When we think about the cellular phones today we just assume we are talking about the smartphone as there is almost no other type available any more. While this is not completely true, the rise of the smartphone is a very interesting business development that will one day surely be highlighted in marketing and business strategy books. First of all, data on sold units are available in great detail and with high accuracy and secondly the market cycle is extremely fast compared to CE devices such as TVs and PCs.

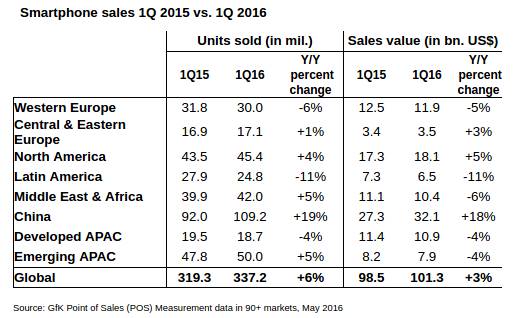

By no means are we at the end of the sales cycle, but if we look at global sales data we see a distinct slowing of the sales growth for smartphones already. Based on data from GfK (see below) the sales growth for smartphones has slowed to 6% of units sold and 3% based on $ value. Taking out the sales growth in China would leave the rest of the world at zero growth. As shown, the sales numbers are quite different for the various regions of the world.

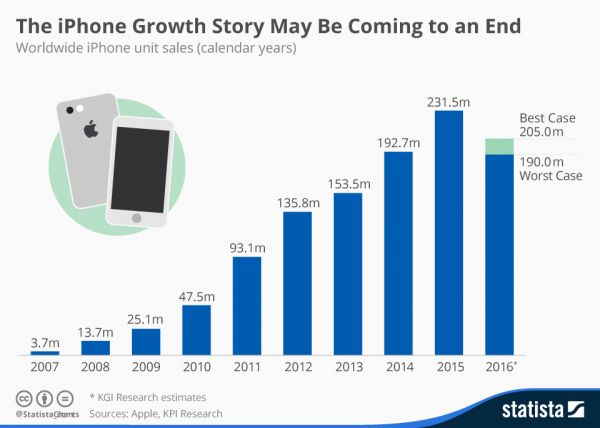

The most significant change in the smartphone market was the recent announcement of Apple that their iPhone sales are shrinking for Q1’16 compared to the same quarter in 2015. In addition, the 2016 forecast for iPhone sales did scare quite a few Apple investors, which sent the Apple stock price into a decline that, meanwhile, has reversed somewhat. Nevertheless, the Apple stock price is almost 30% of its highest value in May 2015.

As Statista shows in its iPhone sales chart, the success story of the iPhone seems to be coming to an end. For many years the iPhone has overruled the basic marketing understanding that lower prices will make up the lion’s share of any market. Now, this market rule seems to be catching up with Apple, after all. Of course, we all expect great things from the Apple iPhone 7 when it is released later this year; it is just questionable whether this will be enough to turn around the sales figures, especially if the growth in unit sales comes mainly from Asian countries.

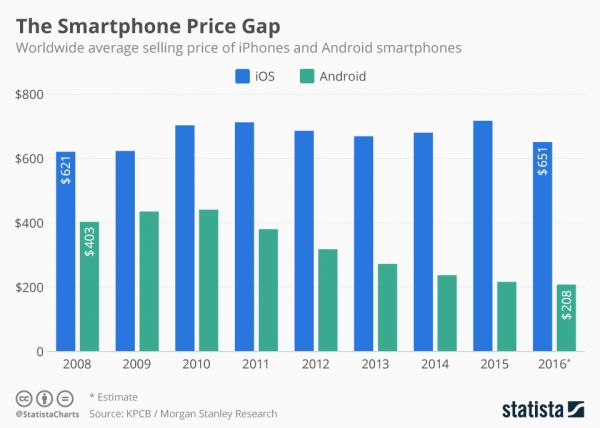

Statista also points out that the price differential between iPhones and Android phones has been creeping up significantly. We all expect pricing for comparable goods to even out in a mature market, Apple has not changed its pricing at all. While high end Android phones, like those from Samsung, are quite comparable to Apple in pricing, many other Android smartphones from lesser known Asian brands are selling for quite a lot less money these days. The price gap between Apple and Android is still growing.

As it seems that the Asian brands are still hoping to make up for low margins by increasing sales volume. This is a strategy that seems ill advised for all countries, besides China. Apple on the other hand was trying to overcome price pressure by offering to the consumer, the most perfect device that there is. While this strategy worked amazingly well for many years, it seems to have come to an end now.

Analyst Comment

I believe that an important part of the market development has to do with the actual and/or perceived performance and quality of the devices. In the first years, Apple was way ahead of its competitors and in these categories and consumers were honoring this by buying Apple ahead of everyone else. Meanwhile, Samsung has been at least on par with Apple’s top models and while they are also on par with their pricing, the rest of the smartphone brands have closed the gap to both market leaders.

I am not only talking about specs such as display resolution, processor performance, etc., but about the overall usability of the devices. Many other brands are offering models that are ‘good enough’ in the eyes of many consumers. As this performance gap closes and the price gap widens, Apple and Samsung will ultimately suffer some setbacks in this market.

As I said before, I can’t wait until I can read all about this in the business strategy books coming out soon.

– Norbert Hildebrand