The staying power of notebooks is strong a full two years into the COVID pandemic, even as offices are welcoming more people back to in-person work, according to a new report by Strategy Analytics. Lessons learned from the pandemic weigh heavily on consumer and commercial buying decisions and as hybrid work becomes the norm, the need for mobile productivity remains high.

The flipside of fewer COVID restrictions around the world means that education budgets have turned away from IT expenditures, which created an unfavorable year-to-year comparison with total shipments declining -7% in Q1 2022.

The full report from Strategy Analytics’ Connected Computing Devices (CCD) service, Preliminary Global Notebook PC Shipments and Market Share: Q1 2022 Results can be found here: https://www.strategyanalytics.com/access-services/devices/tablets-and-pcs/connected-computing-devices/market-data/report-detail/preliminary-global-notebook-pc-shipments-and-market-share-q12022-results

Chirag Upadhyay, Industry Analyst said, “ChromeOS shipments suffered as education demand continued to slow down and consumer upgrades for Chromebook were at the lowest point, even compared to pre-pandemic levels. The Chromebook business is very small but remains very important for top vendors, as they are keeping good inventory before education demand kicks off in Q2 2022 in main markets. Chromebook is still making an impact in new markets albeit slowly as the public sector look to spend towards cheaper devices for education.”

Eric Smith, Director – Connected Computing added, “The total notebook market was only down 7% compared to last year, demand for commercial business stayed strong for Windows 11 PCs and MacBooks powered by M1 chipset, as most enterprise and SMB clients are still choosing hybrid work options and spending extra for quality products. Dell and Apple were good examples of the growth segments of the market: premium Windows notebooks and MacBooks with the M1 chipset.”

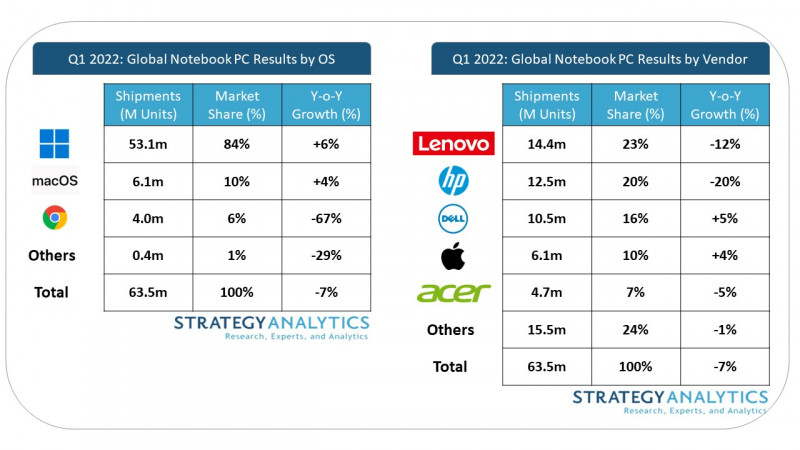

- Lenovo shipped (sell-in) 14.4 million units in Q4 2021 (calendar year), representing -12% growth decline while keeping the number one rank at 23%

- HP took the biggest hit during the first quarter as notebook PC shipments were down -20% year-over-year in Q1 2022 to 12.5 million units; market share also dropped below 20.0% first time since Q1 2016

- Dell was the only top vendor to have registered over 5% growth year-over-year, as 10.5 million units shipped during the first quarter, gaining nearly two percentage points of market share over the last year’s quarter to reach 16.5%

- Apple MacOS carried the momentum from last two quarters as shipments reached 6.1 million MacBooks during the first quarter, a 4% growth from Q1 2021

- Acer maintained the 5th spot globally in Q1 2022 with 4.7 million notebook PCs shipped, a -5% decline year-over-year