Smartphones and tablets have been the darlings of the CE industry for the last few years. While smartphones took over the growing mobile phone market in one swift motion, tablets have often been seen as the PC killer over the last few years.

Up until last year growth rates of both devices were among the highest ever observed in the CE industry. In 2014 we saw the first surprise in the development of both product categories. While the smartphones continued their takeover and continued growth of the mobile phone segment, tablets seem to have reached a wall limiting their further growth. The difference in the two markets can also be seen in recent forecasts from many market research companies.

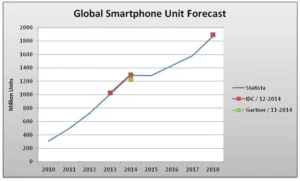

The forecast of the smartphone market seems to be easy and shows continued growth.

The numbers do not vary too much and show us closing in on two billion smartphones sold by 2019 to 2020. For comparison, estimates for the world population are 7.3 billion at the moment and forecasts show this growing to 7.5 billion by 2018. This means that just over 25% of the world’s population will buy a new phone in 2018. With the low penetration of smartphones in India at the moment and growing interest in this product there, the two billion smartphone mark may be reached even earlier.

This development can be interpreted as a twofold market situation; while the growth in developing markets continues to reach India and then other developing countries thereafter (also there are not many countries with strong populations and low smartphone penetration left), the relatively high replacement rate of smartphones assures strong yearly shipments. The risk for the smartphone market, in particular, is a decline in the replacement rate based on lower perceived technical advance in new smartphone lines and declining subsidies by carriers. Phone carriers are interested in more data transport and when device sales to existing customers cannot produce more data usage, their interest in new devices will dwindle. On the other hand, they must be loving the upcoming UHD handset display. While the pixels may be almost free, using them will most certainly not be.

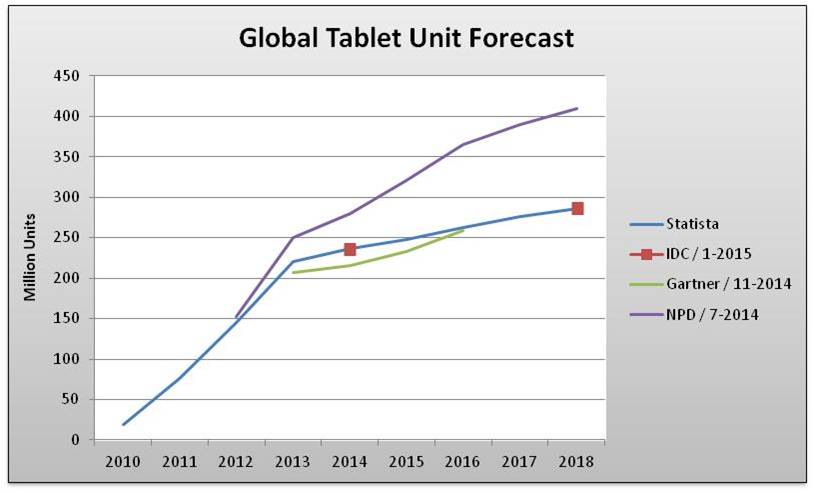

On the other hand the tablet hit a wall in 2014 with growth slowing significantly. This has some market researchers lowering their tablet forecast not only for the coming year, but hitting a wall in general.

The lower forecast suggests a market saturation in the coming years. Many analysts see the phablet as one of the reasons for the slowing tablet market growth, however, there seems also much less interest in replacing a tablet than a smartphone. Looking at the retail prices this is somewhat of a surprise. Even with heavy subsidies for smartphones, tablets are cheaper in most cases and are showing the same increase in processor power and display resolution. For some reason, the consumer who is willing to upgrade their smartphone is much less inclined to upgrade their tablet.

While usage numbers suggest a growing use of tablets for entertainment purposes, a higher resolution display seems not to be enough to trigger an early tablet replacement. Maybe this is also a psychological effect as the tablet is seen as a computer, while the smartphone is our communicator to the world. One is more of a luxury, while the other is more of a necessity.

It is also apparent that the market researchers are less in agreement when it comes to tablet sales. NPD for example has not revised its view of the tablet market as of yet, and to be fair the other market research firms were much closer to the NPD numbers in the past years. Given the popularity of the phablet and more companies entering this segment, the decrease of the tablet market growth makes a lot of sense, especially in developing markets where a phablet could replace the double device (smartphone + tablet) sales seen in the USA and other developed countries.

For now it seems that both markets are on different paths in terms of unit sales, with smartphones continuing on a strong growth path, while the tablet seems to have reached market saturation. Of course this all only makes sense until the market proves otherwise. – Norbert Hildebrand

Body Text

Display Daily Comment

I have believed for some time that part of the “problem”, that people don’t see a need to keep upgrading a tablet is that Apple set the bar very high early on and most tablets do most of what most people want to do. In the end, tablets are media consumption devices, and while you can consume the media you want to, they are achieving their objective. (BR)