Well, it was the second day of SID Display Week and I took myself along to the SID/DSCC Business Conference in line with my plan. The big topic of the day was the over-supply that there is in the market.

How did that happen, when just a year ago, the business was so good and there was even a hope that, perhaps , the famous LCD Crystal Cycle might have finally come to an end. However, as we have reported, that didn’t happen and after the record price gains last year, there have been record price falls, with more on the way. How did it happen?

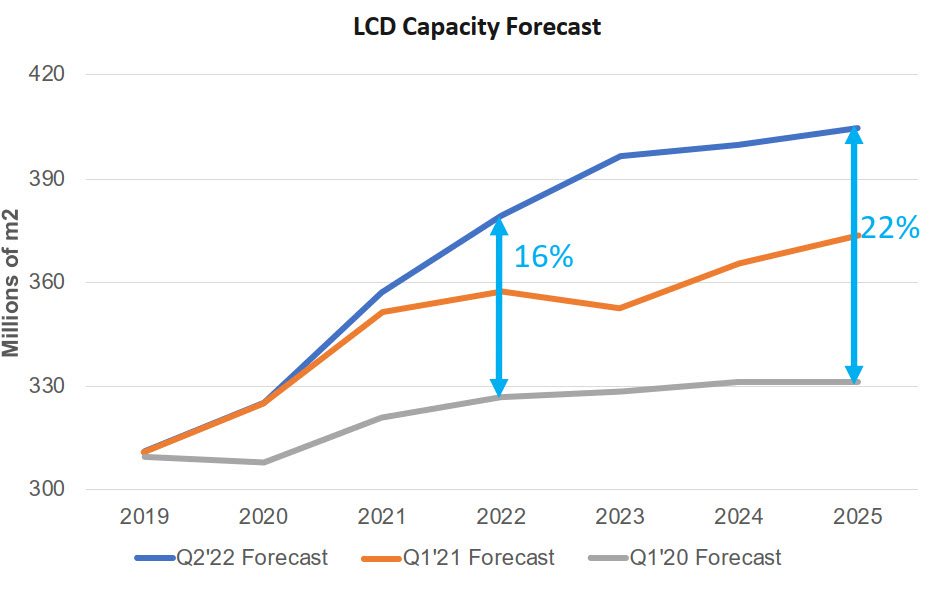

Ross Young of DSCC showed the key slide that explained the problem. He compared DSCC’s forecast for LCD supply made in 2020, 2021 and 2022. The problem is a dramatic increase (>20%) in industry capacity over that period. As he explained to me away from his main talk, at the time of the Business Conference last year, display makers had been remarkably constrained and conservative and had not decided to boost their capacity.

However….. the record price rises for LCDs and great margins proved irresistible and around and just after the conference they boosted output. Traditionally, this has been done in the past by building new plants, but that takes a couple of years, so instead they have found ways of boosting productivity on existing plants, for example by reducing the number of mask steps. In addition, the Korean LCD makers deferred the closure of their TV LCD operations (although Samsung is expected to close its last fab next month). This is the key chart. As prices rose in 2020 and 2021, LCD makers couldn’t resist increasing their capacity.

This is the key chart. As prices rose in 2020 and 2021, LCD makers couldn’t resist increasing their capacity.

The boost in output coincided with a significant reduction in demand as energy, food and other inflation has hit consumers and because of the end of the Covid boost to demand for more home entertainment as well as Work from Home (WFH) and Learn from Home (LFH). The result has been significant panel price reductions, already, with more to come in the second half of this year. Normally, Young has said in the past, price reductions slow or stop when panels hit cash cost, but this year, he said today, prices are likely to go below cash cost and panel makers will be paying for the privilege of making TV panels.

By chance, tonight at the SID Awards Dinner, somebody mentioned that, some years ago, I had given him the idea of the ‘LCD Farmers’. That’s an old idea of mine that LCD makers are like those that grow our food. The price of beef goes up, so farmers get more cattle. That causes the price of beef to go down, so they get rid of their cattle. The price of beef goes up and so we go around again.

The behaviour of the LCD makers also reminded me of an economic concept of ‘The Tragedy of the Commons’ (Wikipedia credits this to an essay written in 1833 by the British economist William Forster Lloyd). In olden times in some countries, shared land existed ‘for the good of all’. If it is over-grazed, everybody suffers, so those putting their animals on the common should be conservative. However, for any one with a herd, if they can let their cattle over-graze and nobody else does, they will have an advantage. As lots of farmers allow over-grazing, the land gets spoiled for everyone. As Ross said, “Ah, game theory”. That’s a more recent version of the same concept, but in the world of LCD, the old version still applies.

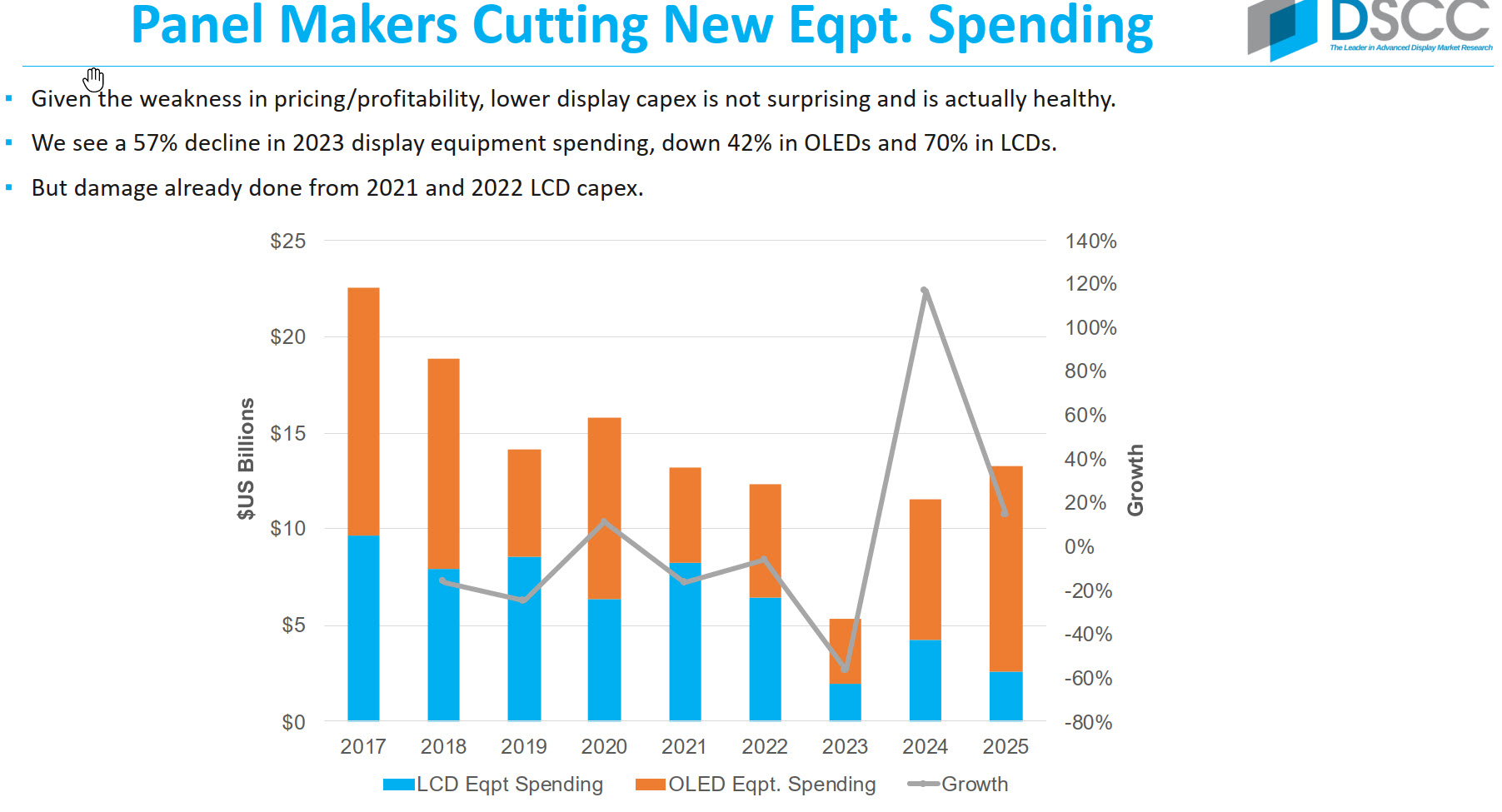

On one hand, I have little sympathy for the LCD makers, which are bringing things down on themselves, but I do have concerns for the people that they rely on to bulid the equipment for their fabs. Because of the overcapacity, panel makers have called a halt or deferred much of their capital expenditure plans, so DSCC sees the equipment market falling radically in 2023, DSCC is forecasting a drop of 57% in spending and that could be a serious issue for the equipment makers, who have not made the decisions (although, to be fair, they have profited from the boost in capacity in 2021 and 2022). (BR)