It was back to the office with a bang this week for me. Because of staff vacations, I had to work close to full time on our newsletters. Next week, we are planning our annual publishing break. We plan to keep putting some major stories onto the website, but the next pdf issue will be on 7th August.

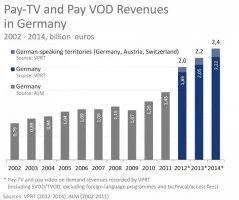

I was particularly struck this week by the data on pay TV revenues in Germany. When we first started tracking the TV market, somebody, somewhere told me that “the Germans won’t spend money on TV”. There had been a long tradition of free to air TV over cable and DTH satellite. Commercial (i.e. not paid for by licensing) didn’t start at all until 1984 and digital terrestrial has never been strong. Many people paid a very few Euros per month for the delivery of free content over a cable network. In 2008, when we made a report on digital TV in Europe, Premiere was the dominant pay TV provider and it had just 13 channels and the cost was €13.99 per month.

“Enhanced” cable packages were available for digital subscribers, but were not very successful in terms of sales (KDG had only about 10% of its subscribers signed up to ‘beyond the minimum’ services).

I remember saying to many of those I spoke to that they should not underestimate the potential in the pay TV market, especially after the arrival of Sky. Although it was said that German consumers were not prepared to spend any money, it was my observation that when I (frequently) travelled in Germany, I saw them spending plenty of real money on clothes, cars, restaurants, hotels and the other benefits of modern capitalist life. However, they did demand good value. If they are not convinced of the value proposition, their cash stays firmly in their pockets.

So, the issue seemed to me that the lack of Pay TV was really about a lack of value or a lack of perceived value. That’s an issue of marketing – whether you are talking about the ‘product mix’ or marketing communications. In terms of product, much German TV was known for being not only dull (lots of studio-based talking heads), but also broadcast at low quality (which caused trouble with the arrival of digital TV when the new LCD TVs, with their ‘analytical’ picture quality, made things look even worse). The low quality persists – I have friends in Germany who regret buying good UltraHD TVs because the signals are often so bad.

When Sky launched in Germany, by taking a big share in Premiere and then re-branding as Sky, it said in 2009 that it thought there was a potential to get into 20% of households eventually – given as 7.4 million households. Many of those that I spoke to were very sceptical as the subscription base was then 2.3 million and declining. I suggested that Sky understood how to market TV services and that they would be more successful than many might expect.

By the end of Q1 this year, the firm had got to 4.25 million so is on the way to its long term target. Interestingly, the overall number of Pay TV subscribers is now 7.7 million, just more than Sky’s long term market ambition. I still wouldn’t bet against Sky getting to its target, although it is bound to take time.

Bob