With 2021 nearing a close, global shipments of Traditional PCs are forecast to reach 344.7 million units, according to the latest forecast from the International Data Corporation (IDC) Worldwide Quarterly Personal Computing Device Tracker.

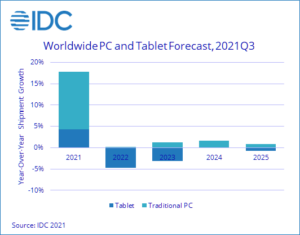

While annual shipments are expected to grow 13.5% during the year, shipments during the holiday quarter are expected to decline 3.4% as supply chain constraints and backups and cost increases around logistics continue to be a burden on getting products into many channels. Tablets face a similar trend with annual shipments in 2021 growing 4.3% while fourth quarter shipments are expected to decline 8.6%.

“The market has pulled past peak pandemic PC demand,” said Jitesh Ubrani, research manager with IDC’s Mobility and Consumer Device Trackers. “While we have seen some slowing of consumer demand in certain segments and markets, demand for gaming remains an exception and overall consumer demand is well above pre-pandemic levels. Additionally, the onset of saturation in some education markets is another cause for lower expectations in the coming quarters.”

Following two straight years of strong double-digit growth, the expectation is that the PC market will begin to slow in 2022. However, as we look towards 2025 the latest IDC forecast still shows a five-year compound annual growth rate (CAGR) of 3.3% with most of that growth coming from the notebook PC segment. Tablets, meanwhile, will continue their decline as the category remains challenged by smartphones and notebook PCs.

“With on-going supply chain challenges we have seen OEMs prioritizing commercial demand in recent months,” said Ryan Reith, program vice president with IDC’s Mobility and Consumer Device Trackers. “More often than not the commercial dollars are larger and more guaranteed compared to the consumer and education segments. The recent slowdown in the consumer segment is expected to continue into 2022, but in the long run we expect the consumer PC market will have a five-year growth rate similar to the commercial segment. Of the three market segments – commercial, consumer, and education – it is looking like commercial will be the only one to grow in 2022. Part of this is driven by supply, but also because it will take time for a consumer refresh cycle to happen following the wave of consumer buying that happened over the past two years. The education segment hasn’t been able to get all the devices it needs, but on a broader scale there haven’t been many cancelled orders. When supply catches up with demand, we expect to see an uplift in the education sector as well.”

IDC’s Worldwide Quarterly P ersonal C omputing Device Tracker gathers data in more than 90 countries and provides detailed, timely, and accurate information on the global personal computing device market. This includes data and insight into global trends around desktops, notebooks, detachable tablets, slate tablets, and workstations. In addition to insightful analysis, the program delivers quarterly market share data and a five-year forecast by country. The research includes historical and forecast trend analysis.