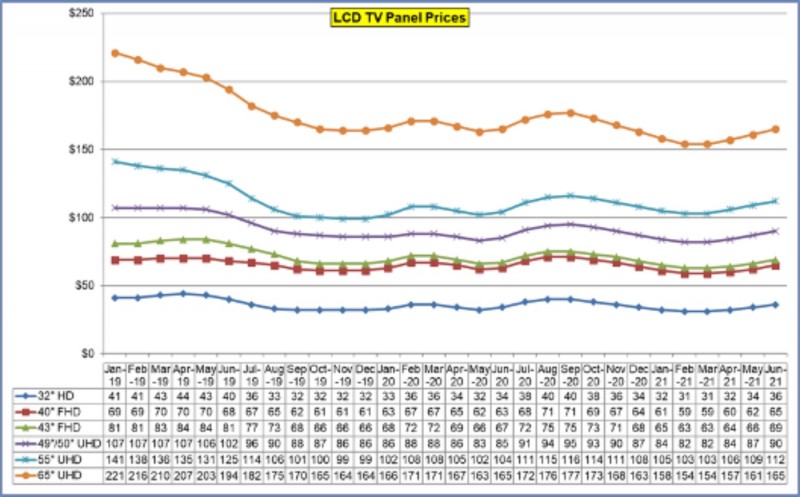

Robust TV demand in the US and China, combined with capacity reductions by the Korean panel makers, is leading to LCD TV panel price increases in Q3, which will improve the profitability for panel makers who rely on TV panels. We at Display Supply Chain Consultants (DSCC) are updating our data and forecast for TV panel prices for the rest of 2020 and adding a forecast for the first half of 2021, and we now expect double-digit % increases for some TV sizes in Q3 2020 compared to Q2.

The first chart shows our latest TV panel price update, with several inflection points already this year. Prices hit all-time lows in Q4 2019, but he industry saw a brief price bump in Q1 after the two Korean panel makers announced capacity cuts. That price increase was cut short by the COVID-19 pandemic, and fears of a demand slowdown, so prices in Q2 dropped back down to roughly the same levels as Q4 2019, with certain sizes hitting all-time lows and other sizes slightly higher than their Q4 2019 trough. Starting in June, we have seen another price bump, bringing prices above their recent high points of Q1 2020, to prices last seen in the summer of 2019.

We now expect prices to increase in Q3 for all sizes of TV panels except 75”, with double-digit % gains in sizes from 32” to 55”. Although we continue to expect that the long-term downward trend will resume in Q4, and that TV panel prices will hit new all-time lows in Q1 2021, the situation remains dynamic, and with the pandemic raging it seems like an eternity between now and the end of the year.

Our forecast presumes a weaker-than-normal holiday selling season in Q4, based on the idea that the surge in demand in Q2 has pulled demand forward. This view is shared by NPD’s Stephen Baker (see comments on his presentation in the DisplayWeek article in this issue), but many variables surrounding the pandemic, the global economy, and political unrest could affect the outcome. We are now projecting another panel price increase starting in Q2 2021, based on demand related to the Tokyo Olympics, if they continue to be held as currently planned.

TV Panel Prices January 2019 – June 2021

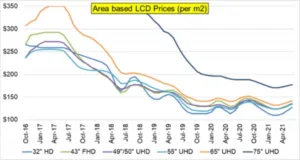

The only exception to the Q3 price increases, as noted, are 75” panels, which are made efficiently on Gen 10.5 fabs. These largest TV panels sell at a premium price in terms of area, as shown in the next chart here. The gap in price per square meter between 75” and 65” is still very wide at $37 per square meter in August but has closed from more than $50 per square meter at the beginning of the year. The current price gap represents a 25% area price premium for 75” over 65”. Viewed another way, Gen 10.5 fabs can generate $1752 of revenue per substrate making 75” panels 6-up at August prices, compared to $1408 of revenue making 65” panels 8-up or $1350 making 43” panels 18-up. Thus the big fabs still have a generous incentive to make 75”, which will lead to continued price pressure on those larger sizes.

Monthly Area Prices per Square Meter for TV Panels, October 2016 – June 2021

The bellwether 32” TV panel typically shows the fastest drops to the lowest area prices in times of oversupply, and the sharpest price increases in times of supply constraint, and we show that pattern repeating itself in Q2 and Q3. In May 2020, 32” panel prices matched their all-time lows, but these panels will get an 18% increase Q/Q in Q3, before falling again in Q4.

After the industry recognized an average TV panel price increase of 4.6% Q/Q in Q1, and a Q/Q price decline of 3.4% in Q2, we are now expecting prices to increase in Q3 2020 by an average of 9.1% Q/Q. As noted above, however, the average increase in sizes between 32” and 55” is substantially larger at 11.7%, while we expect 65” to get a 6% price increase Q/Q and 75” to see a 1% price decline. In Q4, we expect all TV panel sizes to get a price decrease, ranging from 2% to 5% depending on size, with an average of 4.5%, but this would still leave Q4 LCD TV panel prices higher than those in Q2 2020.

Our TV price index, set to 100 for prices in January 2014, has increased from its all-time low of 42.0 in May 2020 to 47.3, and we expect it to decline in Q4 to 43.0 by December. This month of August 2020 will see the first Y/Y price increase in our LCD TV price index since September 2017. Higher prices, combined with robust volumes, will surely improve the profitability picture for panel makers in the third quarter.