New data from Hub Entertainment Research shows that for the first time in five years, consumers are reducing the number of TV sources they use, dropping from an average of 7.4 sources in 2022 to 6.4 in 2023, a relative decline of 14%. The survey involved 1,603 U.S. consumers aged 16-74 who watch at least 1 hour of TV per week. Main reasons for the decline are likely inflation and concerns about the economy.

The data shows that subscription to streaming services decreased this year, with market penetration falling from 89% to 82%. Legacy pay-TV market penetration also dropped from 62% to 55%. The percentage of respondents with three or more subscriptions among Netflix, Hulu, Prime Video, HBO Max, and Disney+ decreased from 50% in 2022 to 42% in 2023.

Despite this, use of free ad-supported streaming TV (FAST) services like Tubi, Pluto TV, Shout! Factory TV, Crackle, and Amazon Freevee remained steady, suggesting that consumers are increasingly relying on these services in the face of economic uncertainty.

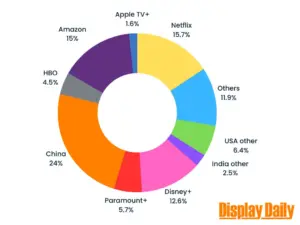

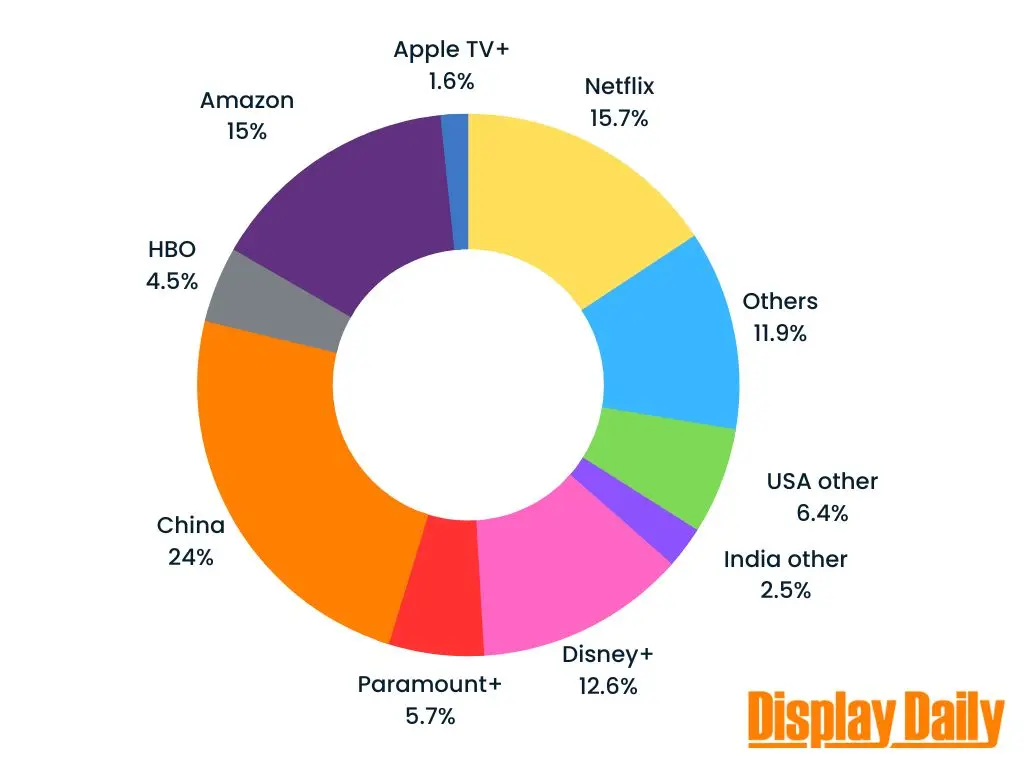

| Netflix | 277 |

| Others | 210 |

| USA other | 112 |

| India other | 44 |

| Disney+ | 222 |

| Paramount+ | 100 |

| China | 424 |

| HBO | 80 |

| Amazon | 265 |

| Apple TV+ | 29 |

Digital TV Research, on the other hand, presents a longer-term global projection for subscription video on demand (SVOD) services, predicting significant growth in subscriptions between 2022 and 2028. In the US, the market for SVOD services might be approaching saturation, leading to slower growth or even a temporary decline. However, globally, especially in developing markets, there could be substantial room for growth. The growth in global SVOD subscriptions could also be driven by the diversification of services offered by platforms, attracting different segments of consumers and meeting varied consumer needs better.

Bad news: the Hub report captures a shorter-term trend specific to 2023, likely influenced by current economic conditions. Good news: the global report, however, looks at a longer-term trend extending to 2028, during which economic conditions, consumer behavior, and market dynamics could change significantly. The growth in global SVOD subscriptions could also be driven by the diversification of services offered by platforms, attracting different segments of consumers and meeting varied consumer needs better.