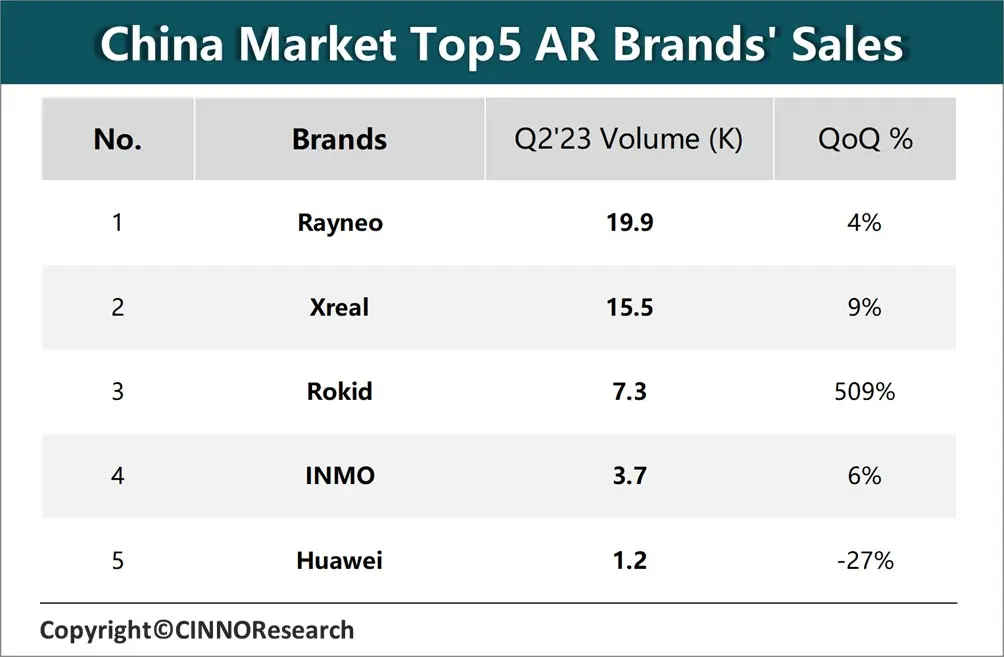

The augmented reality (AR) industry has witnessed remarkable growth in the second quarter of 2023, with the sales volume of domestic AR consumer market reaching 52,000 units, according to Cinno Research. This represents a staggering 251% year-on-year (YoY increase and a substantial 19% month-on-month increase. A key driving force behind this surge is the localization and price advantages of the domestic AR Four Tigers brands, as Cinno chooses to call them, which have successfully captured 90% of the market.

The dominance of the Four AR Tigers (Rayneo, Xreal, Rokid, and INMO) is solid but each has distinct strategies and strengths that contributed to their success.

Rayneo: Rayneo (a subsidiary of TCL) emerged as the industry leader with an impressive 39% sales share in Q2’23. Thunderbird Innovation, the parent company of Rayneo, focuses on AR core optical technology. Their product lineup includes the Air Plus and Air 1S, which have received significant market attention and accounted for 81% of Thunderbird Innovation’s sales. The upcoming launch of Thunderbird X2, a consumer-grade AR glasses based on optical waveguides, is expected to further enhance their sales performance and expand their global presence.

Xreal (Formerly Nreal): Securing the second position, Xreal holds 30% of the market share. The brand initially gained popularity in overseas markets, utilizing their official website to boost brand image and attract traffic. They successfully expanded into the United States, Japan, South Korea, and other countries through strategic 5G bundled package marketing. This overseas success propelled Xreal’s growth in the Chinese market. Xreal also announced multiple product upgrades and a name change from Nreal in May 2023.

Rokid: Positioned in the second echelon, Rokid made significant strides in the market by partnering with Digital China, appointing them as the general agent for Rokid products in China. This collaboration facilitated a robust omni-channel distribution strategy, leading to widespread coverage in domestic core first-tier cities. The launch of Rokid Max’s new product further boosted their sales, achieving a 509% month-on-month increase in Q2’23.

INMO: INMO’s primary focus has been on promoting their self-developed array waveguide AR glasses. Their products stand out due to their fashionable and slender appearance, as well as the wireless integrated design that eliminates the need for cumbersome wires. INMO dominated the domestic consumer-grade AR market using optical waveguide technology, leading sales in Q2’23 with a 6% month-on-month increase.

The AR industry is expected to continue its rapid development in the coming quarters, fueled by consumer demand and advancements in AR technologies. One factor that has led to growth in Q2’23 is tourism, according to Cinno, creating demand for devices to help in navigation, translation, and general entertainment, as Chinese consumers engage with their first post-pandemic and lockdown summer season.