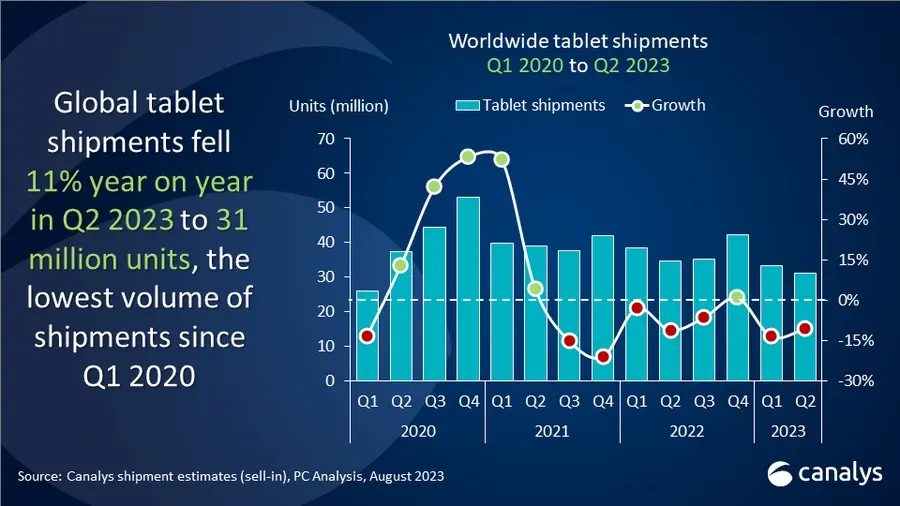

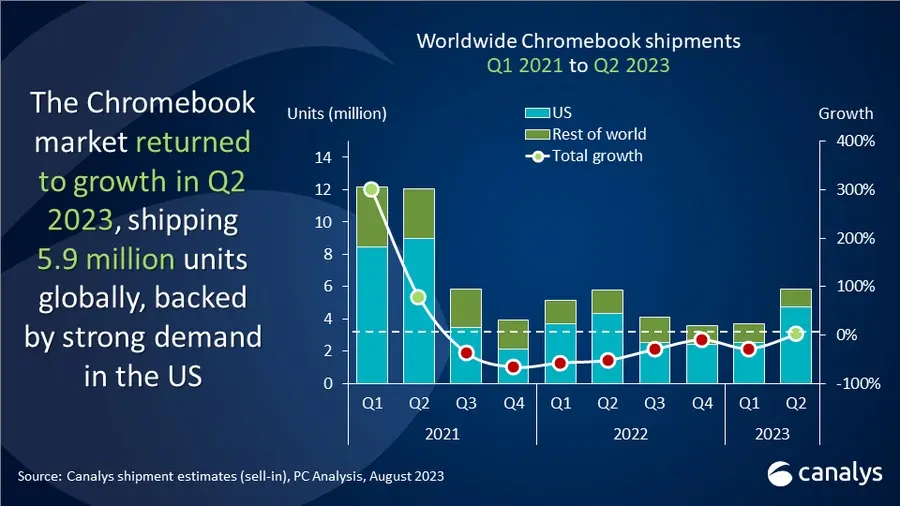

In the second quarter of 2023, the worldwide tablet market experienced a decline of 11% compared to the same period the previous year, reaching a total of 31.0 million units shipped according the latest data from Canalys’ PC analysis service. This marks a sequential decrease from the first quarter and represents the lowest volume of global tablet shipments since Q1’20. In contrast, Chromebooks had a positive quarter, with shipments increasing by 1% year-on-year, totaling 5.9 million units. The growth in Chromebook sales was driven by the resurgence of demand in the education sector, especially during the back-to-school season in North America.

Apple maintained its position as the leading tablet vendor, shipping 12.3 million units, which accounted for nearly 40% of the global tablet market. Despite a 14% annual decline in shipments, Samsung secured the second position, shipping 6.0 million tablets. However, Amazon and Lenovo, ranked third and fourth respectively, faced significant declines in their tablet shipments, experiencing drops of 33% and 39% compared to the previous year. Huawei held the fifth spot in the rankings, with 1.7 million units shipped.

| Vendor | Q2’23 Shipments | Q2’23 Market Share | Q2’22 Shipments | Q2’22 Market Share | Annual Growth |

|---|---|---|---|---|---|

| Apple | 12,350 | 39.8% | 12,102 | 34.9% | 2.0% |

| Samsung | 6,010 | 18.8% | 6,952 | 20.0% | -13.6% |

| Amazon | 2,206 | 6.9% | 3,310 | 9.5% | -33.4% |

| Lenovo | 2,136 | 6.7% | 3,509 | 10.1% | -39.1% |

| Huawei | 1,658 | 5.2% | 1,707 | 4.9% | -2.8% |

| Others | 6,658 | 20.8% | 7,125 | 20.5% | -6.6% |

| Total | 31,018 | 100% | 34,705 | 100% | -10.6% |

Demand for tablets has decreased from the peak levels seen during the pandemic, the market remains relatively resilient. Tablets offer an additional opportunity for vendors to target consumers, businesses, and the education sector, especially considering the challenges faced by the PC and smartphone markets. The second half of the year is expected to bring stronger demand for tablets, with vendors introducing new products, implementing aggressive marketing strategies, and offering promotional activities.

Despite the optimism surrounding tablets, there are concerns about their role in the commercial space. As Intel and AMD pave the way for the development of ‘AI PCs,’ tablets may face challenges in replacing traditional notebooks as worker productivity becomes increasingly reliant on AI functionality.

Turning the focus to Chromebooks, the market experienced a slight growth in Q2’23 after seven consecutive quarters of decline. HP emerged as the top Chromebook vendor, commanding over 10% of the market share with a remarkable 69% increase in shipments compared to the previous year. Lenovo retained its position in second place, with a 15% growth in Chromebook shipments. On the other hand, Dell faced a 15% decline, shipping approximately 1.3 million units, placing them in third position. Acer and Asus ranked fourth and fifth, but both companies experienced a loss of market share compared to the previous year.

| Vendor | Q2 2023 Shipments | Q2 2023 Market Share | Q2 2022 Shipments | Q2 2022 Market Share | Annual Growth |

|---|---|---|---|---|---|

| HP | 1,567 | 26.7% | 926 | 16.0% | 69.2% |

| Lenovo | 1,342 | 22.9% | 1,172 | 20.2% | 14.5% |

| Dell | 1,291 | 22.0% | 1,517 | 26.2% | -14.9% |

| Acer | 1,055 | 18.0% | 1,343 | 23.2% | -21.4% |

| Asus | 372 | 6.3% | 415 | 7.2% | -10.4% |

| Others | 234 | 4.0% | 419 | 7.2% | -44.2% |

| Total | 5,861 | 100% | 5,792 | 100% | 1.2% |

The minor growth in Chromebook sales indicates that these devices are still appealing to consumers and businesses alike, offering an alternative to traditional laptops and tablets. As the demand for computing devices continues to evolve, Chromebooks have proven to be a viable choice for many users.