometer size range, not microns like the current phosphor technologies. GE admits that QDs, phosphors, and OLED will all continue to exist for the foreseeable future. It is the unpredictable progress of each technology that will determine if one will take over in the long term. The take home message from GE – Phosphors are still a display staple, and they are not going away anytime soon.

#4 OLED and QLED still compete for top dog, but QD sets are becoming more affordable

As I walked the show floor, the public-facing positioning of OLED and QLED remained clear (even though this is at odds with my #1 trend). These are the two top display technologies out there and they continue to battle for the top spot. One thing has changed though.

QDs were less at the forefront of some of the best LCD displays as much as they were a highlighted component of the display. For example, the fantastic looking dual-LCD set from BoE was supported by a QD film in the BLU, although you had to read the text next to the TV to know this. The technology front and center here was the dual-LCD giving OLED a run for its money in terms of deep blacks with no halo, along with all the benefits we know and love about QDs (wider color gamut, increased brightness/efficiency). Of course, the unique form factors that OLED can enable was highlighted in many booths, for example curved displays and cockpits covered in OLEDs. The real show-stopping TVs seemed to fit nicely into either the OLED or QLED category with a few exceptions. This is a testament to Samsung and their QLED marketing push for the past few years (although a Samsung booth was noticeably absent from the show floor).

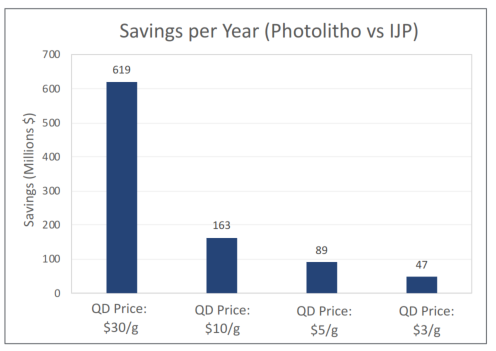

While late 2018 had a few QD-enabled TVs for <$1000, 2019 stands to be the year that QDs finally trickle down into the lower cost sets. With numerous brands (including Samsung) with options for <$1000 TVs, and some brands (Vizio) offering QD sets for <$500, it’s a tipping point that those in the QD industry have been waiting for (some of us longer than others). I challenge you to find an OLED TV for <$500 this year.

DSCC showed some extreme examples of inexpensive QLED TVs, along with their forcast which shows QD film volumes really picking up this year (in part due to lower price point).

Source: Display Supply Chain Consultants, SID Business Conference 2019

Source: Display Supply Chain Consultants, SID Business Conference 2019

For a material that was only known to a select few companies and researchers just five years ago, it has come a long way. There are still challenges to future implementations, but with all the technical progress I observed at the show this year, I’m confident there will continue to be QD-enabled TVs for the foreseeable future. I’m already looking forward to the show again next year. (PP)