Last week, we reported on the acquisition of Vizio by LeEco and this week Ken has written a Display Daily on the topic. It’s an interesting story on many levels.

First, Vizio, as a company that was formed only in 2002, has been a successful TV start-up that has made a lot of money for its investors. That’s a sentence I haven’t written in the 22 years since I started our newsletter. I’m not sure I ever expected to write such a sentence. I’ve written editorials before about the factors that have made TV a very difficult market to make money, so the achievement is even greater. As Jon Peddie wrote in a Display Daily last year, the arc of the TV business has broadly followed the process of industrialisation of the most advanced economies and he catalogued the difficulties of surviving in the US TV market.

So Vizio’s success has been against the trend. The founders were either very clever or very lucky (and almost certainly both!). Vizio exploited a very simple supply chain, from China to the West Coast of the US. It focused on a very simple channel strategy. Initially, it sold only through Costco, which at the time offered a one year “no questions asked” warranty, that allowed mainstream consumers to take a risk on an unknown brand. Costco also had a reputation with its buyers for picking good quality products, which helped. The combination allowed Vizio to achieve rapid growth with a very low margin cost structure and soon Best Buy and Walmart were knocking on the door to buy its sets. That gave it the volume that it needed.

The combination of factors needed always made it difficult to succeed in Europe and despite a number of rumours, the brand has never been seen in the European market. In Europe, there are very diverse technical requirements across the region, the supply chain from China is relatively slow and complicated, but, critically, there is a very fragmented channel structure. The combination of these factors means that it’s impossible to establish a rapid growth, low margin brand for TVs in Europe.

As Ken said, it seems likely that LeEco will continue to develop its business using the Vizio name and exploiting its relationship with Netflix. However, the European content market is even more fragmented than the TV market. Although there is supposed to be a ‘single market’ in the EU, if I travel outside the UK, I cannot access the content on my “Sky Go” roaming TV account. (Well, I can, but I have to use a VPN to spoof the system into thinking that I am actually in the UK. Sadly, this rarely works using a smartphone, where there are other ways for the system to identify where I am). On that basis, for the time being, I am comfortable that it will be several years before the company really attacks Europe.

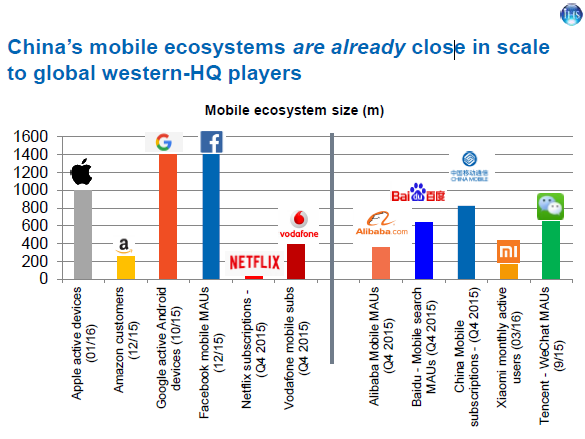

However, IHS’s Ian Fogg has given a couple of talks that I have attended over the last couple of years at IFA, and in London, that highlighted the power and breadth of the major Chinese ‘mobile ecosystem’ companies. Companies such as Alibaba, Baidu, China Mobile, Xiaomi and Tencent are all at the broad level of scale of Google, Facebook and Apple, and they are significant in Europe. That suggests that it could be that it’s the potential strength (it’s not there yet) of the LeEco ecosystem that allows it to enter the TV market in Europe with the Vizio brand at some time.

Bob