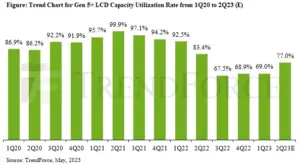

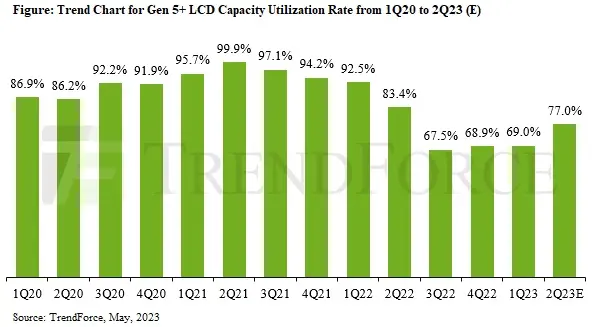

The panel market has faced imbalances due to the addition of new production capacities and a slowdown in demand after the pandemic, according to a report by TrendForce. In response, panel makers have decreased inventory by reducing capacity utilization rates to below 70% in the second half of 2022.

A recent rise in TV panel demand and increasing TV prices are expected to push utilization rates for Gen 5+ LCD production lines up to 77% in the second quarter of 2023. However, even with this increase, total output will be lower than the same period last year due to LG Display reducing production in certain lines.

The uptick in utilization rates is driven by actual order demand, suggesting a healthy supply-demand ratio in the LCD market for 2Q23. To maintain this balance, panel makers are urged to be cautious and adopt quick response strategies throughout the second half of 2023.

After half a year of production adjustments, TV panel inventory has reached a healthy level. Demand and prices for TV panels are on the rise due to early stocking by Chinese brands for the 618 Shopping Festival. Over 90% of Gen 10.x production lines are dedicated to TV panels, with capacity utilization rates predicted to grow more than 10 percentage points quarter-over-quarter, reaching up to 83.2%.

The pandemic triggered a surge in demand for LCD monitors and notebook panels, causing a shift of some TV production capacity to IT projects. However, the lack of significant growth in IT product demand limited the increase in Gen 8.x utilization rates to 7.6 percentage points, resulting in a 79.4% rate in 1Q23. For older production lines (Gen 7.5 and older), utilization rate is projected to increase to 60% due to rising demand in the smartphone panel repair market and a minor increase in IT panel demand. Despite these projections, TrendForce maintains a conservative outlook on growth.