IHS held an analyst’s briefing meeting at the end of the recent TV Connect event in London and we went along to see what the company had to say. It was a short event, with ‘high bandwidth’ – which left more time for networking. After a very brief ‘hello’ from Ben Keen, Piers Harding-Rolls looked at whether there is a real opportunity in VR?

Is There a Real Opportunity in VR?

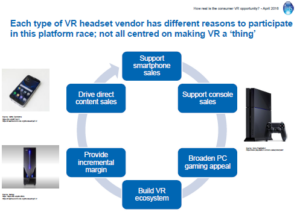

Harding-Rolls started by pointing out that everyone has a different point of view on the market when it comes to VR and with different priorities – for example, Sony is interested in it because of its console business, while another set of makers is interested in how to make the most of their smartphones. Another group is starting from nothing.

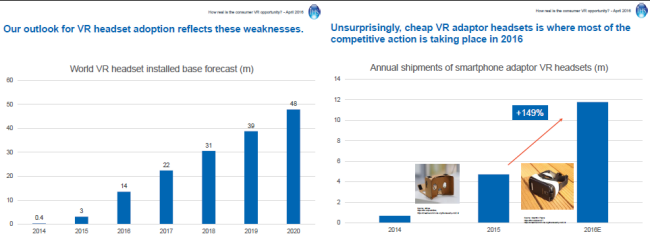

The market is splitting into two clear categories, cheap smartphone holders and more expensive sets with integrated displays. Today’s technology is not really there yet for commercialisation, IHS believes as using VR is a ‘mixed experience ‘ with problems in battery life and heat while the need to have the display tethered to a PC (like the Oculus) is not compatible with market broadening.

These weaknesses will limit the growth of the market and the IHS forecast is based on current technology, and might change if there are technology breakthroughs. adaptor headsets growing

IHS VR Forecasts – Click for higher resolution

IHS VR Forecasts – Click for higher resolution

The market is currently very fragmented with many players trying to get into the market and a variety of monetisation strategies are being employed. Harding-Rolls said that the HTC Vive, the Oculus Rift and Sony’s PlayStation VR are the keys to driving content monetisation through curated stores – but value from content will only be a small part of the market in the short term.

Market scaling will mostly be in terms of interactivity and IHS believes that the ‘middle ground’ may be fertile, where video content can be mixed with gaming and other applications. There is lots to learn in storytelling and content development – and Harding-Rolls said that it will be 12 – 18 months before there is a good flow of content. At the moment, content is very centred on games. especially for paid content.

The IHS forecast for content suggests a market value of €400m in 2016, rising over €1 billion by 2018 which it sees as a ‘reasonable market’. Much of the money will be in high end headsets with dedicated stores, with Gear VR and upwards driving. In summary:

- VR is not a fad – it’s here to stay but will take time to develop as a market.

- Hardware is coming faster than content

- The main monetisation is in dedicated headsets

- If you want to get to big audiences then content and devices have to be cheap or free

- Investing in skills and content is ‘not a bad idea’ at the moment, although unlikely to be profitable in the short term

The Impact of Asia on European Media

Ian Fogg then talked about the impact of Asian companies on European media – a development of his talk at the IHS event at IFA (Fogg Clarifies Mobile Mistakes). He said that HTC Vive is important and Samsung is also a big player in future developments and Fogg believes that Asian companies are already ahead of the West in many ways.

Facebook video is a big driver of traffic but the real drivers in the market are not Facebook or YouTube, but developments in Asia. For example, WeChat already covers video, games, payments, taxis, shopping and P2P payments. It’s a platform or portal in the old parlance and Fogg showed how WeChat had led Facebook Messenger by one to two years in developing many different applications.

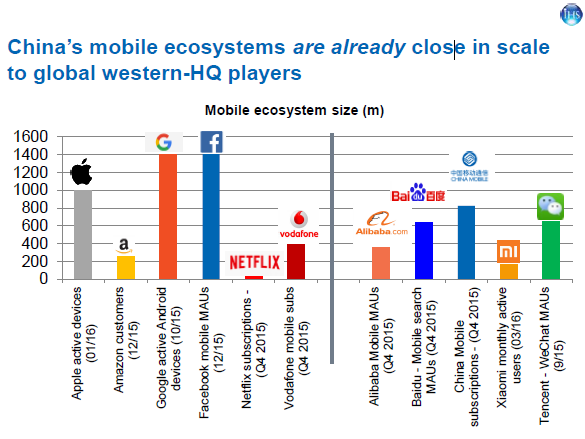

Huawei, Samsung, Sony, LG and many others are trying to develop new interactive devices and Fogg showed some examples from the recent MWC event. Chinese players are completely driving revenues in the Chinese market and there is little western competition. Companies such as Alibaba, Baidu, China mobile, Xiaomi and Tencent are already close to the scale of major companies from the West such as Apple, Amazon, Facebook, Netflix and Vodafone. The markets are developing differently in China without Western competition.

Huawei/Xiaomi have the top app stores in China and Google is not significant. Huawei is now #3 in the global smartphone market and by 2020, IHS forecasts that major Chinese brands will have 38% of the market (with many, many Chinese companies also in ‘Others’). The firm expects revenues of Apple and Samsung to be flat over the next four years.

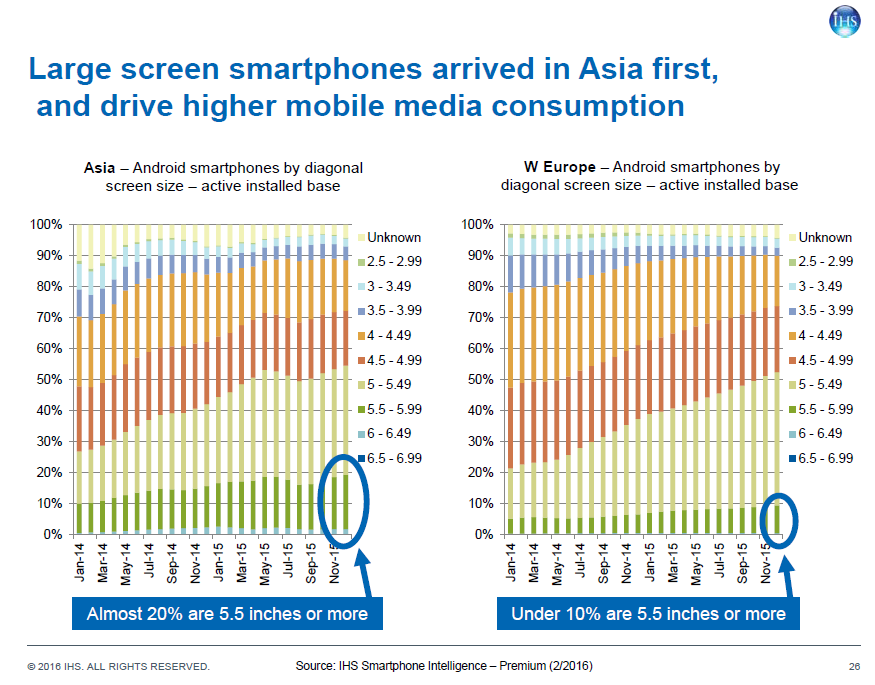

There are significant differences in purchasing patterns in different regions – for example 20% of Asian phones sold are in the 5.5″display category. In Hong Kong, big phones are very popular and larger screens help to drive mobile media consumption, but the EU and the US are behind Asia – the small Apple phone is not selling well.

IHS phone size chart – click for higher resolution

IHS phone size chart – click for higher resolution

IHS collects ‘by model’ data from app stores and that helps the company track brand shares and helps it to identify some local vendors which can be very different. Most phones are supplied by Asian OEMs, and Fogg identified bq and its Aquarius E5 phone as important in Spain and Microsoft’s Lumia 635 as being significant in the UK. There were no other non-Asian OEMs in the top 25 in Taiwan, Spain and the UK!

Technology adoption happens at different speeds in different countries and the regions are driving differently by model/generation. Fogg said that there is no way to plan and develop a mobile business without local detail (available, of course, from IHS!).

In summary:

- China is already ahead and is innovating faster than European or global players

- In mobile everything is linked – social media, payments, video, games and payments

- Chinese phone makers are already global players

- The installed base varies by country – just working by overall volumes is not useful

How to Succeed as an MCN

Daniel Knapp then talked about Multi-channel networks and how to succeed. MCNs are companies that integrate online content (such as YouTube) into portfolios to build collections that can be easily bought into by advertisers and make money from that advertising revenue.

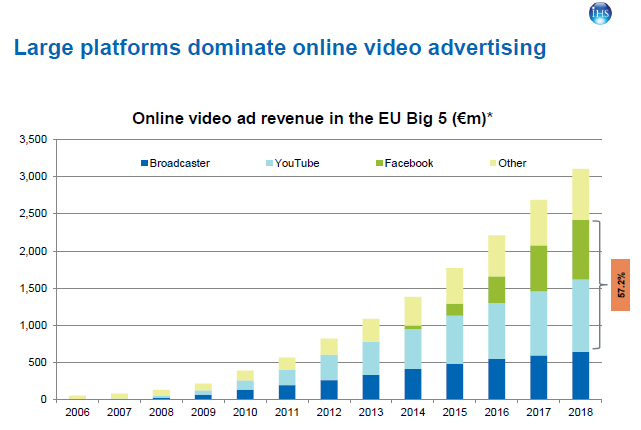

Advertising has been driven to online and increasingly by online video. Online video advertising spend is growing fast, but most of the value is locked into large platforms with FaceBook and YouTube taking nearly 60% by the end of the forecast period.

No MCN is the same as another – each has different models as the industry develops. There have been lots of investments since 2012 with overall valuations over $1 billion, although there are no good metrics for valuation. Those investing feel that they just need to get MCNs because others are doing it. There are lots of questions about MCNs including “What do I do with it?” and “How do I benchmark my performance?”.

There are a huge number of channels on YouTube, but with 50K channels you can get a lot of coverage (around 85%) as there is a “long tail” of YouTube channels.

Knapp said he has 9 ‘rules’ for MCNs.

- Watch the the scale issues

- Find relevance to other traditional broadcast or media, for example, ITN bought a share in Mumsnet (a UK mothers’ forum)

- Watch the competitive set – some areas are not very consolidated yet and there are good opportunities – e.g. automotive

- Identify the value of the number of views vs the number of subscribers. e.g sports is developing more time-based channels

- Concentrated vs diverse approach – some genres are very concentrated with few creatives – there is now a ‘talent war’ starting

- Understand the role of volume/frequency and the shelf life of content – in Germany, for example, each of the main MCNs is very different

- “decentre” YouTube – the MCN concept started there, but FaceBook or Buzzfeed may be more important for some content e.g. Condé Nast has appointed a ‘head of platform relations’. There are no rules about how content is presented as there is in traditional broadcasting, unlike, for example, channel order in TV – you need SEO skills

- MCNs are not just a long tail, but can be starting point to bring content back to the TV. RTL is starting a new 24 hour channel based on YouTube ‘stars’.

- YouTube is not about advertising. There will be more and more branded and sponsored content – this will increase.

All of the industry is new, it’s still new and there will be more rules, Knapp said, and the current ones will be refined.

Netflix & PayTV Friends or Foes?

Ted Hall then looked at the relationship between Pay TV operators and Netflix.

There is still a big question about the effect of Netflix on TV, although it’s a 10 year old question. 25 Pay TV operators have partnerships with Netflix, but they have a variety of strategic goals. Some want to support subscribers while others want to upsell their customers. Others want to boost demand for broadband, develop customer loyalty, create a ‘halo effect’ or have some level of direct revenue generation (typically 10%-15% of Netflix revenue through the platform. Hall said that partners tend not to be market leaders and market-leading companies tend to have their own SVOD services.

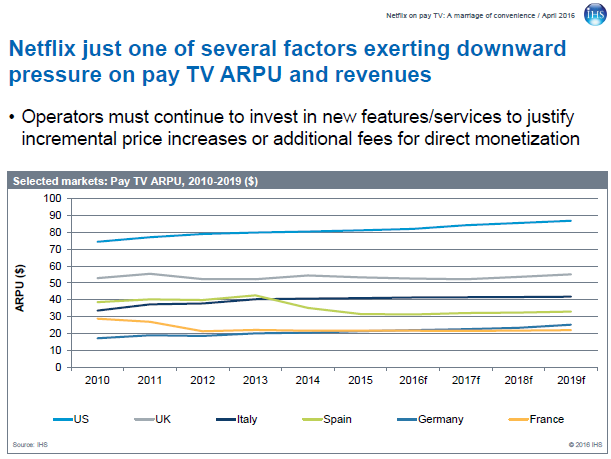

If you check ARPU, Netflix appears not to be having a negative effect, but its also hard to say it’s a positive, although it may be for some vendors. 10 of the partners (mainly Tivo users) out of 25 are seeing some upsell from Netflix.

As more viewers access Netflix, what will the impact be? There will be an on-going increase in Netflix subscriptions.

TVoD seems to be on the decline – Hall said that there can be confusion by viewers over what content is new. Original content on Netflix is proving to be attractive. Pay TV is down in the US, Ital and France, while the UK and Germany are growing as are S Korea, Japan and Poland. In France, new free “catch up” services are proving to be significant.

If you already have SVOD – what is the impact of adding Netflix? Can they co-exist, Hall asked? Some operators are concerned, but others are not. The impact is not clear, but some operators are limiting their promotion of Netflix, even though they allow access to the service.

Adopting Netflix could cause a drop in the sale of premium packages, but there is no evidence in the EU, said Hall, although there are problems in the US. A downward trend in premium packages would be a problem but is probably inevitable. However there will not be a big impact, IHS believes, and the impact of Netflix is ‘mainly additive’.

Netflix’s appeal is to younger viewers and that could mean the service doing better in the longer term and is only one of a number of pressures on ARPU.

Questions?

It was interesting that nearly all the questions after the talks were about VR.

“What content works well on VR?”, was the first question Live concerts and sports are clear, but new genres will be coming in gaming – games will be “exploring-based” and less “action-based” because of difficulties in moving fast. There will be new genres somewhere between linear and games – e.g. Martian. User-generated content could also be important – VR cameras are just starting to ship. YouTube is already storing 360º video. Brands want to be on VR – e.g. Minecraft was on Gear VR before the PC. Brands want to exploit the VR experience – for examples on the IKEA app, you can cook meatballs!

VR volume will be in the consumer market, with Augmented Reality being important in professional applications. Enterprises will play with it. In app purchase could be an important revenue opportunity for VR. Today there is little linear or premium content but as was explained earlier, there will be a more than €1 billion content market later.

Sky Explains Strategic Partner Investments

Finally, Ben Keen of IHS came back to talk to Emma Lloyd – Sky Business Dev & Stratgic Partnerships Director. Keen said she has the best job at Sky. How much has Sky spent? $150 million? After all, it has made investments in Vixs and Roku? Lloyd said that it was “less than $150 million”, but she wouldn’t give a number.

Lloyd said that a lot of the development of the new SkyQ platform had happened in house. The company likes to partner with companies such as Facebook, Google and Cisco to stay ahead of innovation. Sky tries to stay close to start ups as well. For example, with Jaunt, the firm made an investment at seed stage. Although it was less than $1 million, it gave access to camera early. Now content is starting to appear. However, not that many investments have been made, they must be strategic.

Keen asked if the key decision criteria on investments in start-ups are primarily commercial or based technology and innovation. Lloyd said that investment is in the ‘low tens of millions’ over years, so it’s relatively small compared to Sky’s business and the investments are not measured on profit. However, Sky does check value. Sky’s NowTV service, which is important to the company, is based on Roku because of relationship via series E investment of $10 million. The supply of adaptors to Sky is one of only a few ‘white label’ deals that Roku has done. Many components from investments have been used in Sky Q – from Cisco, Pluto TV and others.

Keen said that, to him, it looked as though Sky’s investment are in four ‘buckets’ – Sports /Advertising /OTT content & services (e.g low ARPU telco services which Sky doesn’t want to do) and enabling technologies

Lloyd said that Sky pften invests for insight. e.g. would people use content on phones – you might be able to get an answer from somewhere else around the world. In response to a question from Keen, Lloyd said that Sky has no current plan to go global. (BR)